Navigation: Loans > Loan Screens > Marketing and Collections Screen > Contact tab > Collection/Contact comment tab >

Promise Amount

Enter any amount the customer promises to pay in the Promise Amount field. Try to get the customer to pay at least the same amount displayed in the Total Due field on the Delinquent Payments tab, so the account can be brought current. If you enter an amount in this field, also select "PP - Promised Payment" in the Comment Code field. Once the "PP" code is selected and an amount is entered in this field, this information will be logged on the Loans > Statistics and Summaries > Employee Performance screen and Promise Tracking screen.

The Follow-Up Date field must be set to a date in the future if you enter an amount in the Promise Amount field. If the borrower makes a payment for the promised amount before the afterhours of the date entered in the Follow-Up Date field, the promise is considered kept. The Employee Performance screen and Promise Tracking screen records the promises kept information. However, there is an option that will allow a certain number of grace days after the follow-up date. This option, Use Promise To Pay Grace Days, is explained in the Options section below.

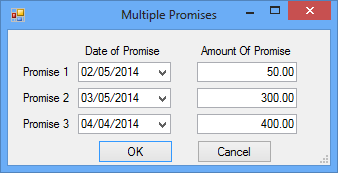

If you click the <Multiple Promises> button to the right of this field, a dialog appears allowing you to enter more than one promise amount and follow-up date. Also see the Use Multiple Promise to Pays and Promise to Pay Date Limit options explained below. The following is an example of this dialog.

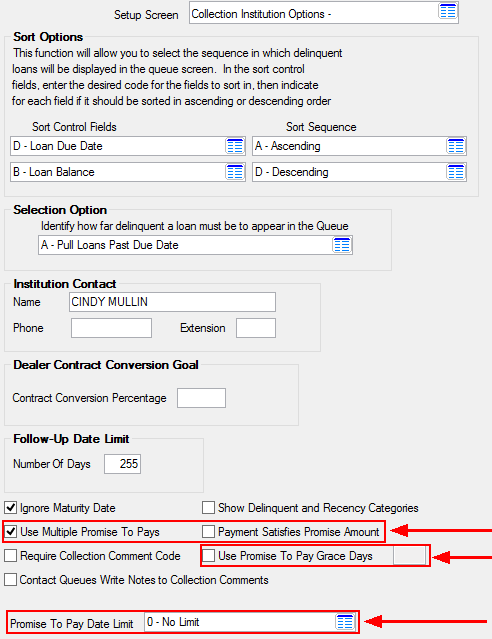

The following options will affect the way the system records promises kept. These options are set up on the Loans > System Setup Screens > Collection Institution Options screen.

•Use Multiple Promise to Pays: If this option is checked, the <Multiple Promises> button will be enabled on the Contact tab, and collectors will be able to enter more than one payment promise amount and date from the borrower.

•Payment Satisfies Promise Amount: If this box is checked, the borrower must make a payment of at least as much as the amount entered in the Promise Amount field in order for it to be counted as a kept promise. For example, if the Promise Amount field is $50 and the borrower makes a $5 payment, the transaction will not be counted as a kept promise. However, if the borrower made a $50 payment, the transaction would be counted as a kept promise. Additionally, the payment must be made on or before the Follow-Up Date in order for it to be counted as a kept promise. However, the following option affects the Follow-Up Date.

•Use Promise to Pay Grace Days: If this box is checked and a number is entered in the field to the right of this box, transactions made after the Follow-Up Date but within the number of days entered will count as a kept promise. For example, if this box is checked and "3" is entered in the field to the right, collectors have up to three days after the Follow-Up Date to get borrowers to make payments in order to have the payments count toward the collectors' promises kept totals.

•Promise To Pay Date Limit: This field corresponds with the Use Multiple Promise To Pays option explained above. If you click the list icon and select a limit from this field, additional promises to pay cannot be made further into the future than what is selected in this field. For example, if this option is set to "30 days," the collector cannot enter a date two months in the future for when the borrower promises to make a loan payment. This is only for multiple payments (click <Multiple Payments> on the Contact tab). One-time Promise to Pay collections use the Follow-Up Date Limit option (as described in the Follow-Up Date topic).

Loans > System Setup Screens > Collection Institution Options Screen