Navigation: Loans > Loan Screens > Marketing and Collections Screen > Delinquent Payments tab > Miscellaneous Fees list view >

The Miscellaneous Fees are fees that can be assessed on a loan after a loan is opened due to specific activity, such as costs your institution might incur because of a bankruptcy and you want to pass the fee onto the borrower. Your institution determines whether or not you allow assessing miscellaneous fees, and which of the miscellaneous fees are allowed.

Miscellaneous fees are different from amortizing fees and costs. Amortizing fees are usually established when the loan is originated and are earned by your institution over the course of the loan. Miscellaneous fees can be applied to an account after it is opened for various reasons. For more information on amortizing fees, see the Amortizing Fees and Costs screen help.

Certain institution options must be set up for your institution in order to use miscellaneous fees. See the Options section in the Miscellaneous Fee Processing topic for more information.

As a fee is assessed, waived, or paid, fee codes are used to identify what the fee is for. These same fee codes are also used in the General Ledger. As a payment of a fee is posted, the afterhours Autopost function directs the amount to the designated General Ledger (see Options in the Miscellaneous Fee Processing help).

As a fee is assessed, an individual fee record is created and displayed in the Miscellaneous Fees list view found on the following screens:

•Loans > Account Information > Additional Loan Fields screen > Daily Statistics & Fees tab

•Loans > Marketing and Collections screen > Delinquent Payments tab

•Loans > Cards and Promotions screen > Fees and Charges tab (for line-of-credit loans only)

•Loans > Transactions > EZPay screen. See Fees for details concerning paying fees from the EZPay screen.

•Loans > Transactions > Make Loan Payment

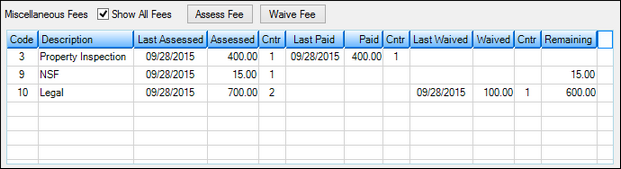

This record is then updated as fees are assessed, paid, or waived. The following is an example of the Miscellaneous Fees list view on the Marketing and Collections screen.

This list view shows information pertaining to all fees that have been assessed, including the date they were last assessed, paid, waived, and the remaining amount of the fee that has yet to be paid by the borrower.

You can also assess or waive fees for the given account by clicking the ![]() or

or ![]() buttons. See Miscellaneous Fees Processing for more information about assessing, waiving fees, and paying fees.

buttons. See Miscellaneous Fees Processing for more information about assessing, waiving fees, and paying fees.

Reports

Two reports can be used for miscellaneous fees: the Fee Journal (FPSRP102) and the Fee Activity Report (FPSRP103).

•The Fee Journal report is run daily and uses the transaction logs (tranlogs) as input to obtain information to show the fees that were assessed, waived, and paid each day.

•The Fee Activity Report is run at monthend and reads loan history to show all fees that were assessed, waived, and paid in the period covered by the history parameter of the report setup. Generally, this is year-to-date information.

Before Fees can be paid, your General Ledger Autopost must be set up correctly. The Autopost is set up at the time your company converts to GOLDPoint Systems. This information is more just for your general knowledge of how the fee payments are filtered into the correct General Ledger account.

Fees are directed to the General Ledger by using Loan Posting Fields #27 (Misc Fee Code). Posting Fields are set up on the GOLD Services > General Ledger > Posting Fields screen in CIM GOLD.

Institutions can reclassify fee amounts when a loan is charged off by adding Loan Posting Fields #3 (General Category) and #33 (Transaction Code). To do this, institution option GAP6 must be turned on. (Reclassification uses the Autopost to move the funds from one General Ledger account to another. See General Ledger Posting Fields in the GOLD Services manual on DocsOnWeb.)

There are basically two types of miscellaneous codes. Income-related fees (like non-sufficient funds or charge-back fees) represent income to your institution, if collected. Non-income related fees (like towing/storage fees) are outlays of cash for services rendered in regard to the loan, and represent a receivable amount that will be cleared if collected.

Four basic transactions relate to miscellaneous fees: Assess (tran code 660/668), Payment by Customer (tran code 850/858), Waive (tran code 670/678), and Charge Off/Reclassify (tran code 22). The G/L account posted to for each of these transactions depends on the type of miscellaneous fee code (income related or non-income related) and possibly whether the loan is charged off. See General Ledger Amount Fields in the GOLD Services manual on DocsOnWeb for more information.

See also: