Field

|

Description

|

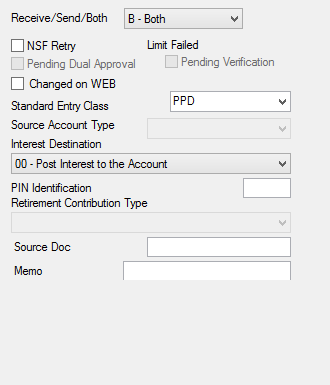

Receive/Send/Both

Mnemonic: DXCOM, DXGO, DXBOTH

|

Use this field to indicate whether the customer directed transfer being created/edited is coming into or out of the customer account. This is a required field. See below for more information.

If the transfer is being received by the account, select "R - Receive" from the drop-down list. If the transfer is being sent out to another institution or another account within your institution, select "S - Send" from the drop-down list. If "B - Both" is selected, a sweep will process both in and out transactions. In order for this option to be available, The Distribution Method field must be set to "XFR-In-House Transfer" and the Distribution Type field must be set to either "Loan (Sweep In/Out)" or "Sweep." This will allow both debits and credits to post to the customer account.

This field is necessary to set up a sweep account. To learn more about the configuration and function of sweep accounts, see the Sweep CDTs help page.

|

|

NSF Retry

Mnemonic: DXNSFR

|

Use this field to indicate whether the system should re-attempt to pull funds the following night if a non-sufficient funds error occurs when trying to complete the customer directed transfer being created/edited. If this field is marked, the system will attempt to try to pull funds each night until a transaction can occur.

|

Limit Failed

Mnemonic: DXLMDT

|

This field is not currently in use because GOLDPoint Systems does not set limits for customer directed transfers.

|

Pending Dual Approval

Mnemonic: DXPDAP

|

Use this field to indicate whether a customer has required a specified person to approve all CDTs on their account. See below for more information.

The following steps describe the process of setting up dual approval on a customer account:

| 1. | On the Internet and Phone Systems > User Profile screen, the company must have the Dual Bill Pay Control field marked. Additionally, they must have the email address of the secondary person who gets the alerts entered in the Dual's eMail field, as shown below: |

| 2. | Once that option is set, and a user from that company creates a CDT bill pay transfer, an email is sent to the address entered in the Dual's eMail field notifying the person that bill payer activity is requesting their approval on the website. |

| 3. | The user then logs on to your institution's website and approves (or denies) the transfer. |

This field is only valid on business accounts. See Pending Verification below for more information about this process.

|

|

Pending Verification

Mnemonic: DXPVER

|

This field indicates whether verification is complete for the setup of the CDT selected in the CDT list view. See below for more information.

The process of Dual Approval (see above) and verification is as follows:

•An employee at the customer site checks and indicates new CDTs are ready to be transferred (Pending Dual Approval), and an employee at your institution performs another check that the CDTs are correct and there are seasoned funds available that send funds for the CDTs (this field).

•A business may require that all new ACH CDTs set up be checked prior to the system transferring them. This process requires that your institution complete the setup for this functionality, and the Pending Dual Approval and this field to be file maintainable.

•When new CDTs are setup and the employee presses Send, the system sends notification to the designated business employee to check the accuracy of all new CDTs and automatically places a check in the Pending Dual Approval field, indicating that there are new CDTs ready to check for approval.

•The designated business employee reviews ACH CDTs online. The employee corrects the CDTs if needed, removes the check from the Pending Dual Approval field, and saves the CDTs.

•Your institution receives an email notification indicating that new CDTs are ready for review. A designated employee at your institution receives the email notifications and confirms whether CDTS are set up correctly and whether the business has seasoned funds to cover “Send” ACH CDTs. The system enters a check in this field and processes the ACH CDTs.

See Pending Dual Approval for more information about this process.

|

|

Changed on WEB

Mnemonic: DXOWEB

|

This field indicates whether the CDT selected in the CDT list view was set up or altered by your customers on your institution's website. A checkmark in this field indicates that file maintenance occurred through your institution's website for the selected transfer.

|

Standard Entry Class

Mnemonic: N/A

|

Use this field to indicate the Standard Entry Class (SEC) code to be used in the selected customer directed transfer (CDT). The three most common SEC codes, which are available in this field, are:

•PPD: Prearranged Payment and Deposit •WEB: Debit Internet-Initiated Entry •TEL: Debit Telephone-Initiated Entry

These codes are included with ACH batches that the system sends to the Federal Reserve Bank.

|

Source Account Type

Mnemonic: DXATPE

|

This field indicates the type of account the CDT being created/edited is debiting from or crediting to (depending on the option selected in the Receive/Send/Both field). See below for more information.

This field will only be file maintainable if the Distribution Method field is set to “ACH - Automated Clearing House."

Possible selections in this field are:

• S - Savings • K - Checking • G - General Ledger • L - Loans

The Distribution Type field must be set to “A - Auto Deposit" in order for the following options to be available:

•Select “G - General Ledger” or “L - Loans” in this field to set up ACH Customer Directed Transfers. The Distribution Method field must be set to “ACH - Automated Clearing House."

•An “L-Loans” in this field will enable your institution to send funds as ACH credits to loan accounts at another institution, using the proper NACHA code. There is no NACHA code to request money (debit) from a loan at another bank.

If your institution wants to use “G - General Ledger” or “L - Loans,” submit a work order to GOLDPoint Systems.

|

|

Interest Destination

Mnemonic: DMIDST

|

Use this field to indicate an interest destination code for the CDT being created/edited. See below for more information.

This code tells the system what to do with interest when it is posted to the account. Interest is always posted to the account and then either withdrawn (if it should be sent to the customer by check) or transferred to another account. Possible selections in this field are:

00 - Post Interest to the Account

01 - Pay Interest by Check

02 - Transfer Interest by CDT*

11 - At Maturity Post To Account, Otherwise by Check

12 - At Maturity Post To Account, Otherwise by CDT*

All accounts except those with a certificate feature (accounts with the Certificate field on the Deposits > Account Information > Account Information screen left blank) must be set up for checking through the Customer Directed Transfers screen.

No CDT setup is required for an interest check. The system will automatically handle the transfer based on the customer account's interest settings. However, if the check should be sent to a different address than the primary address for the customer (specified in CIF), a secondary address needs to be entered through CIF.

This field is only file maintainable if the customer account uses the interest feature and the Distribution Type has been set to "I - Interest." The system automatically populates this field with the value displayed in the Destination field on the Deposits > Account Information > Account Information screen (or the Interest Destination field on the Deposits > Account Information > Interest Fields screen).

*A CDT must be set up if option 02 or 12 is selected in this field.

|

|

PIN Identification

Mnemonic: DMPNID

|

This field is not currently in use.

|

Retirement Contribution Type

Mnemonic: WKRCON

|

This field is not currently in use.

|

Source Doc

Mnemonic: DXSDOC

|

Use this field to indicate any necessary information regarding the source of the selected CDT. This field is optional.

|

Memo

Mnemonic: DXINFO

|

Use this field to indicate any necessary information about the CDT being created/edited. See below for more information.

An asterisk (*) must be entered in the first character space in this field in order for the system to use the information. This information may be required for the system to provide additional functionality based on the following settings:

•If the Distribution Method field is set to "CHK - Check," this information will be printed on the check given to the institution as well as the check stub given to the customer.

•If the Distribution Type field is set to "O - Origination" and the Distribution Method is set to "ACH - Automated Clearing House," enter the name of the source/destination account owner (following the asterisk) in this field.

If no asterisk is used and a description is included, the Memo field will not be used on these types of CDTs.

|

|