Navigation: Loans > Loan Screens > Account Information Screen Group > Additional Loan Fields Screen > Daily Statistics & Fees tab > Maintenance Fee field group >

Maintenance Fee Codes

This topic discusses each of the maintenance fee codes currently available on GOLDPoint Systems. See Maintenance Fee field group and Setting Up Maintenance Fees for information on what maintenance fees are and how to set them up.

|

A behind-the-scenes option, 16-day Rule (MR16DY), is available that also changes whether or not maintenance fees are refunded. If the Payoff Date is 15 days or fewer before the Due Date, then the maintenance fee for that month is refunded back to the borrower. If the Payoff Date is 16 days or more after the Due Date, then the maintenance fee is not refunded back to the borrower. |

This fee is both earned and collected when the payment is actually made. The Earnings Date (MRMNDT) is ignored by the system using this code. When a payment is made, the fee amount is credited to the Maintenance Fee Receivable G/L account on the GOLD Services > General Ledger > GL Account By Loan Type screen. If the loan is current, the system only charges one maintenance fee per loan frequency. For example, if a customer makes one payment at the beginning of the month, the Maintenance Fee is charged with that payment. If they make another payment later in the month, the Maintenance Fee is not charged again.

However, if the loan is delinquent by more than one frequency, the next time a payment is made, the system will catch up on past maintenance fees. For example, if the loan is behind by three months and then a payment is made, the system will collect three months of maintenance fees before applying the rest of the payment to the principal, interest, reserves, late charges, and miscellaneous fees, as designated in the Payment Application.

The Collection Date moves ahead one month after a fee is collected with payment (or multiple months if the account was delinquent). The Collection Date moves ahead to the same day of the month established when the Maintenance Fee was originally established, which is usually the same day as the First Due Date. For example, today is August 10. The First Due Date on the loan is 06-01-2018. The Collection Date is 07-01-2018. If a payment were made today, the Collection Date would advance to 08-01-2018, not 08-10-2018 (the paid date).

You must have Code 8 (PI Fees) be part of the Payment Application field (on the Account Detail screen).

Fee at Payoff

When a loan is paid off, if the Collection Date is in the future from the Effective Payoff Date (e.g., Collection Date is 09-21-18 and Effective Payoff Date is 09-10-18), no maintenance fee is required, nor is there any refund of maintenance fees.

If the Collection Date is in the past from the Effective Payoff Date (e.g., Collection Date is 08-29-18 and Effective Payoff Date is 09-21-18), the system uses the following logic to calculated the fee:

1.Is the Payoff Date greater than or equal to the original Maturity Date on the loan?

Example: Payoff Date is June 1, 2018 and Maturity Date is June 1, 2019. Is June 1, 2018 greater than June 2, 2019? No.

a.Yes, use the Payoff Date as the end date (ENDDT).

b.No, add one month to the Payoff Date and use this as ENDDT. Example: Since the Payoff Date is June 1, 2018 (and it is less than the Maturity Date), we will add one month, so ENDDT is July 1, 2018.

2.Calculate the difference in MONTHS from the Fee Collection Date (MRPIFD) to end date (ENDDT). If either is zero or negative, then the process is complete and a maintenance fee is not collected at payoff.

Example: Collection Date is May 28, 2018. ENDDT is July 1, 2018; therefore, 2 MONTHS.

3.Use this number in the formula: Answer = MRMFEE * MONTHS

Example: $6 = $3 * 2

4.Is Answer zero?

a.If yes, then the process is done and at payoff, the account does not owe any additional maintenance fees.

b.If no, then on payoff, the maintenance fee will be collected for the number of months calculated and collected in a miscellaneous G/L entry for the payoff using the description “MAINTENANCE FEE” in the interest income G/L number for the loan type (entered in the Maintenance Fee Receivable field on the GOLD Services > General Ledger > GL Account by Loan Type screen).

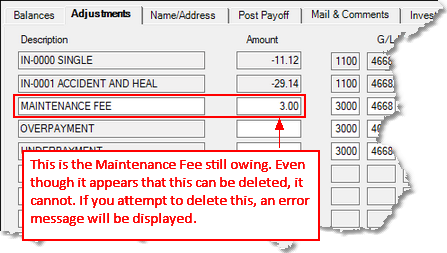

In our example, this would be two months of maintenance fees collected. This amount will show on the Adjustments tab of the Payoff screen when the loan is locked in for payoff, as shown below:

Remember: There is an additional option that will affect whether or not any fees are refunded. See the 16-day Rule Option above for more information.

These fees are earned each month in the afterhours before the day designated by the First Due Date (or Earnings Date), but collected when a payment is made. Once a payment is made, the Collection Date usually catches up to the Earnings Date; it never moves ahead of the Earnings Date. However, if a loan is delinquent by a few months, the Collection Date may be further in the past than one month.

For example, the First Due Date is 02-01-18. Each month on the first (01), the system moves the Earnings Date ahead by one month, regardless of whether or not a payment is made. After a payment is made, the Collection Date also moves to the first of the next month. Now let's say the Earnings Date is 06-01-18, but the borrower has not made a payment for two months, so the Collection Date is 04-01-18. The borrower makes a payment on 06-10-18. The Earnings Date won't move until the afterhours before 07-01-18. But after the payment is made on 06-10-18, the system collects two months of maintenance fees and moves the Collection Date ahead by two months to 06-01-18. On 07-01-18, the system moves the Earnings Date ahead by one month, but the Collection Date stays at 06-01-18 until the next payment is made. The Collection Date never moves ahead of the Earnings Date.

If the account is delinquent and payments resume or are caught up by applying a lump sum, all past maintenance fees are collected first.

IMPORTANT: If you are setting up an account with maintenance fees after the loan has already originated and boarded into CIM GOLD, you should set the Earnings Date to be the same day as the First Due Date. It doesn't need to be the same month, but it needs to be the same day so as to avoid confusion. The Earnings Date is updated in the afterhours of the monthly anniversary of the First Due Date. For example, if the First Due Date is 04-12-2018 and you are setting up the loan with maintenance fees in June, you would set the Earnings Date as 06-12-2018, if you did not want to collect back charges for maintenance fees. If you do want to collect back fees, set the Earnings Date exactly the same as the First Due Date.

G/L and Setup

Afterhours Update Function 90 must be set up in order for the system to move the Earnings Date each month. GOLDPoint Systems will ensure this is set up for your institution when you start using maintenance fees.

The system earns the amount of these fees in the Maintenance Fee Receivable G/L account on the GOLD Services > General Ledger > GL Account By Loan Type screen each month in the afterhours of the Earnings Date. The system uses tran code 919 (Earn Maintenance Fee) to earn the fee. Then when a payment is made, another G/L accounting is made (cash income with offsetting G/L, tran code 1800). On payoff, the G/L trues itself with proper income receivables and offsetting balances.

Code 8 (PI Fees) is required to be part of the Payment Application field (on the Account Detail screen) for the system to collect these maintenance fees using these codes.

Fee at Payoff

Refunding of this fee is based on the anniversary of the day of the First Due Date (LN1DUE). One fee is collected if the account is paid off on the First Due Date day and the Earnings Date was before the First Due Date. For example, if the Earnings Date is 09-10-18, the Collection Date is 08-10-18, and the Payoff Date is 09-25-18, the system will require one month of maintenance fees at payoff (if the account is current).

Maintenance fees are refunded if the account payoff is backdated before the Collection Date.

No fees are collected past the original Maturity Date (MLOMAT) unless the account is delinquent and there are past due fees to collect.

How does the system determine if another Maintenance Fee is Required at Payoff?

Depending on when the final payoff payment is made in the month, the system may require another month's of maintenance fees. For example, if the last Earnings Date was 09-10-2018, but the loan is paid off on 09-30-2018, will the system require one more month's of maintenance fees? The system uses the following logic to determine the number of maintenance fees required (or not required) at payoff:

1.Is the Collection Date greater than the First Due Date (LN1DUE) on the loan? This might be the case if the customer opened a loan one week, made a payment the next week, then paid off the loan the week following that, all before the First Due Date.

a.If yes, continue to the next step.

b.If no, the system changes the Collection Date to the same date as the First Due Date, and when the payoff is calculated, it includes one month of maintenance fees.

2.The system finds the lesser of the Payoff Date and the original Maturity Date (MLOMAT). This ensures that funds are not collected after maturity. If the original Maturity Date is zero, then the current Maturity Date (LNMATD) is used. The result of this compare determines the date (COMPDATE) that will be used in the calculation.

Example: Payoff Date is 09-10-2018. Original Maturity Date and Current Maturity Date is 04-01-2019. Therefore, 09-10-2018 is used as the COMPDATE.

3.Calculate the number of months from the maintenance fee Collection Date (MRPFID) to the compare date (COMDATE) (lesser of payoff date and original maturity date). The formula to do this is:

#Months = (ToCC – FromCC) x 100 + (ToYY – FromYY) x 12 + (ToMM – FromMM)

Where:

CC = century; YY = year; MM = month

To = COMPDATE

From = maintenance fee date

Example: Collection Date is 07-27-18, Payoff Date is 09-10-2018, and Original Maturity Date (MLOMAT) is 04-01-2019. Therefore, we use the Payoff Date in the following calculation:

To = 09-10-2018

From = 07-27-2018

#Months = (20 - 20) x 100 + (18 - 18) x 12 + (09 - 07) = 2

4.Is the day portion of the First Due Date (LN1DUE) less than or equal to 28?

a.Yes, go to step 8.

b.No, find the date that is the end-of-the-month date for the compare date (COMPDATE) (EOMCOMPDATE).

Example: If COMPDATE is 09-10-18, then EOMCOMPDATE for COMPDATE is 09-30-18.

5.Is the day portion of the First Due Date (LN1DUE) less than or equal to the end-of-month compare date (EOMCOMPDATE)?

Example: Is 09-10-18 less than 09-30-18?

a.Yes, continue to step 9.

b.No, is the day portion of COMPDATE less than the EOMCOMPDATE?

i.Yes, go to step 9.

ii.No, go to step 10.

6.Is the day portion of the First Due Date (LN1DUE) less than or equal to the COMPDATE day?

Example: Is 27 less than 10?

a.Yes, go to step 10.

b.No, continue to the next step.

7.Subtract one month from #Months. Our example had 2 for #Months; therefore, now we have 1.

8.Multiply the number of months (#Months) by monthly maintenance fee (MRMFEE) to get the fee amount owed at Payoff.

Remember: There is an additional option that will affect whether or not any fees are refunded. See the 16-day Rule Option above for more information.

Maintenance Fee Code 02 uses the Rule of 78s (or sum of the digits) to collect or refund maintenance fees at payoff. Each month the fees are earned and collected regularly in a straight line method, as discussed in Code 01 above. But at payoff, the system uses the Rule of 78s to determine the maintenance fees owed or refunded.

Rule of 78s adds up the total amount of maintenance fees if the loan were paid off by the full term of the loan, then each month the account earns the regular fee amount in the afterhours before the Due Date. Rule of 78s is a lending methodology that gives added weight to months in the earlier cycle of a loan.

In a 12-month loan a lender would sum the number of digits through 12 months in the following calculation:

1+2+3+4+5+6+7+8+9+10+11+12=78

In an 18-month loan, the sum of digits would be:

1+2+3+4+5+6+7+8+9+10+11+12+13+14+15+16+17+18=171

For a two year loan the total sum of the digits would be 300, and so forth.

Once the sum of the months is calculated, the fees are weighted in reverse order applying greater weight to the earlier months. For a one year loan the weighting factor would be 12/78 of the total maintenance fees in the first month, 11/78 in the second month, 10/78 in the third month, etc. For a two-year loan the weighting factor would be 24/300 in the first month, 23/300 in the second month, 22/300 in the third month, etc.

Example: Loan is opened on 05-15-2018 with the First Due Date of 06-01-2018. This is a 12-month loan with $3 of monthly maintenance fees, totaling $36. The following table will illustrate the Rule of 78s calculation in this scenario:

Due Date |

Fee |

Month |

% of Total Fee |

Rule of 78s Fee |

|---|---|---|---|---|

06-01-2018 |

3 |

1 |

.1538 |

5.54 |

07-01-2018 |

3 |

2 |

.1410 |

5.08 |

08-01-2018 |

3 |

3 |

.1282 |

4.62 |

09-01-2018 |

3 |

4 |

.1154 |

4.15 |

10-01-2018 |

3 |

5 |

.1026 |

3.69 |

11-01-2018 |

3 |

6 |

.0897 |

3.23 |

12-01-2018 |

3 |

7 |

.0769 |

2.77 |

01-01-2019 |

3 |

8 |

.0641 |

2.31 |

02-01-2019 |

3 |

9 |

.0513 |

1.85 |

03-01-2019 |

3 |

10 |

.0385 |

1.37 |

04-01-2019 |

3 |

11 |

.0256 |

.92 |

05-01-2019 |

3 |

12 |

.0128 |

.46 |

Total |

36 |

35.99 |

Using the table above, let’s say a borrower pays off the loan on 10-01-2018. The system has collected four months of maintenance fees, totaling $12. With Rule of 78s, the borrower would have owed $19.39 (add up Rule of 78s Fee months 1-4), a difference of 7.39. Additionally, that month’s fees have not yet been collected (only earned), so the payoff would also need to collect that month’s fee of 3.69. Therefore, the Adjustments tab on the Payoff screen would show that the account owed an additional $11.08 of maintenance fees (7.39 + 3.69).

See How does the system determine if another Maintenance Fee is Required at Payoff? above for more information on how the system determines whether or not that last payoff amount includes one more month's of fees.

Remember: There is an additional option that will affect whether or not any fees are refunded. See the 16-day Rule Option above for more information.

Maintenance Fee Code 03 uses the Rule of 78s (or sum of the digits) to collect or refund maintenance fees at payoff unless the loan is a renewal loan and is being renewed/refinanced within 120 days of being opened (LNOPND). For a loan to be considered a renewal loan, the Renewal/Pro-rate (PORNWL) box on the Loans > Payoff screen > Balances tab must be checked. When that box is checked and the renewal is within 120 days of opening, the system uses the daily pro-rate for the fee collected. If it's not checked or the renewal/refinance date is more than 120 days after the open date, the system uses the method described in 02 above.

Remember: There is an additional option that will affect whether or not any fees are refunded. See the 16-day Rule Option above for more information.

Maintenance Fee Code 04 uses the actuarial method to collect or refund maintenance fees at payoff. Each month the fees are earned and collected regularly in a straight-line method, as discussed in Code 01 above. But at payoff, the system uses the actuarial method to determine the maintenance fees owed or refunded.

To calculate the unearned fees using the actuarial method, we use this formula:

u = |

kR( |

n * p * V |

) |

100 + V |

where k is the number of payments remaining after payoff, and R is the regular maintenance fee.

How is u used?

In the event that a loan is paid off early:

Payoff Amount = (k + 1)R – u

where k is the number of payments remaining after payoff.

First, calculate h by using the following formula:

h = |

n * Interest Rate/12 * $100 |

– $100 |

1 – (1 + Interest Rate/12)-n |

n = number of payments remaining when the loan was paid off

Example: A loan was paid off in full before its Due Date, with 6 payments remaining after payoff. The regular monthly fee was $3, and the Interest Rate was 8.4%.

h = |

6 * .084/12 * $100 |

– $100 |

1 – (1 + .084/12)-6 |

h = |

$2.46 |

Now plug that number back into the original formula:

u = |

6*3( |

2.46 |

) |

100 + 2.46 |

u = |

18(.024) |

u = |

.432 |

Now figure out the amount of maintenance fees owed:

Payoff Amount = (k + 1)R – u

where k is the number of payments remaining after payoff, R is the regular maintenance fee, and u was calculated above.

Fees Owed = (6 + 1)3 – .432

Fees Owed = 20.57

Remember: There is an additional option that will affect whether or not any fees are refunded. See the 16-day Rule Option above for more information.

Maintenance Fee Code 05 uses the actuarial method to collect or refund maintenance fees at payoff unless the loan is a renewal loan and is being renewed/refinanced within 120 days of being opened (LNOPND).

For a loan to be considered a renewal loan, the Renewal/Pro-rate (PORNWL) box on the Loans > Payoff screen > Balances tab must be checked. When that box is checked and the renewal is within 120 days of opening, the system uses daily pro-rate for the fee collected. If it's not checked or the renewal/refinance date is more than 120 days after the open date, the system uses the method described in 04 above.

When this code is applied, the system earns fees each month in the afterhours (tran code 919) on the day before the anniversary of the First Due Date (LN1DUE) without collecting them. The fee amount is collected when a payment is made.

Fee at Payoff

Fees are not rebated with this code. All fees are earned and collected to the Original Maturity Date. When a loan is paid off, any outstanding fees are collected from the last Collection Date (MRPIFD) to the Original Maturity Date (MLOMAT) using a G/L credit to the Maintenance Fee Receivable G/L account for the loan type (LNTYPE), as set up on the GOLD Services > General Ledger > G/L Account By Loan Type screen.

For example, if a payment is two months behind, but in the third month the borrower wants to pay off the loan, all maintenance fees that have not been collected for the life of the loan will be due at payoff.

Scenario:

•A loan is opened with a loan term of 24 months with a Maintenance Fee Code of 06 and Fee Amount of $3.00. The total amount of Maintenance Fees due on this loan is $72. The Original Maturity Date on the loan is March 02, 2019.

•The borrower has earned 20 months of fees, and made 20 payments, resulting in a collection of $60 in fees.

•The last Collection and Earn Dates for the Maintenance Fees is November 02, 2018.

•On December 10, 2018, the borrower pays off the loan early. The Adjustments tab of the Payoff screen will display the amount of Maintenance Fees still owing as “12.00” (December, January, February, and March’s maintenance fees).

•The $12.00 amount will be added to the final payoff amount.

Setting Up Maintenance Fees

Maintenance fees are usually set up when loans are originated. However, you can set up this maintenance fee code after a loan is opened by using the Maintenance Fees field group on the Loans > Account Information > Additional Loan Fields screen > Daily Statistics & Fees tab. Be careful if setting up maintenance fees after a loan is opened, as the system will “catch up” any outstanding maintenance fees the next time a payment is made.

For more information on how to set up maintenance fees, see the Setting Up Maintenance Fees topic in the Loans in CIM GOLD manual in DocsOnWeb.