Field

|

Description

|

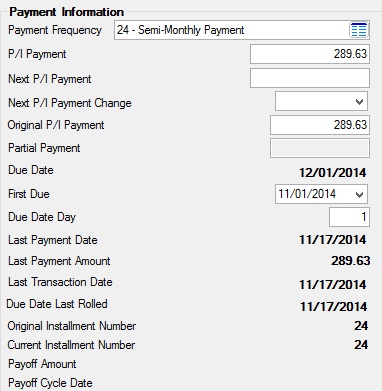

Payment Frequency

Mnemonic: LNFREQ

|

This field displays the number of months or frequency of regular loan payments (Biweekly doesn't work for ARMs, P/I doesn't calculate, etc). See below for more information.

The codes include the following:

Code

|

Description

|

1

|

Monthly payment

|

2

|

Bi-monthly payments (every 2 months)

|

3

|

Quarterly payment

|

4

|

Payment every 4 months

|

6

|

Semi-annual payment (every 6 months)

|

12

|

Annual payment

|

26

|

Bi-weekly (every two weeks)

|

If payment frequency code 26 is used, an Interest Calculation Method code of 001 or 101 must be used.

If your institution allows changing payment frequencies, see the Loans > Account Information > Payment Information screen help for more information on how to change frequencies.

|

|

P/I Payment

Mnemonic: LNPICN

|

This field contains the portion of the regular payment that is divided between the amount to interest and amount to principal. This field is sometimes calculated by the system; however, the user has the ability to file maintain this field when needed.

When the Payment Method is 5 (line-of-credit) and the Payment Type field on the Loans > Line-of-Credit Loans screen is "2" or "4," this field will be the principal payment and will be the amount to principal only.

|

Next P/I Payment

Mnemonic: LNPINX

|

This field replaces the P/I payment as the amount to divide between principal and interest on a payment when the due date is advanced by the system to be greater than the P/I effective date, which is the date found in the Next P/I Payment Change field below.

For ARM loans (payment method 7), this amount is either manually entered or automatically calculated based on the information entered on the ARM Information screen. It will be calculated on the number of days entered in the Days Before Rate Change (on the Loans > Account Information > ARM Information screen) before the date entered in the Next P/I Payment Change field. This amount will also be calculated any time the calculated date is in the past and there is not already something entered in this field.

|

Next P/I Payment Change

Mnemonic: LNPIEF

|

This field contains the principal/interest effective date, which is the date that the next P/I payment should replace the current P/I payment. See below for more information.

This field, in conjunction with the Next P/I Payment field above, may be used to make a payment change in the amount of money applied to principal and interest. (This is the payment due date for the new P/I.)

The P/I effective date is used for both manual loan adjustments and automatic P/I payment changes on adjustable mortgage loans (ARM, payment method 7). The Next P/I Payment will be calculated on the date of the number of days entered in the Before Rate Change (on the Loans > Account Information > ARM Information screen) prior to the actual date entered in the field.

To perform file maintenance on ARM (payment method 7) loans you must access the ARM Information screen.

If manual changes are desired, the Rate Change Frequency field on the ARM Information screen should be zero (0).

|

|

Original P/I Payment

Mnemonic: LNOPIC

|

This field is used in connection with late charge code 24. The late charge uses the original P/I payment in the late charge calculation. Also, at the time a loan is opened (transaction code 680), the system will automatically enter the P/I payment into this field. If there is a zero P/I payment, such as for a line-of-credit loan, a zero will be entered into this field.

|

Applied To Payment

Mnemonic: LNPRTL

|

This field is for payment methods 3 (precomputed), 5 (consumer line-of-credit), 6 (daily simple interest), 9 (commercial LOC daily), and 10 (commercial LOC periodic). File maintenance is not allowed on this field for payment methods 3, 5, 9, and 10. File maintenance is allowed for payment method 6 loans.

For daily simple interest loans (payment method 6), the amount in this field has already been applied toward the payment due. It appears in the Applied To Payment field to monitor the amount paid in order to know when the payment due date can be advanced. Once a full payment has been applied, the due date will advance automatically. See below for more information.

If more than a full payment is posted, the full amount is credited to the payment, the due date advances by one frequency, and the amount paid which exceeded the payment amount will appear in this field (Applied To Payment). The borrower will then only have to pay the difference between the calculated payment and the amount in the Applied To Payment field in order for the full payment to be satisfied and the due date advanced.

Option: A loan-level option is available that treats any amount paid over the actual payment as a principal decrease, rather than applying it toward the next payment. If less than a full payment is posted, it would go toward the payment due and appear in the Applied To Payment field. This option is only available for daily simple interest loans (payment method 6).

See also:

Special Delinquency Calculations for Consumer Loans

|

WARNING: If you change payment method 5 or 6 to 0 or 7, the amount in the Applied To Payment field will clear to 0. This amount will show in the history.

|

|

|

Due Date

Mnemonic: LNDUDT

|

This is the date the next regular payment is due. It is determined by the system from the Payment Frequency code above, but can be file maintained. See below for more information.

This field can be used in conjunction with the Due Date Day field below. The system requires a due date to be on the loan before the loan can be opened.

File maintaining the Due Date field will change the Due Date Day field to match the day portion of the due date.

For an LIP loan, this is the date to which the payments have been received. If interest is charged against the LIP, the due date and the LIP Next Bill or Charge Date should always agree. If the LIP interest is billed, the LIP Next Bill or Charge Date will roll when the interest is billed and the due date will roll when the payment is collected.

For payment method 5 loans with a zero balance, a balance increase transaction will update the loan due date by adding the number of days before the finance charge date to the current run date.

An online error message will appear when file maintenance occurs on this field. If the interest calculation code is a 1, 2, or 3, the system will not allow the due date to be anything except one payment frequency ahead of the date last accrued. For LIP loans with an interest calculation code of 1, 2, or 3 and an LIP method code of 2 or 102, the error message will also appear. The error message will be "NO F/M – DATE LAST ACCRUED NOT 1 FREQ BEHIND DUE DATE."

If Institution Option DD27 is set, the due date day will not be allowed to be greater than 27.

|

Note: If a user attempts to change the Due Date or Due Date Day and the system displays an error message, it's likely that certain options are set up for your institution which prevent altering due dates and due date days. See the following institution options for more information:

•CDUR •DDCD •DDAO •DDPF •DD27 •MDDD

Additionally, some institutions have requested hard-coded restrictions on changing these fields. Contact your GOLDPoint Systems account manager to see if such restrictions are in place at your institution.

|

|

|

First Due

Mnemonic: LN1DUE

|

In this field, enter the first payment due date on this loan in MMDDYYYY format. See below for more information.

|

WARNING: Do not leave this field blank.

|

This is a critical field that is used by numerous afterhours reports. Coupons and bill/receipt statements use this date to determine the first coupon/billing. ARM loans will not perform the calculation for a new P/I prior to the first due date. Example: If the date the new P/I is to be calculated is 12/15 but the first due date is 2/1, the program will not calculate a P/I on 12/15. In this scenario, either the date in the Next P/I Payment Change field above or in the First Due field is wrong.

For line-of-credit loans (payment method 5, 9 or 10), if the first due date is not known, enter the date the loan was opened, so the field will not be blank. (A bill/receipt will not be created until there is a principal advance. The statement will be created on the next coupon/bill cycle after the advance.)

See also:

Bill and Receipt, payment method 0, 6, and 7 (Cycled Billing) (FPSRP003)

Bill and Receipt, payment method 0, 6, and 7 (Variable Billing (FPSRP155)

|

|

Due Date Day

Mnemonic: LNDUDY

|

This field is used to establish the day of the month the loan payment is due. See below for more information.

This field is used in conjunction with the Due Date field above. If you change the day in this field, the next Due Date will change accordingly. For example, if you changed this day to "15," the next Due Date field also changes to be 15 of the next month. This field is only used if the payment frequency is monthly.

If you want the Due Date Day to be the last day of the month, the number in this field changes. For example, if you tried to set up the due date to be the last day of February, the last day that you could enter in the Due Date field is February 28. The system would not allow you to enter 31 days in February because that is an invalid date. Thus, on succeeding months the due date would appear as the 28th of the month. The Due Date Day field allows you to override that date making the due date as the 31st of each subsequent month.

On months that have 31 days, the system will automatically places 31 in the Due Date Day field. In the months that follow, the system will make the due date the last day of the month, even when there are only 30 days in the month. This field is file maintainable, but the system will insert default settings.

If you change the Due Date Day and then click <Save Changes>, the system automatically updates the Due Date field accordingly, and vice versa. The Due Date will move to the next month if the indicated Due Date Day is in the future.

If Institution Option MDDD is set, file maintaining the Due Date Day field will automatically change the day portion of the Due Date field, unless the loan is bi-weekly or the resulting due date would be invalid.

If Institution Option DD27 is set, the due date day will not be allowed to be greater than 27.

|

Note: If a user attempts to change the Due Date or Due Date Day and the system displays an error message, it's likely that certain options are set up for your institution which prevent altering due dates and due date days. See the following institution options for more information:

•CDUR •DDCD •DDAO •DDPF •DD27 •MDDD

Additionally, some institutions have requested hard-coded restrictions on changing these fields. Contact your GOLDPoint Systems account manager to see if such restrictions are in place at your institution.

|

|

|

Last Payment Date

Mnemonic: LNDTLP

|

This field shows the date that the last payment was posted. If a payment reversal (tran code 608) occurs, the system will look in the history for the previous last payment date and enter that date in this field. The last payment date is reported to the credit bureau and is updated as payment activity occurs on the loan.

Note: The loan transaction 590 (Charge LIP Interest to LIP Undisbursed Balance) also updates the date of last payment. However, the reversal of this transaction will not change the last payment date.

If institution option NDLP is not set and a deferment was recently run, this field will display the deferment date.

|

Last Payment Amount

Mnemonic: LNLPMA

|

This is the amount of the last loan payment the account owner made on the Last Payment Date above. See below for more information.

This field indicates the most recent amount paid on the customer account. Each time a payment transaction is run on the account, this field is updated with the amount of the transaction.

If institution option NDLP is not set and a deferment was recently run, this field will display the deferment amount.

For loans that are boarded through GOLDAcquire Plus or GOLD Loan Gateway, an institution option is available that affects whether an amount is transferred into the Last Payment Amount field. If this institution option (OP30 UOLP – Use Origination Payment Amount) is set, when a loan is boarded through GOLDAcquire Plus or GOLD Loan Gateway, the Origination Tracking Final Payment amount (OTLPAM) will transfer into the Last Payment Amount field (LNLPMA) for the loan.

Without this option set, the Open Loan transaction (tran code 680) clears the amount in LNLPMA. If UOLP is set, then the CSOT record will be read and populate LNLPMA with OTLPAM.

The Final Payment amount field (OTLPAM) is found on the Loans > Purchase Disclosure or Original Loan Disclosure screens.

|

|

Last Transaction Date

Mnemonic: LNTRAN

|

This field contains the date of the last transaction on this account. The system supplies this date through the teller transactions, and the field is not file maintainable. This field is also updated by tran code 520 (Assess finance charge) for line-of-credit loans (payment method 5). Backdated Transactions: If a transaction is backdated, this field will display the backdated effective date, not the date the transaction was actually processed.

|

Due Date Last Rolled

Mnemonic: LNROLL

|

This field displays the last time the due date was artificially rolled by the system. Rolling the due date is a term meaning the customer paid less than the full payment amount, but met other criteria that allowed the system to forward the due date by one frequency. For more information on how to set up the rules accompanying rolled due dates, see the Payment Due Date Roll field group on this tab.

|

Original/Current Installment Number

Mnemonic: LNCINO

|

The Original Installment Number is the original number of payments when the loan was opened. This field is transferred over from GOLDTrak PC using the NBR_OF_PAYMENT (No. Pmts) field on the application. This information is helpful when researching deferment payments. The Original Installment Number and Current Installment Number are the same, and stay the same throughout the life of the loan, unless one or both of the following occurs on the loan:

1.The loan frequency is changed. If the loan frequency is changed, the Current Installment Number increases or decreases accordingly. For example, if the Current Installment Number is 100 for monthly payments, and the Payment Frequency (above) is changed to weekly, the Current Installment Number is increased to 400. However, the Original Installment Number stays the same. The Original Payment Frequency field displays what the payment frequency was when the loan was originated. If your institution allows changing payment frequencies, see the Loans > Account Information > Payment Information help for more information on how to change frequencies.

2.If a deferment or loan extension is applied to the loan, the Original Installment Number remains static and the Current Installment Number advances the number of frequency cycles that the account was deferred/extended. Installments/payments that are made that roll the due date update the Installments Made field on the Payment Information screen. |

Payoff Amount

Mnemonic: M1POFF

|

The Payoff Amount field is the total amount needed if the loan were to be paid off today. The payoff amount (POPOFF) is displayed on the Loans > Payoff screen. For more information on paying off a loan, see help for the Payoff screen. If a reversal of a payoff is processed, this field changes to zero.

|

Payoff Cycle Date

Mnemonic: M1DATE

|

This field displays the final cycle date of the recurring payment that will result in the account being paid off. Cycle dates are determined by the Cycle Code field on the Loans > Account Information > Payment Information screen.

|