Navigation: Loans > Loan Screens > Account Information Screen Group > Reserves Screen Group > Reserve Analysis Screen >

This tab displays all previously performed projections for the account number entered. Projections are created by the GOLDTrak transfer or by clicking the <Save Projection> button on this screen, or they are created with your annual analysis processing. This screen only displays summary information in a list view.

Loans > Account Information > Reserves > Reserve Analysis Screen, Options, Limits & Loan Fields Tab

Batch projection records will remain on the Loan System for two years unless deleted manually (batch means they were created in the afterhours process). All items are stored and used in the next analysis in the section comparing that projection to the actual history for that projection year. If multiple projections for a loan have been “saved,” the latest projection will be used with the next analysis. Example: Two projections are saved, one dated 6-2013, and the other dated 9-2013. An analysis is processed on 11-2013. The analysis will use the 9-2013 projection information for the comparison.

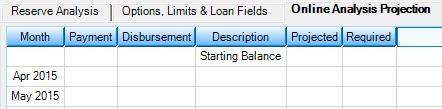

Online Analysis Projection list view

This list view is divided into six columns. The following paragraphs describe each of the columns on this list view.

Month: This column displays the month of the loan payments. The first month represents the beginning of the analysis period (the month the new reserve payment begins).

Payment: This field displays the amount to be paid each month to the reserve accounts. This is a total of the reserve 1 and reserve 2 monthly payments, unless you are excluding reserve 2 from the analysis. This amount is determined by adding all reserve disbursements for the year and dividing that amount by the loan payment frequency (generally 12 months).

Disbursement: This field indicates the total amount to be disbursed from the reserve account. This is a total from reserve 1 and reserve 2 disbursements, unless you are excluding reserve 2 from the analysis. The amounts are pulled from the Loans > Account Information > Reserves > Account Reserve Detail screen.

Description: This is a description of the accompanying line item from the columns to the left.

Projected: This is a running balance of the projected reserve balance after loan payments would be received and reserve disbursements are disbursed for both reserve 1 and reserve 2, unless you are excluding reserve 2 from the analysis. This is the amount that would be in the account at monthend.

The first “projected” amount is an adjusted reserve balance based on whether the loan due date month is for the current month, in the future, or in the past.

If the due date month is the same as the analysis date, the “projected” balance would be the reserve balance minus any disbursements due to be made in that month.

If the due date month is ahead of the analysis date, the system subtracts from the reserve balance the monthly reserve payment for each month until it reaches the analysis date. Nothing is done with disbursements.

If the due date month is in the past, the system adds the monthly reserve payment amount to the reserve balance for each month until it reaches the analysis date. Nothing is done with disbursements.

Required: This is a running balance of what the reserve balance should be, based on the cushion you have selected. One month should always be equal to zero, 1-month cushion, or 2-months cushion. This column is used to determine the surplus or shortage. Any amount higher or lower than the selected cushion would represent the surplus or shortage.

Example: If the monthly reserve payment is $100.00 and you use a 2-month cushion (which would be $200.00) and the amount in the Projected column is $250.00, you would have a surplus of $50.00 because the low balance cannot be higher than the 2-months cushion $200.00, which would be displayed in the Required column.