Navigation: Loans > Loan Screens > Account Information Screen Group > Reserves Screen Group >

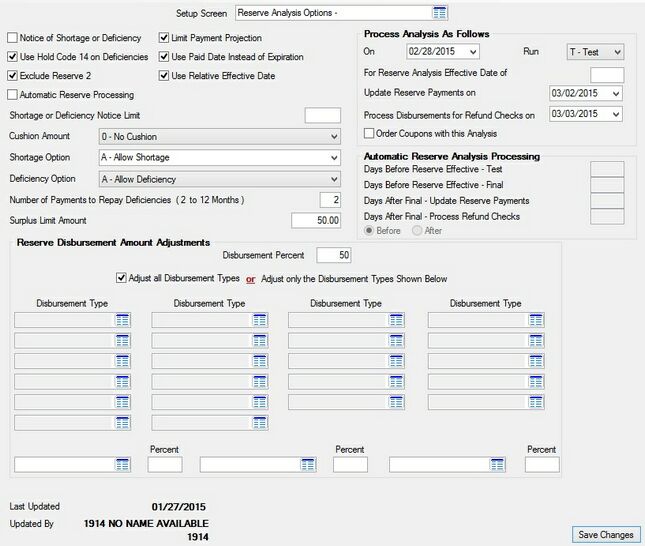

Use this Loans > System Setup screen (also located under Loans > Account Information > Reserves) to view and edit reserve analysis information for your institution. The information entered on this screen affects the functions of Loans > Account Information > Reserves screens.

Reserve analysis information is usually processed once a year. Once an analysis is processed, reserve disbursement checks, refund checks, notices, remittance forms, register reports, etc. can all be printed using the Loans > Check Printing > Reserve Checks screen.

Additionally, statements can be downloaded, printed, and sent to your customers to notify them of reserve payment projections using the Reserve Analysis Statement (FPSRP339). See also the Reserve Analysis Report (FPSRP139) on DocsOnWeb for more information.

Loans > System Setup Screens > Reserve Analysis Options Screen

|

Note: There is a service charge assessed each time an analysis runs in the afterhours per statement created. Contact your GOLDPoint Systems representative to learn more about this service charge. |

|---|

System history retention periods for reserve analysis option records can be adjusted for your institution on the Deposits > Definitions > System History Retention screen.

The fields on this screen are as follows:

Field |

Description |

|||||||||

Notice of Shortage or Deficiency

Mnemonic: ABNOTC |

Use this field to indicate whether a generic notice will automatically be created if a customer loan's reserves experience a shortage or deficiency. See below for more information.

|

|||||||||

Use Hold Code 14 on Deficiencies

Mnemonic: ABHC14 |

Use this field to indicate whether Hold code "14 - TOV Reserve Deficiency on this Account" will be placed in the first Hold Code field on the Loans > Account Information > Account Detail screen if a reserve deficiency is found on a customer account. Hold code 14 requires a teller override to process transactions.

If this field is marked, Hold code "14 - TOV Reserve Deficiency on this Account" will replace any selection already made in the first Hold Code field on the Account Detail screen.

|

|||||||||

|

Mnemonic: ABSKR2 |

Use this field to indicate whether Reserve 2 should be excluded from reserve analysis calculations.

If there is a Reserve 2 payment amount on the Loans > Account Information > Reserves > Account Reserve Detail screen, that amount will be included in the New Loan Payment amount (on the Loans > Account Information > Reserves > Reserve Analysis screen).

All Reserve 2 disbursements will be displayed in system history regardless of the status of this field. |

|||||||||

|

Mnemonic: ABARPS |

Use this field to indicate whether the system will automatically calculate dates for processing reserves. This processing includes the analysis test, final analysis, reserve payments, processing disbursements for refund checks.

Marking this field makes the Automatic Reserve Analysis Processing field group file maintainable and disables the Process Analysis As Follows field group. |

|||||||||

|

Mnemonic: ABLPMP |

If this field is available for use by your institution, use this field to indicate whether the number of Payment Projections on the Reserve Analysis Statement (FPSRP339) should be limited. |

|||||||||

Use Paid Date Instead of Expiration

Mnemonic: ABUPAY |

Use this field to indicate whether the Pay Date should be used instead of the Expiration Date when the system processes reserve analysis payments. The Anticipated Payments section and the Payment Effective Date on the Reserve Analysis Statement (FPSRP339) will both use the Pay Date as well.

The Pay Date and Expiration Date fields are located on the Loans > Account Information > Reserves > Account Reserve Detail screen. |

|||||||||

|

Mnemonic: ABURDT |

Use this field to indicate whether a relative effective date should be used for the Payment Effective Date on the Reserve Analysis Statement (FPSRP339) instead of the actual Reserve Effective date.

When an analysis is run according to the For Reserve Analysis Effective Date of date, the Payment Effective Date will reflect that date. However, if this field is marked, the Payment Effective Date will be the next due date. If the Due Date (from the Loans > Account Information > Additional Loan Fields screen) and the Reserve Effective date (from the Loans > Account Information > Reserves > Reserve Analysis screen) are the same, the Payment Effective Date will be the same.

If this field is marked, the Anticipated Payments field on a customer's Reserve Analysis Statement may start one month later. |

|||||||||

Shortage or Deficiency Notice Limit

Mnemonic: ABNLMT |

Use this filed to indicate the limit of the reserve balance before a shortage or deficiency notice is created. If the reserve amount is less than the value entered in this field, a shortage or deficiency notice will not be created. For example, if the value in this field is 5.00 and the reserve amount is $4.99, no notice will be created.

|

|||||||||

|

Mnemonic: ABCUSH |

Use this field to indicate the cushion amount to be used in determining shortage or deficiency status on a customer account. A cushion cannot be larger than 1/6 of the total reserve disbursements. See below for more information.

|

|||||||||

|

Mnemonic: ABSHTB |

Use this field to indicate how customers should repay reserve amounts if a shortage is revealed during reserve analysis processing (as set up in the Process Analysis As Follows field group). Open the link below for more information.

|

|||||||||

|

Mnemonic: ABDEFB |

Use this field to indicate how customers should repay reserve amounts if a deficiency is revealed during reserve analysis processing (as set up in the Process Analysis As Follows or Automatic Reserve Analysis Processing field groups) Open the link below for more information.

|

|||||||||

Number of Payments to Repay Deficiencies

Mnemonic: ABNDEF |

Use this field to indicate how many payments are needed to repay a deficiency on a customer account. Possible values in this field are numbers 2-12.

|

|||||||||

|

Mnemonic: ABSURP |

Use this field to indicate the surplus limit amount on which refunds will be based. If a surplus is calculated on a customer account and the surplus amount is greater than or equal to the value in this field, the total value of the surplus will be refunded to the customer.

A surplus is calculated after the Cushion Amount (see above) has been reached. Any surplus less than 12 cents will not appear on the statement. |

|||||||||

Process Analysis As Follows field group |

See Process Analysis As Follows field group for more information. |

|||||||||

Automatic Reserve Analysis Processing field group |

See Automatic Reserve Analysis Processing field group for more information. |

|||||||||

Reserve Disbursement Amount Adjustments field group |

See Reserve Disbursement Amount Adjustments field group for more information. |

|||||||||

|

Mnemonic: ABDTLA, ABEMPX |

These fields display information about the most recent change made to information on this screen. This information includes the date of the change and the employee/teller number and name of the person who performed the change. |

|

Record Identification: The fields on this screen are stored in the FPAB record (Analysis Option). You can run reports for this record through GOLDMiner or GOLDWriter. See FPAB in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen.

•Set up the desired field level security in the FPAB record on the Field Level Security screen/tab. |