Navigation: Loans > Loan Screens > Marketing and Collections Screen > Contact tab > Collection/Contact comment tab >

Follow-Up Date

Use the Follow-Up Date field to enter a follow-up date to call the borrower to check up on whether any payments were made to bring the account current. You can select the date from the drop-down calendar.

The Follow-Up Date field must be set to a date in the future if you enter an amount in the Promise Amount field. If the borrower makes a payment for the promised amount before the afterhours of the date entered in the Follow-Up Date field, the promise is considered kept. The Employee Performance screen and Promise Tracking screen records the promises made, kept, and broken information. However, a few options affect the Follow-Up Date field, as explained below.

More than one promise amount and follow-up date can be entered if you click . See the Promise Amount field description for more information on multiple promises.

Options

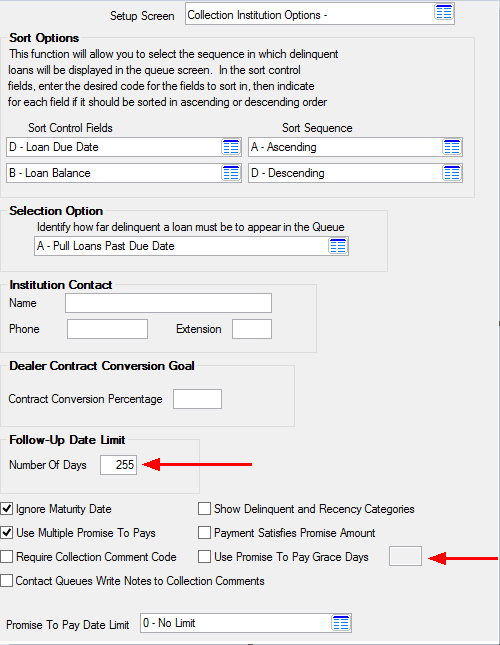

The following options affect the Follow-Up Date. These options are set up on the Loans > System Setup Screens > Collection Institution Options screen.

•Follow-Up Date Limit: This option limits how far into the future collectors can select a follow-up date. For example, if "30" is entered in this field, collectors will not be able to enter a follow-up date for two months from now for when the borrower promises to make a loan payment.

•Use Promise To Pay Grace Days: If this box is checked and a number is entered in the field to the right of this box, transactions made after the Follow-Up Date but within the number of days entered will count as a kept promise. For example, if this box is checked and "3" is entered in the field to the right, collectors have up to three days after the Follow-Up Date to get borrowers to make payments in order to have the payments count toward the collectors' promises kept totals.

See these options on the Collection Institution Options screen below:

Loans > System Setup Screens > Collection Institution Options Screen