Use the Loans > Insurance > Adjustments screen to record any claims filed by this borrower, or to record any specialty insurance purchased by the borrower. Entering information in these fields does not actually process claims or purchase specialty insurance. These fields are more for note-taking and data-collection purposes. You may want to use the Loans > Account Information > Notepad screen or Collection Comments instead to record this information.

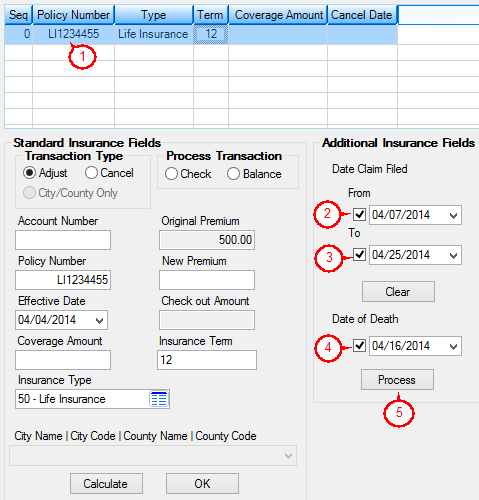

| 1. | In the Additional Insurance Fields field group at the top of the Adjustments screen (as shown below), select the insurance policy from the top list view for which you want to record a claim. |

|

| 2. | Check the From box and select the date this borrower filed the claim. A date range is available because sometimes borrowers can't remember the exact date the claim was filed, but they can remember a range. |

|

| 3. | Check the To box and select the end date if using a range for when the claim was filed. If the borrower does know the exact date, enter the same date as the date entered in the From field. |

|

| 4. | If recording a date of death for a death claim for life insurance, check the box under Date of Death, and then select the date this insurance policy owner died. This information is transferred to CIF (see the Death Date field on the Customer Relationship Management > Households screen). |

|

| 5. | Click  . The claim information is saved. You can use this information to run a report in GOLDWriter or GOLDMiner to research any claims that were processed during a specific time frame. . The claim information is saved. You can use this information to run a report in GOLDWriter or GOLDMiner to research any claims that were processed during a specific time frame. |

|

|

Tip: Use the mnemonics listed on these fields to use in the report you create from GOLDWriter or GOLDMiner.

|

|

|

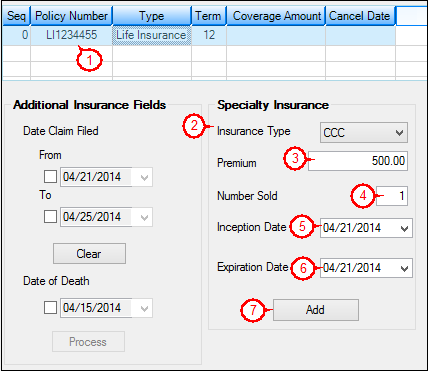

| 1. | In the Additional Insurance Fields field group (as shown below), select the insurance policy from the top list view for which you want to record specialty information. |

|

| 2. | Select the type of specialty insurance this borrower bought from the Insurance Type field. This insurance is different from the insurance policies displayed on the Loans > Insurance > Policy Detail screen. Examples of specialty insurance include AAA Auto insurance, Unipay, and Continental Car Club. GOLDPoint Systems sets up which specialty insurance your institution offers. |

|

| 3. | Enter the premium amount of the specialty insurance policy in the Premium field. |

|

| 4. | Enter the number of specialty insurance policies purchased by this customer. For example, if insuring more than one car, the customer may have purchased more than one service insurance policy. |

|

| 5. | Enter the date the specialty insurance policy took effect in the Inception Date field. |

|

| 6. | Enter the date the specialty insurance policy expires for this borrower in the Expiration Date field. |

|

| 7. | Click  . The specialty insurance information is saved. You can use this information to run a report in GOLDWriter or GOLDMiner to research any specialty insurance policies that were recorded during a specific time frame. . The specialty insurance information is saved. You can use this information to run a report in GOLDWriter or GOLDMiner to research any specialty insurance policies that were recorded during a specific time frame. |

|

Note: Entering information in these fields does not actually create a specialty insurance policy for the borrower. Specialty insurance is purchased at the time the loan is opened. You can also use the Loans > Optional Products > Ancillary Products screen to view and record specialty insurance purchased by the borrower.

|

|

|