Navigation: Loans > Loan Screens > Account Adjustment Screen >

Current Account Information field group

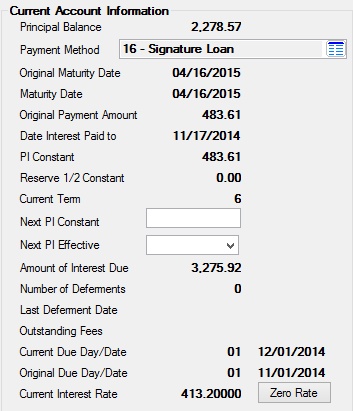

The fields in the Current Account Information field group on the Account Adjustment screen display information about the current loan account. These fields are not file maintainable and are primarily pulled from other screens in the CIM GOLD system. However, you can click the ![]() button at the bottom of this box to change the information in the Current Interest Rate field to "0.00" (zero). The system will ask you to verify that you want to change the rate to zero.

button at the bottom of this box to change the information in the Current Interest Rate field to "0.00" (zero). The system will ask you to verify that you want to change the rate to zero.

|

WARNING: You cannot reverse changing the Current Interest Rate to zero once you have changed it. This will affect all loan calculations in CIM GOLD. To change the Current Interest Rate to a rate other than zero, use the New Interest Rate field in the Alter Account field group on this screen. You can also change the Current Term, Current Payment Amount, and Current Due Day fields by using the New Term, New Payment Amount, and New Due Day fields in the Alter Account field group. |

|---|

The fields in this field group are as follows:

Field |

Description |

|||||||||||||||||||

|

Mnemonic: LNPBAL |

This field displays the unpaid principal balance of the loan. It can only be entered, changed, or otherwise affected by teller transactions, which means it cannot be file maintained through this screen. Depending on the kind of loan, a transaction may either reduce or increase this balance.

An option is available to open a new loan with a principal balance of zero for payment method 5 loans. This option is requested by work order.

Institution Option SOVC requires a supervisor override when posting a principal decrease. |

|||||||||||||||||||

|

Mnemonic: LNPMTH |

This field displays the payment method code. The payment method code determines how to calculate interest and what rules to follow in processing the loan account. Once the payment method has been set up on a loan, it should not be changed. Loans use fields differently for different payment method codes. In addition, most payment method codes will have a separate screen of individualized fields that will need to be completed for the type of loan specified by the code. These fields are important to the proper processing of the loan. See below for a list of possible selections in this field.

|

|||||||||||||||||||

|

Mnemonic: MLOMAT |

This field contains the original maturity date from the time the loan was originated and is the date the last payment is due. |

|||||||||||||||||||

|

Mnemonic: LNMATD |

This field contains the date the last payment is due and the loan should be paid off. At origination, this field and the Original Maturity Date above are the same. See below for information about institution options related to this field.

|

|||||||||||||||||||

|

Mnemonic: LNOPIC |

This field is used in connection with late charge code 24 (percentage of original P/I). The late charge uses the original principal and interest (P/I) in the late charge calculation. Also, at the time a loan is opened (tran code 680), the system will automatically enter the principal and interest constant into this field. If there is a zero P/I, such as for a line-of-credit loan, a zero (0) will be entered in this field. |

|||||||||||||||||||

|

Mnemonic: LNPDTO |

This is the date, calculated with each payment, up to which interest has been paid on the loan. When charging interest on LIP loans, this date will appear in the history. See below for more information.

|

|||||||||||||||||||

|

Mnemonic: LNPICN |

This field displays the current loan payment amount due this month (or according to how often a payment is due). This field displays the portion of the regular payment that is divided between the amount to interest and amount to principal. This field is calculated by the system. If you calculate a new payment amount or term, after changes are saved, that amount will appear in this field. |

|||||||||||||||||||

|

Mnemonic: None (calculated as LNR1CN+LNR2CN) |

This is the sum of the reserve 1 constant and the reserve 2 constant. |

|||||||||||||||||||

|

Mnemonic: LNTERM |

This field contains the term of the loan in months. It is used in calculating rebates on loans with precomputed interest (payment method 3), and in determining the remaining term of ARM (payment method 7) loans.

|

|||||||||||||||||||

|

Mnemonic: LNPINX |

The next P/I constant replaces the P/I constant as the amount to divide between principal and interest on a payment when the due date is advanced by the system to be greater than the P/I effective date, which is the date found in the Next PI Effective field below. |

|||||||||||||||||||

|

Mnemonic: LNPIEF |

This field contains the principal/interest effective date, which is the date that the next P/I constant should replace the P/I constant. This field, in conjunction with the Next PI Constant field above, can be used to make a payment change in the amount of money applied to principal and interest. (This is the payment due date for the new P/I.) |

|||||||||||||||||||

|

Mnemonic: TYDINT |

This is the amount of interest due with the next regular loan payment. |

|||||||||||||||||||

|

Mnemonic: MLCNT1 |

This field shows the total number of deferments processed for the life of the loan. Deferments are processed either through the EZPay screen (if your institution allows it) or in CIM GOLDTeller. See the following topics for more information on deferments:

Deferments screen |

|||||||||||||||||||

|

Mnemonic: MLDTE1 |

This is the date the deferred payment was last late. If this field is blank, the payments have never been late. Deferring interest means that if a principal and interest payment does not cover all of the accrued interest owing, the remaining unpaid interest is added to the loan principal balance. After deferral (adding it to the principal balance), interest is also accrued on the deferred amount. See the Loan Deferments screen for additional help regarding deferments. |

|||||||||||||||||||

|

Mnemonic: LNFEES |

This is the total amount of outstanding fees owed. |

|||||||||||||||||||

|

Mnemonic: LNDUDT |

This field displays both the current due date day and the date the next regular payment is due. Your institution has the option of changing the current due date; however, once it has been changed once, the field will be highlighted in red. This means that a change has been made and that the Current Due Day cannot be changed again. See below for more information.

|

|||||||||||||||||||

|

Mnemonic: LN1DUE |

This field displays the first payment due day and date on this loan. The Day portion of this field displays the day of the month, and the date portion displays the date in DD/MM/YYYY format.

This is a critical field that is used by numerous afterhours reports. Coupons and bill/receipt statements use this date to determine the first coupon/billing. For line-of-credit loans (payment method 5), if the first due date is not known, the date the loan was opened will appear in this field, so the field will not be blank. (A bill/receipt will not be created until there is a principal advance. The statement will be created on the next coupon/bill cycle after the advance). |

|||||||||||||||||||

|

Mnemonic: LNRATE |

This field displays the current annual interest rate using three decimal places. This is the rate calculated at which the payment is being made. You can change this rate by clicking <Zero Rate>, then typing a new rate in the New Interest Rate field in the Alter Account field group and clicking <Save>. This will change the interest rate for the loan. If the rate is changed for daily simple interest loans (payment method 5 or 6), the accrued interest is recalculated to the current date using the old rate, and the date last accrued is changed to today's date.

An institution option is available that does not allow employees to change the interest rate through the New Interest Rate field. |