Navigation: Loans > Loan Screens > Marketing and Collections Screen > Delinquent Payments tab >

Miscellaneous Fees list view

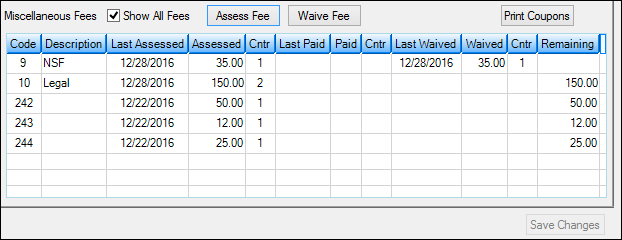

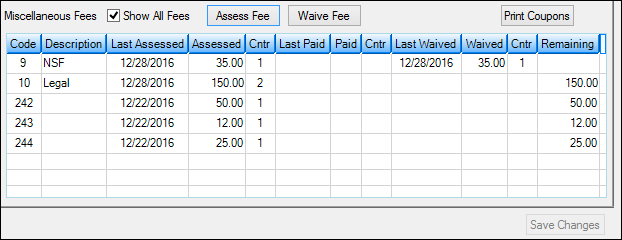

The list view at the bottom of the Delinquent Payments tab displays miscellaneous fees assessed against this account. If the Show All Fees checkbox (located above the list view) is not checked, then those fees that have been paid off (remaining balance is zero) will not appear in this table. If Institution Option DSAF is set to "Y," Show All Fees will default to a checked box. If this option is not set, Show All Fees will default to an unchecked box.

This table displays the fee code and description, the date the fee was last assessed, the amount of the last assessed fee, the number of times the fee has been assessed on this account, the date the fee was last paid, the amount that was paid, the number of times the fee has been paid, the date the fee was last waived, the amount of the last waived fee, the number of times the fee has been waived, and any remaining amount of the unpaid fee.

This list view also appears on the Loans > Account Information > Additional Loan Fields screen > Daily Statistics & Fees tab.

|

Tip: See the Miscellaneous Fees help for information on how to assess and waive miscellaneous fees. |

|---|

If this is a card loan, fees can be set up on the Loans > Cards and Promotions screen > Fees and Charges tab.

If you have the proper security, you can assign fees to be used from the Loans > System Setup Screens > Client Code Setup > Miscellaneous Fee Codes screen. Fee codes are defined by GOLDPoint Systems. Fee codes, descriptions, and TORCs can be seen on that screen's help page.

|

Note: The following amounts may appear in this list view table. They are not fees but arrearages for Chapter 13 Bankruptcy accounts. You cannot assess arrearage amounts through this screen. To process arrearage amounts on an account, use the Claim Information link on the Loans > Bankruptcy > Bankruptcy Detail screen.

•240 – Prepetition Income Fees •241 – Prepetition Receive Fees •242 – Prepetition Escrow Due •244 – Prepetition Principal Due •247 – Post-petition Income Fee •248 – Post-petition Reveive Fee •249 – Post-petition Interest Due •250 – Post-petition Escrow Due •251 – Post-petition Principal Due

To pay the arrearage amounts, use the Petition Claim Payment transaction (tran code 2850-07) in CIM GOLDTeller. |

|---|

Fee Record

When a fee is first assessed, a fee record is created. This record provides a summary of the activity for the fee and is displayed in this list view, as shown below:

Above the miscellaneous fees record table is the Show All Fees checkbox. If this box is checked, all fees, even those with zero as the remaining balance, will appear in the Miscellaneous Fees list view. If this box is not checked, only fees with a non-zero remaining balance will appear in this list view.

The miscellaneous fees table displays the following information:

Column |

Description |

|---|---|

Code

FOFECD |

This is the fee code number, as set up through the Loans > System Setup Screen. For more information on setting up fee codes for your institution, see Miscellaneous Fee Processing. |

Description |

This is the description of the fee. |

Last Assessed

FODLAS |

This is the date the miscellaneous fee was last assessed. Miscellaneous Fee Processing describes how to assess miscellaneous fees through either CIM GOLD or GOLDTeller. |

Assessed

FOAMAS |

This is the amount of the fee that was assessed on this account. |

Cntr

FOASCT |

This column is a counter. Each time a specific miscellaneous fee is assessed on the account, this counter goes up. |

Last Paid

FODLPD |

This is the date the miscellaneous fee was last paid by this account owner. |

Paid

FOAMPA |

This is the amount the account owner paid toward the miscellaneous fee. See Miscellaneous Fees Processing for more information on paying miscellaneous fees. |

Cntr

FOPDCT |

This column counts the number of times payments have been made toward paying off the miscellaneous fee. |

Last Waived

FOWVDT |

This is the date, if applicable, the miscellaneous fee (or part of the fee) was waived by your institution. Miscellaneous Fee Processing describes how to waive miscellaneous fees. |

Waived

FOAMWV |

This is the amount your institution has waived for this miscellaneous fee, if applicable. |

Cntr

FOWVCT |

This column counts the number of times the miscellaneous fee (or part of the fee) was waived by your institution. |

Remaining

FOFREM |

This is a calculated field that shows the amount of the fee that remains to be collected. It is calculated by subtracting the amount paid and the amount waived from the amount assessed:

Remaining = Assessed – Paid – Waived

If the Show All Fees box is unchecked, fees that have been paid off or waived in full will not appear in this table. |

See also: