Navigation: Loans > Loan Screens > Account Information Screen Group > Additional Loan Fields Screen > Daily Statistics & Fees tab >

Maintenance Fee field group

Maintenance fees are regular monthly fees your institution charges customers for maintaining the loan. Maintenance fees may also be referred to as PI Fees. Maintenance fees are earned per month and do not collect interest. They are not miscellaneous fees, nor are they amortizing fees, though you can set up amortizing fees to function similarly to maintenance fees.

Maintenance fees are usually set up during loan origination and boarded into loan servicing. However, if you have proper security, you can set up maintenance fees after loans are opened. See Setting Up Maintenance Fees for step-by-step procedures on how this is done.

If you have proper security, you can make adjustments to the amount of the maintenance fee once the loan is opened (even reducing it to $0). You also need to set Code 8 (PI Fees) to be part of the Payment Application field (found on the Loans > Account Information > Account Detail screen). Regardless of the order you put the PI Fee in the Payment Application field, the system always takes the PI Fee first. For example, if the Payment Application field contains "47218," the maintenance fee will be applied to the account before the other amounts are paid when a loan payment is made. Once the fee has been satisfied, the rest of the money will be applied in the order indicated in Payment Application; in this example it would be late charges, miscellaneous fees, interest, and finally principal.

Maintenance fees can only be applied to interest-bearing loans (payment method 6). If you want to set up a type of maintenance fee for precomputed loans, you would set them up as amortizing fees (see the Loans > Account Information > Amortizing Fees and Costs screen. Maintenance fees vary from institution to institution, but most institutions charge no more than $3.50 per month. Maintenance fees are regulated by state law.

Collection of Maintenance Fees

The system handles the collection of maintenance fees differently for each institution. This is based on the Maintenance Fee Code. Some institutions earn and collect the maintenance fee when a payment is made. Other institutions earn the fee at a regular day each month and account for it in the General Ledger (using Afterhours Update Function 90 and tran code 919), but when the actual payment is made, another G/L accounting is made (cash income with offsetting G/L, tran code 1800). On payoff, the General Ledger trues itself with proper income receivables and offsetting balances.The system credits the Maintenance Fee Receivable G/L account on the GOLD Services > General Ledger > G/L Account By Loan Type screen with the maintenance fee amount. See the Maintenance Fee Code description below for more information.

For example, if "3.00" is entered in the Fee Amount field, the system assesses $3.00 on the account (tran code 919) in the afterhours before the Earnings Date each month (using Afterhours Update Function 90). When the customer makes a payment, the system collects $3.00 of the payment for the maintenance fee. However, at Payoff (tran code 580) or Death Claim Payoff (tran code 2600-06), a customer may owe more than one month's of maintenance fees (or a portion of the fee balance). See Maintenance Fees at Payoff below for more information on how the fee is calculated at payoff.

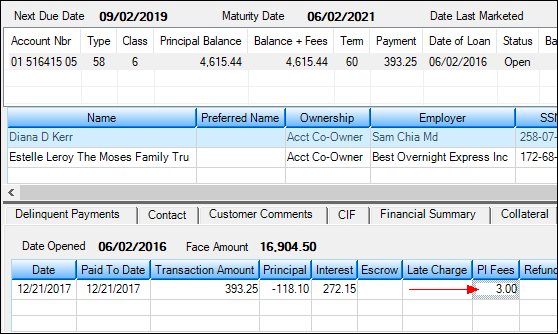

When a payment is processed and part of the amount goes to a maintenance fee, the amount will show in the PI Fees column in Loan Disclosure History, as shown below:

Loans > Marketing and Collections Screen > Loan Disclosure History Tab

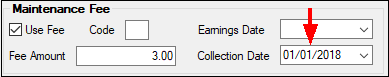

The Collection Date field will be advanced. For some Maintenance Fee Codes, the Collection Date will be the date the payment was made. For others, it will advance to the next day of the month that matches the day portion of the First Due Date. See the following example below:

Additional Fields Screen > Daily Statistics & Fees Tab

|

WARNING: Any of the following criteria will prevent the account from earning maintenance fees:

1.The proper fields in this field group are not filled out (see field descriptions below).

2.PI Fee is not part of the payment application (see above).

3.The account is closed, unopened, charged off, service released, bankrupt, or has a zero balance.

4.The account is non-performing with the delinquent number of days being greater than the specified number in option NPDY.

5.The account has a General Category equal to 80, 82, 83, 84, 86, 87, 88, 89.

6.The account has a hold code of 4 or 5 (bankruptcy).

7.Account is past the original Maturity Date (MLOMAT). |

|---|

On payoff, the borrower may owe more than one month's of maintenance fees depending on which Maintenance Fee Code your institution uses and when the borrower pays off the loan. For example, an option is available that only allows maintenance fee refunds if the payoff is made 15-days or before the Due Date. At 16 days, no refund is given and the entire amount of that month's maintenance fee is earned by your institution. For more information concerning each of these payoff rules, see the Maintenance Fee Codes definition.

Late Charges

If your institution uses a late charge code that is calculated using the percentage of the unpaid portion of P/I (Late Codes 23 and 25), an institution option is available that will leave the maintenance fee out of the calculation when determining what the late charge is. When institution option OP17 LMPL (Leave Maint. Fee in P/I for Late Charge) is set to "Y," the Maintenance Fee will not be subtracted from the unpaid portion when calculating the amount of late charge. See Late Charge Code for more information.

Security to the Maintenance Fee fields should be restricted to supervisors and managers. Entering information in these fields will affect the customer's monthly payment, and the G/L needs to be set up correctly before fees can be taken. If you do have security, you can make changes to the information in these fields. See the Setting Up Maintenance Fees topic for more information on how to set up the General Ledger accounts to accept the fee amounts.

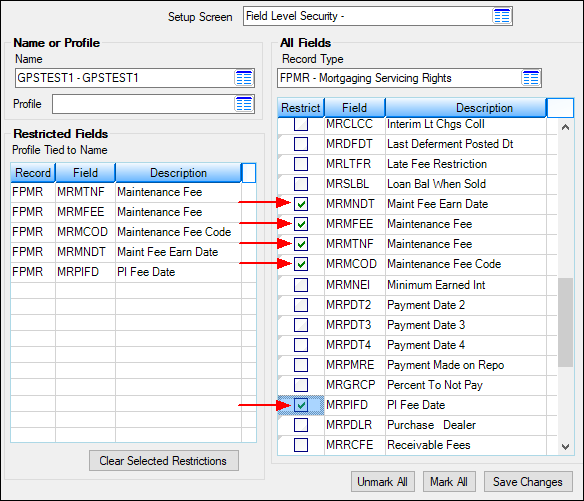

To restrict employees from making changes to these fields, access System Setup Screens > Field-level Security tab for an employee, then choose the "FPMR - Mortgaging Servicing Rights" record. In that record, check the following boxes to restrict the employee from making changes to those fields:

Loans > System Setup Screens > Field-level Security Screen

Field Descriptions

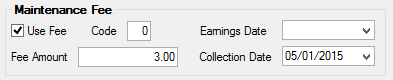

The following is an example of the Maintenance Fee field group, followed by field descriptions.

Field |

Description |

|

Mnemonic: MRMTNF |

Checkmark this box if you want to assess a maintenance fee to this loan. Usually this box will already be checked when the loan is boarded for loan servicing. However, if you have proper security, you can set up new maintenance fees. See the Setting Up Maintenance Fees topic for more information. Note: If you are setting up maintenance fees for the first time on an account (after it has been originated), you must make sure that Code 8 (PI Fees) is part of the Payment Application field (found on the Loans > Account Information > Account Detail screen).

If the Judgment with Other Fees transaction (tran code 2510-13) is processed on an account that has maintenance fees, the system clears this box and maintenance fees are no longer collected after the Judgment Date. See the Judgment with Other Fees transaction in the Transactions manual for more information. |

|

Mnemonic: MRMCOD |

This is the maintenance fee code. Maintenance fee codes determine:

1.How maintenance fees are collected. 2.What happens with maintenance fees at payoff.

There are seven possible fee codes. See the Maintenance Fee Codes help for details on each of the fee codes. |

|

Mnemonic: MRMFEE |

This is the monthly amount collected from the borrower for maintenance fees. You can make adjustments to the amount of the maintenance fee once the loan is opened (you can even reduce it to $0 if you have the proper security). You must also set Code 8 (PI Fees) to be part of the Payment Application field (on the Account Detail screen), so part of the payment will go to the maintenance fee.

The amount to charge for maintenance fees is governed by state regulations. Generally, maintenance fees are no more than $3.50 per month. |

|

Mnemonic: MRMNDT |

This date indicates the date the system last earned the maintenance fee amount. The day of this date should be the same as the First Due Date day on the loan. You should not make changes to this field unless you are a supervisor who understands maintenance fees. Based on the Maintenance Fee Code, the system calculates the maintenance fees owed based on this First Due Date day, and that's why this date should always match the First Due Date day. (Example: if First Due Date is 02-13-17, the Earnings Date will be MM-13-YY, with month being the current month and year being the current year.)

Earning a maintenance fee is not the same as collecting a maintenance fee. Depending on the Maintenance Fee Code (see above), an account will earn a fee amount each month on a given date regardless of whether a payment is made. So if a payment is two months late, the account has still earned two maintenance fees and will require that amount the next time a payment is made. The system does not actually collect the fee until a payment is made.

For example, the Fee Code is "01," Earnings Date is "10-10-2018", and today's date is 11-02-2018. The system ran a tran code 919 in the afterhours before 10-10-2018 to earn the fee. At this point, no "real" money has been collected; just a record that the account has earned a fee. When the payment is actually made, the system will collect the amount of the maintenance fee from the payment and credit it to the Maintenance Fee Receivable G/L account on the GOLD Services > General Ledger > GL Account by Loan Type screen. The Earnings Date will stay at "10-10-2018" until the afterhours before "11-10-2018." But the Collection Date will move ahead by one month (or multiple months if more than one payment is late), and will update to also be "10-10-2018."

Afterhours Update Function 90 must also be set, as that tells the system when to "earn" the maintenance fee and update the date in this field.

For Fee Code 00, the maintenance fee is earned and collected with the loan payment only (see Collection Date below). |

|

Mnemonic: MRPIFD |

This field displays the date the system last collected the loan fee. For Maintenance Fee Code 01, when a payment is made, the system moves ahead this date to match the Earnings Date. For Maintenace Fee Code 00, the system moves ahead this date by one month.

You should not change the date in this field, or the system will collect more or less fees, depending on which date you change this to.

If setting up a maintenance fee for the first time, you should enter the date the last payment was made, or if no payments have been made, set it for date the First Due Date.

We can also run an init for this field if loans are converted onto your system and maintenance fees need to be set up. On conversions, we usually use the date the last payment was made as the Collection Date.

The date you enter here causes the system to collect past amounts. For example, if you need to set up a maintenance fee for an account, and the account has already been open for three months, you would enter the First Due Date in this field. Then when the borrower makes a payment (or the payment is earned, depending on the Maintenance Fee Code), the system will calculate and collect three months of maintenance fees. Use caution when changing this field.

This field is required when setting up maintenance fees. If a date is not entered here, you may receive an error similarly to the following: BAAS: INVALID DATE(S) ENCOUNTERED.

Once a payment has been processed on an account and the maintenance fee is collected, the system updates the Collection Date field with the first day of next month (for Maintenance Fee Code 00) or catches up with the Earnings Date (for Maintenance Fee Code 01). |