Navigation: Loans > Loan Screens > Insurance Screen Group > Adjustments Screen >

You can cancel insurance policies using the Loans > Insurance > Adjustments screen

|

WARNING: You must be logged on to GOLDTeller before processing these steps. |

|---|

To cancel insurance polices:

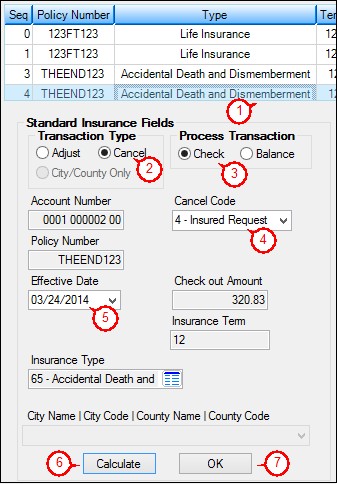

1.After accessing and selecting an account, click the insurance policy you want to adjust from the top list view on the Adjustments screen. The fields below the list view are populated with that insurance policy information.

2.Select the Cancel radio button in the Transaction Type field group. (See Adjust Insurance Premiums for how to adjust insurance.)

3.If you do not select either the Check or Balance radio buttons in the Process Transaction field group, the system defaults to Balance, meaning the cancellation will be subtracted from the principal balance on the loan. If the borrower would rather have a check for any unearned interest or unamortized finance charges due back to them, select Check. (See the Setup note at the bottom of the main Adjustments screen help for more information on General Ledger numbers tied to these amounts.)

4.Enter the Cancel Code used with this cancellation. Only two cancellation codes are available:

•2 - Flat Cancel = This cancels the insurance policy as though it never existed.

•4 - Insured Request = This cancels the insurance policy as of the date of the cancellation. For example, if a force-placed insurance policy were canceled after two months of a 12-month term, the two months of premium would not be returned to the borrower; only the outstanding other 10 months of premium.

5.Enter the Effective Date of when this cancellation will be processed. The default is today's date and will be effective as soon as the transaction is processed. If canceling with a flat cancel (Cancel Code 2), you may want to enter the same date as the policy effective date.

6.If you selected Check in step 3 above, you will need to click <Calculate> to calculate the amount of the check due back to the borrower.

7.Click <OK>.

GOLDTeller opens with one of the following transactions:

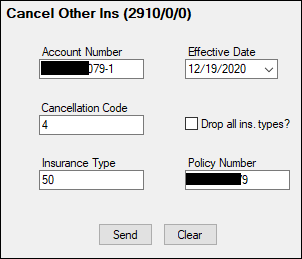

•If you selected Balance in step 3 above, the transaction displayed is the Cancel Other Insurance transaction (tran code 2910-00), as shown below.

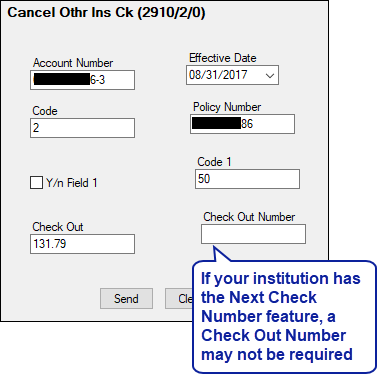

•If you selected Check in step 3 above, the transaction displayed is the Cancel Other Insurance by Check transaction (tran code 2910-02), as shown below.

All the information that was entered on the Adjustment screen is transferred onto the transaction.

| 8. | If you are canceling with a check, you may need to enter the Check Out Number of the check, unless your institution has the check automatically entered using the Next Check Number screen under Functions in CIM GOLDTeller. |

| 9. | Click <Transmit>. The system will notify you of any errors or whether the transaction processed successfully. Check Writer in GOLDTeller will print the check (if applicable). |

The next loan payment (P/I Constant) for this account will be adjusted accordingly (insurance premium subtracted from the Principal Balance).

An institution option, RCPI (ReCalculate P & I after insurance cancellation), is available that will re-compute the P/I Constant needed after a force-placed insurance cancellation (except for flat cancels) to pay a loan off by the maturity date. If RCPI is set up, the transaction will determine the appropriate P/I Constant to pay the loan off by maturity and the P/I Constant will be updated accordingly. (In other words, the P/I Constant will be recalculated using the Principal Balance at the time of the cancellation and remaining payment term.)

This option does not affect flat cancellations (Cancellation Code 2) of insurance (as if the insurance never existed). In that case, the P/I Constant (and the Next P/I Constant table) always reverts to its state as of the time before the insurance was force placed.

Note: If you do set this option, for some customers their P/I Constant may go down but for others, their P/I Constant may go up. You may need to test this on your beta machines by running some insurance cancellations with the option on and off to understand the results before committing to turn on this institution option.

Scenario:

An interest-bearing loan (payment method 6) had an original loan balance of $5,000 for three years and now has $1,988.67 remaining with 12 months left on the loan. The P/I Constant is $183.28. (Interest Rate = 18.99 and Interest Calculation Method = 102 (360/360)). That month, a force-placed insurance policy is placed on the loan with a 12-month term and premium amount of $1,000 (assuming no finance charges). This changes the P/I Constant to $266.61.

After two months of $300 payments ($600 total), the insurance policy is canceled because the borrower found their own insurance and no longer needs force-placed insurance. The term left on the loan is now 10 months with Principal Balance now at $1,447.39. When the system recalculates the P/I Constant (because RCPI is set to “Y”), the P/I Constant is now $157.64 for the remaining term of the loan. |

The Loans > History screen records all the fields that were changed due to this cancellation, as shown below. Clicking on the 022 LOAN FILE MAINT descriptions will show the details of the fields that were changed.

|

For more information on how the cancel transactions affects loans, see the following topics:

Cancel VSI Insurance transaction (tran code 2890-00)

Commission Adjustment transaction (tran code 461)

Remove Homegard Insurance transaction (tran code 2890-07)

Remove Flood Insurance transaction (tran code 2890-08)

Remove Fire Insurance transaction (tran code 2890-09)

Remove LPD Insurance transaction (tran code 2890-71)