Navigation: Loans > Loan Screens > Account Information Screen Group >

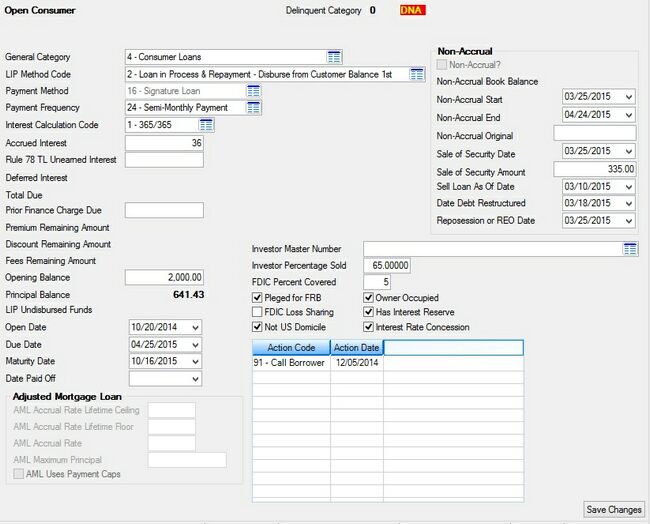

Use this screen to view and edit information about the selected customer loan account as it will appear in Call Reports (FPSRP315).

The list view on the bottom-right of this screen displays all action codes currently active on the customer loan account, as well as the date the code was placed on the account. Action codes are assigned to individual loans on the Loans > Account Information > Actions, Holds and Event Letters screen.

Loans > Account Information > Call Report Classifications Screen

The fields on this screen are as follows:

Field |

Description |

|||||||||||||||||||||||

|

Mnemonic: LNGENL |

Use this field to indicate the general category of the selected customer loan account. General category codes are reported to the credit bureau and are used on OTS reports. See General Category codes for a list of possible selections in this field. |

|||||||||||||||||||||||

|

Mnemonic: LNLMTH |

Use this field to indicate what interest rate is used to calculate interest and other rules that are followed in processing the customer LIP account. You must make an entry in this field for the LIP to be considered when interest is calculated. Many reports determine if a loan is an LIP using this field. See LIP Method codes for a list of possible selections in this field. |

|||||||||||||||||||||||

|

Mnemonic: LNPMTH |

This field displays the payment method code of the customer loan account. A payment method code determines how interest is calculated (as well as other rules that are followed in processing a loan). Payment methods are typically set up when the loan is created and should not be changed once the loan is active. See below for a list of possible selections in this field.

|

|||||||||||||||||||||||

|

Mnemonic: LNFREQ |

Use this field to indicate the frequency regular payments on the customer loan account. Possible selections in this field are Monthly, Semi-Monthly, Bi-Weekly, and Weekly.

For interest-bearing loans (payment method 6), the payment frequency can be changed on the Loans > Account Information > Payment Information screen. For signature loans (payment method 16), the payment frequency can be changed on the Loans > Account Information > Signature Loan Details screen. |

|||||||||||||||||||||||

|

Mnemonic: LNIBAS |

Use this field to indicate to use in calculating interest on the customer loan account. This code is used for all payment methods except 3 (Precomputed). See below for more information.

|

|||||||||||||||||||||||

|

Mnemonic: LNACIN |

Use this field to indicate the interest accrued on the selected customer loan account. Open the link below for more information.

|

|||||||||||||||||||||||

|

Mnemonic: LN78CG |

Use this field to indicate the amount of interest that has yet to be earned on the selected customer loan account (if the loan is precomputed). This field is updated by the system but can be file maintained. |

|||||||||||||||||||||||

|

Mnemonic: LNDEFI |

This field displays the customer loan account's current amount of deferred interest, if the loan has not yet been assumed and a loan assumption record has been created. |

|||||||||||||||||||||||

|

Mnemonic: ASBATOTAMT |

This field displays the total amount due to pay off the selected customer loan account. |

|||||||||||||||||||||||

|

Mnemonic: LNRLPC |

Use this field to indicate the sum of all finance charges owed by the customer loan account prior to the last billing period. The system updates this field, but it can be manually file maintained. |

|||||||||||||||||||||||

|

Mnemonic: LNPREM |

This field indicates the remaining premium amount for insurance disbursements on the customer loan account. |

|||||||||||||||||||||||

|

Mnemonic: LNDREM |

This field displays any remaining discounts or promotions available on the customer account. This field is maintained by the system and is not file maintainable. |

|||||||||||||||||||||||

|

Mnemonic: LNFREM |

This field displays the total amount of all fees still due on the selected customer loan account. |

|||||||||||||||||||||||

|

Mnemonic: LNOBAL |

Use this field to indicate the balance of the customer loan account when it was first opened. On loans with precomputed interest (payment method 3), this amount will include the loan principal plus the add-on amounts. This field is normally entered through a teller transaction but can be manually file maintained. This field feeds to the New Loan Report (FPSRP023) for TFR reporting. |

|||||||||||||||||||||||

|

Mnemonic: LNPBAL |

This field displays the unpaid principal balance of the customer loan account. This field can only be entered, changed, or otherwise affected by teller transactions. It cannot be file maintained through this screen.

An option is available to open a new loan with a principal balance of zero (0) for line-of-credit loans (payment method 5). This option is requested by work order. For more information, see the description for transaction code 680 in Appendix A of the Loans manual in DocsOnWeb. Institution Option 7 SOVC requires a supervisor override when posting a Principal Decrease transaction (tran code 510-47). |

|||||||||||||||||||||||

|

Mnemonic: LNLBAL |

This field displays the amount of funds not yet disbursed from a loan-in-process (LIP) customer account. This field is increased by a 510 credit transaction and decreased by a 500 debit transaction, an interest charged transaction, or construction disbursement 430 or 431 transactions from within the GOLDTeller system.

When GOLDWriter mnemonic LNUNDISB is used, this field will display the undisbursed balance for either LIP or line-of-credit loans (payment method 5). This mnemonic enables your institution to display the undisbursed amounts for both LIP or line-of-credit loans in the same column. For LIP loans, the mnemonic will display the LIP undisbursed balance by reading this field. The LIP Method Code must be greater than 0. For line-of-credit loans, the undisbursed amount is calculated as follows: Credit Limit - Principal Balance = Undisbursed Amount.

The value in this field is subtracted from the Total Due (above) when applied. This field is not file maintainable. |

|||||||||||||||||||||||

|

Mnemonic: LNOPND |

Use this field to indicate the date the customer loan account was first opened or funded. The system automatically enters this information when a new loan (tran code 680) is opened through GOLDTrak PC. This field can be file maintained. For precomputed interest (payment method 3) loans, this field is one of the keys for calculating refunds of precomputed interest. |

|||||||||||||||||||||||

|

Mnemonic: LNDUDT |

Use this field to indicate the next date a regular payment is due on the customer loan account.

This field is entered automatically by the system, based on the value in the Payment Frequency field above, but it can be file maintained. For an LIP loan, this is the date to which the payments have been received. For payment method 5 loans with a zero balance, a balance increase transaction will update the loan due date by adding the number of days before the finance charge date to the current run date.

An online error message will appear when file maintenance occurs on this field. If the interest calculation code is a 1, 2, or 3, the system will not allow the due date to be anything except one payment frequency ahead of the date last accrued. For LIP loans with an interest calculation code of 1, 2, or 3 and an LIP method code of 2 or 102, the error message will also appear. The error message will be "NO F/M – DATE LAST ACCRUED NOT 1 FREQ BEHIND DUE DATE."

|

|||||||||||||||||||||||

|

Mnemonic: LNMATD |

Use this field to indicate the date the last payment is due and the customer loan account should be paid off. All loans must have a maturity date (except line-of-credit loans) or else the payment cannot be posted. See below for more information.

|

|||||||||||||||||||||||

|

Mnemonic: LNCLDT |

Use this field to indicate the date the customer loan account was paid off. This field is updated when a payoff transaction code 580 is processed. A payoff correction code 588 will clear the field.

Institution Option CLZB automatically closes zero-balance line-of-credit loans. At the time the loan is closed, the payoff date is also updated. The Close Loan transaction is a file maintenance tran code 22 to field 999. This transaction is run by the system in the afterhours of the maturity date. It is displayed on the History screen for the account at maturity. The loan will automatically close on the night of the maturity date. If the maturity date is on a weekend or holiday, the loan will close on the night of the first business day following the maturity date.

In order for a loan to mature and then close, the following monetary balances must be zero: principal balance, reserve balance, partial payments, miscellaneous funds, late charges, loan fees, accrued interest, accrued interest on reserves, and accrued interest on negative reserves. In addition, the loan cannot have an LIP Method Code greater than zero. |

|||||||||||||||||||||||

Adjusted Mortgage Loan field group |

See Adjusted Mortgage Loan field group for more information. |

|||||||||||||||||||||||

Non-Accrual field group |

See Non-Accrual field group for more information. |

|||||||||||||||||||||||

|

Mnemonic: LNIMST |

Use this field to indicate the Investor Number for the customer loan account, if applicable.

Investor numbers are set up for your institution on the Loans > Investor Reporting > Investor Master screen and organized into groups on the Loans > Investor Reporting > Investor Group screen. Groups are assigned to individual customer loan accounts on the Loans > Investor Reporting > Loan Investor Fields screen. |

|||||||||||||||||||||||

|

Mnemonic: LNISLD |

Use this field to indicate the percentage of the customer loan that has been sold to the indicated Investor (see above).

Investors are set up for your institution on the Loans > Investor Reporting > Investor Master screen and organized into groups on the Loans > Investor Reporting > Investor Group screen. Groups are assigned to individual customer loan accounts on the Loans > Investor Reporting > Loan Investor Fields screen. |

|||||||||||||||||||||||

|

Mnemonic: M1PCVD |

If the FDIC Loss Sharing field has been marked, use this field to indicate the percentage of loss absorbed by the Federal Deposit Insurance Corporation in regards to the customer loan account. |

|||||||||||||||||||||||

|

Mnemonic: LNPFRB |

Use this field to indicate whether the selected customer loan account has been pledged to the Federal Reserve Board. |

|||||||||||||||||||||||

|

Mnemonic: M1FLOS |

Use this field to indicate whether the customer loan account is part of a loss sharing agreement with the Federal Deposit Insurance Corporation (FDIC). Be sure to enter the percentage of loss absorbed by the FDIC in the FDIC Percent Covered field above. |

|||||||||||||||||||||||

|

Mnemonic: M1NUSD |

Use this field to indicate whether any real estate property used as collateral on the customer loan account is not an address within the United States. |

|||||||||||||||||||||||

|

Mnemonic: LNOWNR |

Use this field to indicate whether any real estate property used as collateral on the customer loan account is occupied by the customer. |

|||||||||||||||||||||||

|

Mnemonic: M1HSIR |

Use this field to indicate whether an interest reserve has been designated for the customer loan account.

Interest reserves can be established by creditors to ensure that interest is paid on on a loan by designating a portion of the loan for use in paying accrued interest. |

|||||||||||||||||||||||

|

Mnemonic: M1IRCN |

Use this field to indicate whether the customer loan account has been given an interest concession (see the Call Report help manual for more information).

An interest concession is a reduction of the interest rate charged on a loan (compared to commercial interest rates). Such concessions are typically provided by government agencies or grants. |

|

Record Identification: The fields on this screen are stored in the FPLN, FPM1, and FPL3 records (Loan Master, Miscellaneous Loan Record Fields, Loan Teller Processing). You can run reports for these records through GOLDMiner or GOLDWriter. See FPLN, FPM1, and FPL3 in the Mnemonic Dictionary for a list of all available fields in these records. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen.

•Set up the desired field level security in the FPM1 and FPL3 records on the Field Level Security screen/tab. |