Navigation: Loans > Loan Screens > Account Information Screen Group > Reserves Screen Group > Account Reserve Detail Screen > Reserve Disbursements tab >

Disbursement Information field group

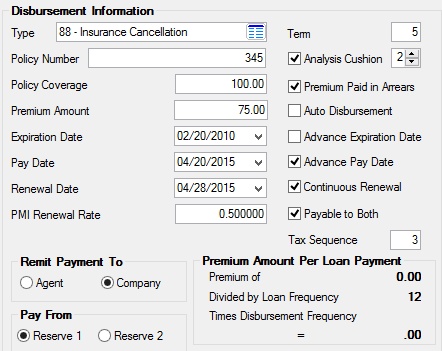

The fields in the Disbursement Information field group on the Reserve Disbursements tab of the Account Reserve Detail screen are used to create new reserve information or change already created reserve information.

The fields in this field group are as follows:

Field |

Description |

|||||

|

Mnemonic: RDATYP |

Use this field to select the type of reserve disbursement for the current setup. See Reserve Disbursement Types for more information. |

|||||

|

Mnemonic: RDPLCY |

In this field you can enter the insurance policy number if this disbursement is for insurance. You may also enter the company/agent's account number for this policy. The policy number is reported to the company or agent on the remittance advice forms sent with the check. See the Loans > Check Printing > Reserve Checks screen help for more information. If you are manually disbursing taxes, you may want to enter the tax parcel or identification number in this field. |

|||||

|

Mnemonic: RDPCVR |

This field is used as a reference only to indicate the amount of the policy or the coverage on the property. Negative amounts are not allowed. The system does not use this field for any processing. |

|||||

|

Mnemonic: RDAMNT |

This is the amount of the insurance premium if this disbursement is for insurance policies such as fire, flood, or even private mortgage insurance. This field will be the total amount of the premium for the term specified in the Term field below. Therefore, this may be a monthly premium, six-month premium, yearly premium, etc. |

|||||

|

Mnemonic: RDSEXP |

This field should contain the date the insurance policy expires, taxes are due, etc. Enter the date using MMDDYYYY format, or use the drop-down calendar to select the date.

|

|||||

|

Mnemonic: RDDUDT |

In this field enter the date on which the system should automatically make the disbursement from the appropriate reserve. If the Advance Pay Date field below has a checkmark, the system will maintain this date for you based on the Term field below.

|

|||||

|

Mnemonic: RDRNEW |

This field is the reserve disbursement renewal date. Enter the date using MMDDYYYY format, or use the drop-down calendar to select the date. |

|||||

|

Mnemonic: RDPMIR |

This field stores the monthly or yearly rate the PMI premiums are calculated from. This is an informational field only; the system does nothing with it. It can display up to seven numbers with a decimal showing six decimal places. If a decimal is not entered, the system will automatically enter one. The final position allows for a plus or minus sign with only the minus sign (-) displaying. An example of an entry is 3.456789 or 3.456789-. |

|||||

|

Mnemonic: RDCL24 |

This is a 24-character length field in which any alphanumeric data can be entered. This could be used to help you identify more details about the reserve item, such as the property that the policy covers, or more details on the type of policy, etc.

Institution option RDPO is used for tax purposes in conjunction with the tax services and reserve disbursement types 10, 12, 13, 16, 17, 19, 79, 80, 81, 82, 83, 94, 96, and 97. The institution enters the tax ID number on the Tax Information & Notes tab. If this option is set, the tax ID data stored in this field will appear in the policy number sections on the Reserve Disbursements list view; the Remittance Advice Form (printed from the Reserve Checks screen), the Reserve Disbursement Posting Journal (FPSRP033); and the Auto Reserve Disbursement Report (FPSRP306). |

|||||

|

Mnemonic: RDXTRM |

Reserve analysis is done on a term basis (monthly). For example, a six-month term would have reserve analysis done on a 1/6 basis. That is, the monthly reserve requirement is calculated by dividing the disbursement amount by the term of the disbursement. The following reserve types are not included for analysis: 01, 11, 15, 19, 21, 23, 25, 26, 28, 41, 43, 60-78, 86-93, 95, 97-99.

For example, a term of “12” automatically advances the next Pay Date (see above) one year ahead, providing the Advance Pay Date (automatic advance) field below displays a checkmark. |

|||||

|

Mnemonic: RDHCSH |

Two fields appear here. The first is a checkbox that indicates whether your institution wants to use a specific number of months for the cushion for a specific disbursement type when performing the analysis. The default is unchecked. The second field works only if there is a checkmark in the first field. The second field indicates the number of months to be used as the cushion. See below for more information.

|

|||||

|

Mnemonic: RDAREA |

Check this field if the policy is paid in arrears. Example: You pay the premium in June which is actually for the May coverage. (This is used by some PMI companies.) |

|||||

|

Mnemonic: RDAPAY |

This field determines whether you want the system to make automatic disbursements on this reserve type or not. The default is unchecked. See below for more information.

|

|||||

|

Mnemonic: RDAEXP |

Check this field if you want the Expiration Date field above to be automatically advanced by the Term field below. The default value is unchecked, which will clear the expiration date to zero.

|

|||||

|

Mnemonic: RDAADV |

Check this field if you want the Pay Date field to be automatically advanced by the Term field below. If the Auto Disbursement field above has a checkmark and the Advance Pay Date does not have a checkmark, then the Auto Disbursement field will automatically have the checkmark removed after disbursing the amount. If the Advance Pay Date field has a checkmark, then both the Auto Disbursement and the Advance Pay Date fields will remain checked. |

|||||

|

Mnemonic: RDCONT |

Check this field if the policy is a continuous renewal policy. The default for this field is unchecked. |

|||||

|

Mnemonic: RDPTOB |

Marking this field will cause checks to be made payable to the IRS owner and the first name on the payee line when an automatic reserve disbursement is processed for disbursement codes 10, 12, 13, 16, 17, 19, 79, 80, 81, 82, 83, 94, 96, and 97. The mailing address will be that of the IRS owners.

Example: The IRS owner is John Doe with a mailing address of 1515 N. 500 W., Provo Utah. The payee is Utah County Treasurer. The check will be made payable as follows:

John Doe and Utah County Treasurer 1515 N. 500 W. Provo, Utah 84601 |

|||||

|

Mnemonic: RDCODE |

This field is used in conjunction with the Info Pro tax services and reserve disbursement types 10, 12, 13, 16, 17, 19, 79, 80, 81, 82, 83, 94, 96, and 97. When GOLDPoint Systems receives a tax update file from Info Pro, the program will match the data in the Miscellaneous field above (tax ID number) and the Tax Sequence field to determine which reserve disbursement record to update. 0 = the annual payment, 1 = the first installment, 2 = the second installment, etc. |

|||||

Use these radio button fields to indicate who receives the check from the selected disbursement. Possible selections are Agent and Company. Once you select the appropriate radio button, the payment will be sent to either the agent displayed in the Agent Information field group or the company displayed in the Company Information field group. |

||||||

Use these radio button fields to indicate which reserve balance (1 or 2) should be used for the selected disbursement. |

||||||

These fields display the calculation of the portion of the reserves collected with each loan payment for the current disbursement item.

This field group displays the Premium Amount (which can also be the annual amount of taxes if setting up a tax-type reserve, see above), which is divided by the loan frequency and multiplied by the disbursement frequency. Example: If the loan payment frequency is monthly (12) and the annual premium for this reserve is $1,200, the monthly payment about of the reserve would be $100.00. You would enter this amount in one of the applicable Reserve Constant fields on the Reserve Payment tab of this screen. |