Navigation: Loans > Loan Screens > Account Information Screen Group > Call Report Classifications Screen >

Non-Accrual field group

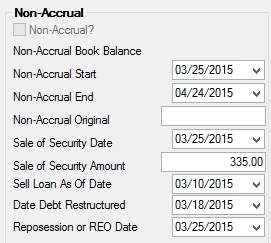

Use this field group on the Call Report Classifications Screen to view and indicate non-accrual information for the customer loan account.

An account can be deemed a non-accrual loan through GOLDTeller transaction 583. To remove the Non-Accrual status from a loan, use GOLDTeller transaction 584.

Two reports are available that will display all non-accrual accounts generated at monthend. See the Non-Accrual Loan Report (FPSRP137) and the Accrued Interest Report (FPSRP019) in the Loan Reports manual for more information.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: LNACST |

This field indicates whether the customer loan account is non-accrual. An account can be deemed a non-accrual loan through GOLDTeller transaction 583. To remove the non-accrual status from a loan, use GOLDTeller transaction 584.

The loan must be in a non-accrual status prior to processing a charge-off. |

|

Mnemonic: LNNABB |

This field indicates the book balance of the customer loan account. At the time the loan becomes non-accrual (tran code 583), this balance becomes the same as the Principal Balance.

As payments are posted to the loan, the non-accrual balance is reduced by the full payment (principal and interest amounts). The Principal Balance will continue to amortize as it normally would. If a partial charge-off transaction is processed, this balance becomes lower by the charge-off amount. If insurance is force placed, the same amount will be added to this field as to the Principal Balance. |

|

Mnemonic: L3NASD |

Use this field to indicate the date the Non-Accrual status was set on the customer loan account. This is the date an employee at your institution ran the Non-Accrual transaction (tran code 583) in GOLDTeller. |

|

Mnemonic: L3NAED |

Use this field to indicate the date the Non-Accrual status was removed on the customer loan account. This is the date an employee at your institution ran the Clear Non-Accrual transaction (tran code 584) in GOLDTeller. A Supervisor override is required when processing this transaction. |

|

Mnemonic: L3NAOA |

Use this field to indicate the remaining amount of the customer loan account when the loan was set to Non-Accrual status. This field is automatically entered when the Non-Accrual transaction (tran code 584) is run through GOLDTeller. This value includes the Principal and interest on the loan. This field can still be file maintained. |

|

Mnemonic: L3RRSD |

Use this field to indicate the date any security tied to the customer loan account was sold in order to pay off the loan or make a regular payment. This date is entered when an employee at your institution runs the Sale of Security transaction (tran codes 2510-03 and 2510-06). This field can still be file maintained. |

|

Mnemonic: L3NASA |

Use this field to indicate the amount of any security tied to the customer loan account that was sold in order to pay off the loan or make a regular payment. This amount is entered when an employee at your institution runs the Sale of Security transaction (tran codes 2510-03 and 2510-06). This field can still be file maintained.

This amount is calculated as the Principal Balance + principal reduction (the amount the principal balance was reduced during the transaction) minus LIP undisbursed. This amount is also displayed on line 8 of the RC-N Memoranda. |

|

Mnemonic: LNASOF |

Use this field to indicate the date the loan is sold as of. This date can be a due date, paid-to-date, or effective date. |

|

Mnemonic: LNRSDT |

This field indicates the date debt was restructured on the customer loan account. This field is used in determining restructured loans and leases on the FDIC Schedule RC-C Memoranda report (FPSRP166). |

|

Mnemonic: L3RRSD |

Use this field to indicate the date any security tied to the customer loan account was sold in order to pay off the loan or make a payment. This field is automatically updated when your institution runs the Sale of Security transaction (tran codes 2510-03 and 2510-06) on the loan account.

See also: Sale of Security Amount above |