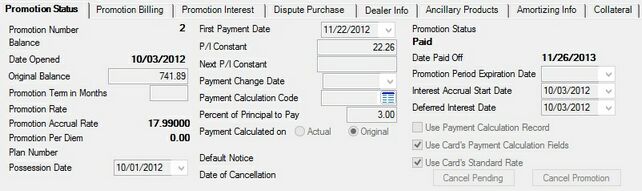

Navigation: Loans > Loan Screens > Cards and Promotions Screen > Promotions tab >

Use this tab to view and edit information about the status of the promotion selected in the Promotion list view for the customer loan account.

Loans > Cards and Promotions > Promotions > Promotion Status Tab

The fields on this tab are as follows:

Field |

Description |

|

Mnemonic: NLSEQI |

This is the number of the promotion. The first purchase on a line-of-credit loan is given Promotion Number 1. The next purchase gets Promotion Number 2, and so forth.

Some institutions use a very high Promotion Number (the highest number possible is 65,535) to use for unpaid late charges or miscellaneous fees.

These numbers are helpful if you ever need to make changes to specific promotion numbers.

See the LOC Transactions topic for more information on transactions that can be run on promotions. |

|

Mnemonic: NLPBAL |

This field displays the current principal balance of the selected promotion on the customer loan account. |

|

Mnemonic: NLDTOP |

This field displays the date the selected promotion was opened on the customer loan account. Each promotion has its own Date Opened. The first promotion (Promotion Number 1) will be the Date Opened for the whole loan, as displayed in the Date Opened field on the Account Status tab at the top of this screen. |

|

Mnemonic: NLOBAL |

This field displays the original balance of the selected promotion on the customer loan account. If the Payment Type on the loan is 3, 5, or 7, the system may use either the Original Balance or the Actual Balance to calculate the Minimum Payment Amount each billing cycle. To determine whether the system uses the Original Balance or Actual Balance, select either the Actual or Original radio buttons in the Payment Calculated on field described below. |

|

Mnemonic: NLTERM |

This field is for informational purposes only and is not used in any calculations. Some institutions enter the number of months of the promotional interest rate before the loan returns to the standard interest rate. Other institutions enter the total number of months for the whole loan. However, line-of-credit loans usually do not have a Maturity Date and do not close once the loan is paid in full. There is an option for the system to close line-of-credit loans after so many months if the Principal Balance remains at zero. But other than that, the loans stay opened.

Examples:

If a purchase include six months SAC cash, "6" would be entered in this field.

One purchase is for 12-months at a reduced interest rate, so "12" would be entered here, while another purchase maintains the same interest rate throughout the life of the loan. An institution might enter "360" in this field to indicate 30 years; which would denote the loan will be open indefinitely or until paid off. |

|

Mnemonic: NLRATE |

This field displays the original accrual rate for the selected promotion on the customer loan account. If you have proper security, you can make changes to this rate using the Promotional Rate field on the Promotion Interest tab.

The promotional rate is usually only in effect on the account for a specific period of time. The promotion (purchase) loses that interest rate in the afterhours of the Billing Date after the Promotion Period Expiration Date. |

|

Mnemonic: N/A |

This field displays the current accrual rate for the selected promotion on the customer loan account. This will be the Promotion Rate if the Promotion Rate has not expired (see above). It is has expired, this rate will be either the Standard card rate (if the loan is not delinquent) or the Default Rate (if it is delinquent), which are found on the Rate Information tab at the top of this screen. |

|

Mnemonic: N/A |

This field displays the amount of interest calculated for one day at the current Promotion Accrual Rate for the selected promotion on the customer loan account.

This value is calculated as: |

|

Mnemonic: NLPNUM |

This field displays the plan number assigned at loan origination for the selected promotion. |

|

Mnemonic: NLPOSS |

Use this field to indicate the date the purchaser took possession of collateral on the customer loan account. |

|

Mnemonic: NLPICD |

Use this field to indicate the first due date on the selected promotion for which a minimum payment will be billed. The interest on this promotion will not be billed until the minimum payment is billed. |

|

Mnemonic: NLPICN |

Use this field to indicate the minimum acceptable payment on the selected promotion for the customer loan account. |

|

Mnemonic: NLPICN |

Use this field to indicate the next minimum acceptable payment on the selected promotion (if the promotion is variable). |

|

Mnemonic: NLPIED |

Use this field to indicate the date the next minimum payment due will be billed on the customer loan account. |

|

Mnemonic: NLPCPT |

This field displays the percent value used when calculating the payment due for the selected promotion on the customer loan account. This value also appears in the Percent of Principal to Pay field below. If the Use Payment Calculation Record field below is marked, this field cannot be set to "0." |

|

Mnemonic: NLPCTB |

This field displays the percentage that is used to calculate the minimum acceptable payment for the selected promotion on the customer loan account. This value depends on the selection in the Payment Calculation Code field above. |

|

Mnemonic: NLOORA |

Use these fields to indicate which balance to use in the calculation of the minimum acceptable payment for the selected promotion on the customer loan account. Possible selections are the Actual (current) or Original (opening) balance. |

|

Mnemonic: NLPNDT |

This field indicates the date a default notice was sent to the customer (if any). |

|

Mnemonic: NLCAND |

This field displays the date the selected promotion was canceled on the customer loan account (if applicable). |

|

Mnemonic: N/A |

This field displays the current status of the selected promotion on the customer loan account. Possible values in this field are Expired, Loss of Promotion, Delinquent, or Active. |

|

Mnemonic: NLDTCL |

If the promotion has been paid off, this field displays the payoff date for the selected promotion on the customer loan account. |

Promotion Period Expiration Date

Mnemonic: NLEXDT |

Use this field to indicate the date the selected promotion will expire on the customer loan account. |

|

Mnemonic: NLDBAC |

Use this field to indicate the first date when interest began accruing on the customer loan account for the selected promotion. |

|

Mnemonic: NLDIED |

Use this field to indicate when interest on the selected promotion will be deferred on the customer loan account. On this date, interest will be billed as a finance charge. This is the last date the customer can pay off the promotion. |

|

Mnemonic: NLULRT |

Use this field to indicate whether the selected promotion will use the card’s Standard Rate to accrue interest on the customer loan account. |

Use Payment Calculation Record

Mnemonic: NLUPCR |

Use this field to indicate whether the selected promotion will use the Payment Calculation record to identify the percentage to use when calculating the next minimum acceptable payment due on the customer loan account.

The Payment Calculation Code (see above) must not be zero if this field is marked. |

Use Card's Payment Calculation Fields

Mnemonic: NLULOC |

Use this field to indicate whether the selected promotion should use the same rate as a loan card for calculating the minimum payment due on the customer account. |