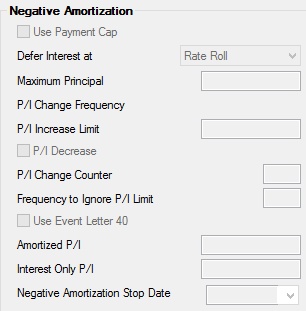

Navigation: Loans > Loan Screens > Account Information Screen Group > ARM Information Screen > Rate Caps & Negative Amortization tab >

Negative Amortization field group

The Negative Amortization field group on the Rate Caps & Negative Amortization tab of the ARM Information screen contains information about negative amortization.

The fields in this field group are as follows:

Field |

Description |

|||||||||||||||

|

Mnemonic: LNPCAP |

A checkmark in this field indicates that you want to use a payment cap. No checkmark indicates that no payment cap is to be used and amounts entered in the fields controlled by this field will be ignored. See below for more information.

|

|||||||||||||||

|

Mnemonic: LNDFIM |

This field allows you to select when to defer interest. Deferring interest means that if a P/I does not cover all of the accrued interest owing with the payment, the remaining unpaid interest is added to the loan principal balance and to the Deferred Interest field (on the Loans > Payoff screen). See below for more information.

|

|||||||||||||||

|

Mnemonic: LNAMMX |

This field contains the maximum amount the loan principal balance can be increased due to deferred interest (negative amortization). On negative amortizing loans, where the principal balance can increase, this field sets the maximum allowed. At the time a payment method “7” loan is opened using a 680 tran code, the system will automatically enter 125% of the original loan amount in this field. This is a required field for all payment method 7 loans. If you do not allow the principal balance to increase (negative amortizing), you must enter the original principal balance.

If a principal increase transaction or deferral of unpaid interest makes the balance exceed the amount in this field, the system gives an error message and cancels the transaction. |

|||||||||||||||

|

Mnemonic: LNAMPC |

This field contains the frequency on which the P/I will change on this loan. It is entered in months. For example, if the P/I is supposed to change annually, “12” will be in this field. This field can be file maintained on the ARM Detail tab. |

|||||||||||||||

|

Mnemonic: LNAMPL |

This field contains the percentage limitation of the increase or decrease to the P/I per P/I change frequency. This field is only used if a checkmark is entered in the Use Payment Cap field above. Values are entered by the user as a 3-decimal number (7.500). |

|||||||||||||||

|

Mnemonic: LNAMDC |

If a checkmark is entered in this field, the system looks at the percentage in the P/I Increase Limit field above and uses that same percentage to decrease the P/I. This field defaults to a blank checkbox, indicating “No.” This field is only used if a checkmark is entered in the Use Payment Cap field above. |

|||||||||||||||

|

Mnemonic: LNAMCC |

Although this is a system-supplied field, it is file maintainable. This field indicates how many times the P/I has changed over the life of the loan, and is automatically entered by the system. It is used when the Use Payment Cap field above has a checkmark and the Frequency to Ignore P/I Limit field below is not zero. It indicates which P/I changes should do full amortization regardless of the P/I Increase Limit. The system knows when to fully amortize a P/I when this field becomes divisible by the Frequency to Ignore P/I Limit field. Example: If the Frequency to Ignore P/I Limit field is 5, then when the counter becomes 5, 10, 15, etc., the P/I is fully amortized. |

|||||||||||||||

|

Mnemonic: LNAMIG |

This field indicates how many P/I changes will use the P/I increase limit. It then ignores the increase limit and the P/I will be increased to the amount required to amortize the loan over the remaining term. This field is only used if a checkmark is entered in the Use Payment Cap field above. |

|||||||||||||||

|

Mnemonic: LNE040 |

This field indicates if a special ARM change letter is to be created. If this field is checked, the ARM change letter will be created at the time of the P/I change only, not when the rate changes. Do not check this field if the P/I change frequency and the rate change frequency are the same.

This would be used, for example, if a loan has monthly rate changes but an annual P/I change. The event 40 letter will generate only when the P/I is changed, but it will display the last 12 monthly interest rates. |

|||||||||||||||

|

Mnemonic: LNAPIC |

If a loan is set up for negative amortization, the system will automatically enter the P/I needed to amortize the loan over the remaining term. This amount will automatically be displayed on the ARM event letters and the bill and receipt statement. Refer to warning below.

|

|||||||||||||||

|

Mnemonic: LNIPIC |

If a loan is set up for negative amortization, the system will automatically enter the Interest Only P/I needed to pay just the interest that is due with the payment. This amount will automatically be displayed on the ARM event letters and the bill and receipt statement. Refer to warning below.

|

|||||||||||||||

Negative Amortization Stop Date

Mnemonic: M1NADT |

This date indicates when the account will stop negative amortization. |