Navigation: Loans > Loan Screens > Marketing and Collections Screen >

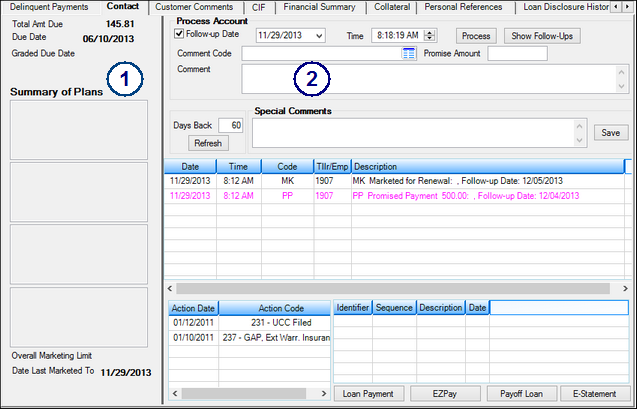

The Contact tab on the Marketing and Collections screen is divided into two sides.

Loans > Marketing and Collections Screen, Contact Tab

|

The left side of this tab displays the total amount due on the loan, the date the loan is due, the graded due date (if applicable), a summary of plans available for the borrower, the overall marketing limit, and the date the account was last marketed. See the table below for more information about the fields on the left side of this tab. |

|

The right side of this tab is used to record comments and information about collection efforts as well as any other information helpful in maintaining the account. See Collection/Contact Comment for more information about the function of the right side of this tab. |

Left Side

The fields on the left side of this tab are as follows:

Field |

Description |

||

|---|---|---|---|

|

Mnemonic: TOTAMT |

This display-only field is the sum of the Remaining Unpaid Portion, Remaining Amount Due (LNRPDU), Credit Life Due, Late Charge Due, and Unpaid Principal Due fields. This field equals the total amount due on the customer's statement as of the night of the billing. However, if after the night of billing, credits or debits (or assessments) are made to the Credit Life Due, Remaining Unpaid Portion, Remaining Amount Due (LNRPDU), Late Charge Due, or Unpaid Principal Due fields, the total amount due will no longer match the statement.

|

||

|

Mnemonic: LNDUDT |

The is the date the payment is due. When the most current payment billed has been paid, the next due date rolls into this field. This is a system-entered field and is not file maintainable.

When a payment is reversed (tran 608), this field is updated to restore the reversed payments for the months for which they were billed. |

||

|

Mnemonic: N/A

|

This field displays the graded due date of the loan. Rules for graded due dates are established specifically for your institution. See Special Delinquency Calculation for Consumer Loans on the Loans > Account Information > Account Detail help.

|

||

Summary of Plans

Mnemonic: N/A

|

If this account has any payment plans calculated on the Loans > Payment Calculator screen, the summary of those payment plans will be displayed in these fields, as shown below.

The Payment Calculator screen corresponds to GOLDTrak PC and allows you to set up new payment plans and loan agreements, and then open GOLDTrak PC and print accompanying documents for approval. |

||

Overall Marketing Limit

Mnemonic: N/A |

This is the overall credit limit approved for this borrower. This information is pulled from the Overall Credit Limit field (CIOVCL) on the CIF tab. |

||

Date Last Marketed To

Mnemonic: N/A |

This field displays the date someone last marketed to this borrower. In order to market (sale) loans to a borrower, the user must select "MK - Marketed for Renewal" from the Comment Code field on this tab. |