Navigation: Loans > Loan Screens > Account Information Screen Group > Reserves Screen Group > Account Reserve Detail Screen >

This tab is only available in certain circumstances. See below to learn more.

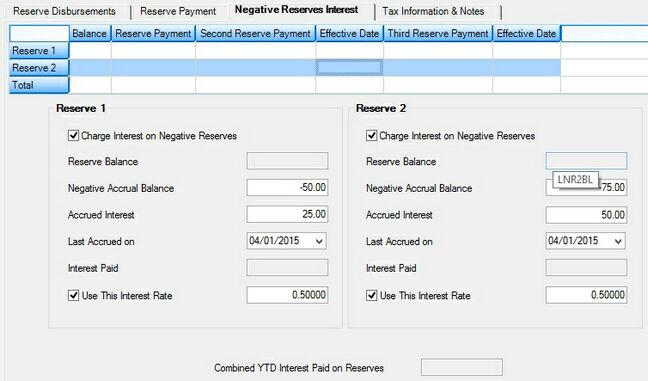

The following bullet points explain how the Interest on Negative Reserves feature works:

•The Charge Interest on Negative Reserves field (see table below) must display a checkmark to charge interest.

•Interest on negative reserves accrues only in the afterhours, except for teller tran code 815 (discussed later in this document). It uses the amount in the Negative Accrual Balance field (see table below) to accrue interest on.

•Interest is only accrued when the Reserve Balance field (see table below) changes (e.g., when a loan payment is posted or a reserve disbursement is processed). In addition, interest will only accrue on the Reserve Balance that had activity. For example, if both the Reserve 1 and Reserve 2 Balances are negative and a credit or debit is only applied to the Reserve 1 Balance, only the Reserve 1 Accrued Interest and date Last Accrued will be updated (see table below).

•If you backdate payments or credits to the reserve, the interest will accrue that night on the negative balance prior to the backdated transaction (it doesn't recalculate using the backdated transaction). Example: On 10/15 the Negative Accrual Balance was -$500.00 and the Last Accrued On was 10/12. You post a loan payment backdating it to 10/05 with $100.00 being credited to reserve 1, making the reserve 1 balance -$400. In the afterhours, the accrual process will accrue interest from 10/12 to 10/15 on the -$500, change the Last Accrued On to 10/15, and change the Negative Accrual Balance to -$400. Beginning on 10/15, interest will accrue on the Negative Accrual Balance of -$400. (Note that the backdating of 10/5 was not considered in the accrual.)

•The accrual that takes place in the afterhours does not write to Loan History. The Negative Interest Transaction Log (FPSRP159) is the only place to see what was in the Negative Accrual Balance field. For more information, see FPSRP159 in the Loan Reports manual.

•The actual reserve 1 and 2 Balances are stored on the Reserve Payment tab. The fields for setting up and accruing interest are located on the Negative Reserve Interest tab.

•To help you quickly identify if the loan uses the negative interest accrual feature, a checkmark will appear in the Charge Interest on Negative Reserves field.

•Teller Inquiry 815 will accrue interest for both reserve 1 and 2 up to or through the current date, based on your institution options.

•Interest is accrued using either the loan rate, the accrual rate for ARMs, or the Interest Rate if the Use This Interest Rate field (see table below) is checked.

•Tran codes 810 (reserve 1) and 820 (reserve 2) are used to pay the amount in the Accrued Interest field (see table below) via the GOLDTeller System. If the customer was billed last week, etc. and wants to pay all accrued interest up to today, then the teller could do an inquiry 815, which would show the new amount. When 810/820 transactions are processed, the system accrues and file maintains the fields during the afterhours processing.

•For corrections of interest paid, you do not need to back out other activity. However, you must reverse the same amount that was posted (the system reads history to verify the amount). It will also add that amount to what is already in the Accrued Interest field. For example, you posted $25.00 on 7/24 and the accrued interest went to 0. On 8/1 you disbursed from the reserves again and the accrued interest went to $5.00. On 8/11 you reverse the $25.00 interest paid. It will add the $25.00 to the $5.00 and $30.00 will now be in Accrued Interest. The Accrued Interest date does not change.

•The billing for the interest due requires the use of event letter #43. Submit a work order requesting GOLDPoint Systems to set up event letter #43.

The amount of negative interest due is not included in the Amount Due section of the Bill and Receipt Statement (FPSRP003). However, interest payments received will appear on the history section of the statement. Interest paid for the year will appear on the statement the first three months of the following year if the report option is set up.

•Interest paid on the negative reserve balance will be included on the year-end statement and will be reported to the IRS as “1098 Interest Paid,” provided the loan meets all the IRS reporting requirements and GOLDPoint Systems's setup criteria. Refer to the GOLDPoint Systems year-end documentation for more details.

•Two reports are available for Interest on Negative Reserves. The Negative Interest Transaction Log (FPSRP159) shows all file maintenance performed on any of the fields on this tab. The Interest on Negative Reserves Report (FPSRP161) displays the amount of interest accrued on the negative reserves and the amount paid. Refer to the Loan Reports manual for details on these reports.

Also, the Reserve Negative Balance Report (FPSRP073) identifies all loans with a negative reserve 1 or 2 Balance. This is available regardless of whether you use the charge interest on negative reserve feature or not.

•The Payoff System accrues the interest due. It will also post the interest at the time of actual payoff.

Setup The following features must be set up in order to use this tab.

•Institution Option RSNI - This must be requested through a work order.

•Institution Option I1DY - This option determines whether to accrue interest to the payoff date or through the payoff date. WARNING: This is for all payoff calculations, not just the interest on reserves. Refer to the Loans > Payoff screen for more details. This must be requested through a work order.

•G/L Posting fields – Amount field #26 must be set up in the Autopost (both reserve 1 and 2 use the same field).

•The Charge Interest on Negative Reserves field (see table below) must be checkmarked. Both reserve 1 and reserve 2 function separately; therefore, both fields must be checkmarked.

•Event letter 43 must be used for billing purposes. This must be requested through a work order. |

Loans > Account Information > Reserves > Account Reserve Detail Screen, Negative Reserves Interest Tab

The Combined YTD Interest Paid on Reserves field at the bottom of this tab displays the amount of interest paid year-to-date for both reserve 1 (tran code 810) and reserve 2 (tran code 820). This field clears to zero as part of the year-end processing.

You can set up two different negative reserve balance payments on this tab; one for reserve balance 1 and one for reserve balance 2. Each of the two reserve balances is represented by an identical Reserve field group on this tab. Use these field groups to view and edit negative interest information for the reserve balances on a customer account. The fields in these field groups are as follows:

Field |

Description |

||

Charge Interest on Negative Reserves

Mnemonic: LNR1IN, LNR2IN |

This field must be checkmarked to accrue interest on negative reserves. Both fields must be checked to charge interest on both reserve 1 and reserve 2.

|

||

|

Mnemonic: LNR1BL, LNR2BL |

This field contains the amount that has been paid by the borrower to apply to such things as taxes, insurance, etc. It can only be entered through a teller transaction.

Institution Option I R2NG prevents a negative Reserve 2 Balance. With this option, if a transaction creates a negative balance, the error message, “Disbursement/Reserve 2 Would be Negative” appears on the Afterhours Processing Exceptions Listing report. If you would like this option, submit a work order. |

||

|

Mnemonic: NIR1BA, NIR2BA |

This is the amount by which the Reserve Balance (above) is below zero and is the amount interest is accrued on. This balance is updated during the afterhours process. The amount in this field will always be blank or negative. This field will generally be the same as the Reserve Balance field, except if a debit or credit was made to the reserve during the day.

This field is file maintainable and the amount must always be zero or entered with a minus (negative) sign or an error message will appear. The Charge Interest on Negative Reserves field above for the appropriate reserve must be checkmarked before an amount can be entered in this field.

|

||

|

Mnemonic: NIR1AC, NIR2AC |

This is the amount of interest that has been accrued on the amount in the Negative Accrual Balance field above. The interest is always calculated using the 365/365 days per year calculation. The 366 days calculation will not be used for a leap year, but the 29th is used in the monthly calculation for February (same calculation that paying interest uses). |

||

|

Mnemonic: NIR1DT, NR2DT |

This is the date on which interest was last accrued. The system will only accrue interest on balances that have activity. For example, if both the reserve 1 and reserve 2 balances are negative and a credit or debit is applied only to the reserve 1 balance, only the reserve 1 balance will be updated. The reserve 2 balance will be updated when it has activity. |

||

|

Mnemonic: NIR1PD, NIR2PD |

This is the amount of interest the borrower has paid. Teller tran codes 810 (reserve 1) and 820 (reserve 2) are used to pay the reserve interest. This amount is reported to the IRS, if applicable. |

||

|

Mnemonic: NIR1UR, NIR1RT |

Mark the checkbox field if you want to enter a rate in the adjacent text entry field. If the checkbox field is left blank, the interest rate on the loan, pulled from the Loans > Account Information > Account Detail screen, will be used. For payment method 7 loans (ARM), the interest rate used to calculate the interest is pulled from the Current Rate field on the Loans > Account Information > ARM Information screen. The program does not check the rate change dates, etc., and it doesn't switch rates in between if the rate rolls; it uses the rate in the Current Rate field at the time of accrual.

If the checkbox is marked, use the adjacent text entry field to indicate the interest rate you want to use when charging interest on the negative reserve balance. |