Navigation: Loans > Loan Screens > Account Information Screen Group > Additional Loan Fields Screen > Valuation/Billing tab >

Non-Accrual field group

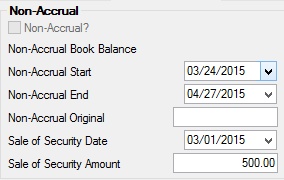

These Non-Accrual fields designate whether this loan account has been deemed a non-accrual loan through GOLDTeller transaction 583; when the non-accrual status was applied and when it ended (if applicable); the original amount of the loan when it entered non-accrual; and whether the security used to back the loan was sold and the amount for which it was sold.

Accounts are set up with a non-accrual status through the Non-Accrual transaction (tran code 583) in GOLDTeller. To remove the non-accrual status from a loan, use GOLDTeller transaction 584. Refer to the Non-Accrual Loan Report (FPSRP137) and the Accrued Interest Report (FPSRP019) in the Loan Reports manual for more information.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: LNACST |

This field indicates if the loan is in a non-accrual status. At the time the loan becomes non-accrual, the non-accrual balance becomes the same as the loan principal balance. As payments are posted to the loan, the non-accrual balance is reduced by the full payment (principal and interest amounts). The loan principal balance will continue to amortize as it normally would.

Transaction 584 (Clear Non-Accrual/Reclassify) will delete the checkmark (if there is one) in this field and will reclassify the balance between the principal balance and the non-accrual book balance.

The loan must be in a non-accrual status prior to processing the charge-off. |

|

Mnemonic: LNNABB |

This is the book balance of the loan. At the time the loan becomes non-accrual (tran code 583), the non-accrual balance becomes the same as the loan principal balance.

As payments are posted to the loan, the non-accrual balance is reduced by the full payment (principal and interest amounts). The loan principal balance will continue to amortize as it normally would.

Transaction 584 (Clear Non-Accrual/Reclassify) will clear the amount in this field, and will reclassify the balance between the principal balance and the non-accrual book balance.

If a partial charge-off transaction is processed, the non-accrual balance becomes lower by the charge-off amount.

If insurance is force placed, the same amount will be added to this field as to the principal balance. |

|

Mnemonic: L3NASD, L3NAED |

These fields display the date the non-accrual status was set and removed (if applicable) on this loan.

The Start date is set on the day an employee at your institution runs the Non-Accrual transaction (tran code 583) in GOLDTeller. The End date is set on the day an employee at your institution runs the Clear Non-Accrual transaction (tran code 584) in GOLDTeller. A Supervisor override is required when processing this transaction.

These dates are set by the system but can be edited in these fields. |

|

Mnemonic: L3NAOA |

Use this field to indicate the amount of the loan that was remaining when the loan was set to non-accrual status. This field is automatically entered when the Non-Accrual transaction (tran code 584) is run through GOLDTeller. It includes the principal and interest on the loan, as displayed in the Principal Balance field on the Loans > Account Information > Account Detail screen. It usually matches the amount in Non-Accrual Book Balance above.

Even though this field is entered with the Non-Accrual transaction, you can file maintain it to a different amount. |

|

Mnemonic: L3RRSD |

Use this field to indicate the date any security tied to this loan was sold in order to pay off the loan or pay down the loan amount. The Sale of Security Date is recorded when an employee at your institution runs the Sale of Security transaction (tran codes 2510-03 and 2510-06).

See also: Sale of Security Amount below |

|

Mnemonic: L3NASA |

Use this field to indicate the amount any security tied to this loan was sold in order to pay off the loan or pay down the loan amount. The Sale of Security Amount is recorded when an employee at your institution runs the Sale of Security transaction (tran codes 2510-03 and 2510-06).

The amount is calculated as LNPBAL + principal reduction (the amount the principal balance was reduced during the transaction) minus LIP undisbursed (LNLBAL). This amount is also displayed on line 8 of the RC-N Memoranda.

This field is also displayed on the Loans > Bankruptcy > Foreclosure, Repossession and Judgment Information screen. |