Navigation: Loans > Loan Screens > Statistics and Summaries Screen Group >

The Promise Tracking screen (under Loans > Statistics and Summaries in CIM GOLD) is an effective tool to monitor the success of collectors in contacting delinquent borrowers and soliciting payments. This screen reflects any "promise payment" activity on an account in regards to collection efforts.

This screen is a table that shows employee numbers, the number of paid promises that were kept and broken, and payments that were made due to soliciting efforts by collectors on this account.

The following is an example of this screen:

Information is logged and displayed on this screen when employees at your institution use the Queues > Collection > Collection Queues screen, or the Contact tab of the Marketing and Collections screen. Using that tab, employees contact borrowers and solicit borrowers to make loan payments.

For collection efforts to be logged on this screen, the employee must select a Comment Code that starts with "PP," then fill in the Promise Amount and Follow-Up Date fields on that screen, as shown below:

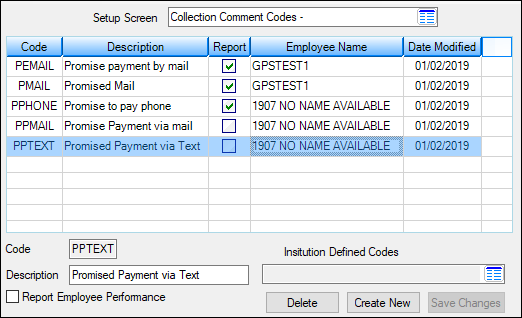

WARNING: The only PP payment set up as a default on the system is "PPAY," which is just the "PP" comment code. If you want to enter more promised payment codes for tracking purposes, you will need to create them on the Loans > System Setup Screens > Collection Comment Codes screen.

The comment codes must start with PP in order to be logged on the Promise Tracking screen. If the codes only start with one P or a different letter or number, they will not be recorded.

For example, if you want to track how successful text solicitations are compared to phone, you might set up two comment codes called "PPTEXT" and "PPHONE." Then when employees log their efforts accordingly, you can quickly see which ones were more successful. See the following example of the Collection Comment Codes screen. If you want to know more about that screen, see the Collection Comment Codes help.

Loans > System Setup Screens > Collection Comment Codes |

|---|

Multiple Promises to Pay

The Contact tab of Marketing and Collections screen also allows collectors to take multiple promise amounts and dates from customers. Those amounts and dates are also recorded on this screen, as well as whether those amount and date promises were kept. See also the Use Multiple Promise to Pays and Promise to Pay Date Limit options explained on the Promise Options help page.

If the customer makes a payment for the promised amount before the afterhours of the date entered in the Follow-Up Date field, the promise is considered kept. The Employee Performance and Promise Tracking screens record the promises kept information. However, there is an option that will allow a certain number of grace days after the follow-up date. This option, Use Promise To Pay Grace Days, is explained on the Promise Options help page.

Column Descriptions

The list view on this screen displays the following information:

Column |

Description |

Employee Number

Mnemonic: QPEMP# |

This column displays the number of the employee who made the promised payments with the account owner. |

Broken

Mnemonic: QPPRBK |

This column displays a checkmark if the promised payment was broken. For a promise to be considered broken, a loan payment would not have been made within seven days after the Follow-Up Date entered on the Contact tab of the Marketing and Collections screen. However, if your institution uses the Use Promise To Pay Grace Days option on the Collection Institution Options screen (under Loans > System Setup Screens), then the system will use the number of grace days entered in that option.

For example, if Use Promise To Pay Grace Days is selected and the number of days is set to 3, then the promised payment must be received within three days after the Follow-up Date to be considered kept. Otherwise, the promise is broken.

Additionally, if the payment amount was made in the allotted time, but it was for less than the amount in the Promise Amount field, the promise may still be considered broken if the Payment Satisfies Promise Amount (on the Collection Institution Options screen) is not selected. If that option is selected, the payment amount must be for at least the amount entered in the Promise Amount field to be considered kept.

See the Promise Options help page for information on options that will affect whether promises are kept or broken. This column is updated in the afterhours. |

Kept

Mnemonic: QPKPP1, QPKPP2, QPKPP3 |

This column displays a checkmark if the promised payment was kept. See the Broken definition above for information on what is considered a kept and broken promise. |

Promise Made

Mnemonic: QPDTPM |

This is the date the collector contacted the loan account borrower concerning making loan payments. Employees or collectors use the Contact tab of the Marketing and Collections screen to contact borrowers about their loan payments. |

Promise Date

Mnemonic: QPYDTE |

This column displays the date by which the borrower indicated they could make a payment (i.e., the follow-up date). The user enters this date in the Follow-Up Date field on the Contact tab of the Marketing and Collections screen.

If your institution uses multiple promises, this date is entered in the Date of Promise field on the Multiple Promises dialog (click <Multiple Promises> on the Contact tab). See the Promise Options help page for multiple promises information. |

Promise Amount

Mnemonic: QPPRAT |

This field displays the promised amount the borrower agreed to pay by a certain date.

This amount is pulled from the Promise Amount field when an employee selects "PP - Promised Payment" from the Comment Codes field and enters an amount the account owner promises to pay on the Contact tab of the Marketing and Collections screen.

If your institution uses multiple promises, this amount is entered in the Amount Of Promise field on the Multiple Promises dialog (click <Multiple Promises> on the Contact tab). See the Promise Options help page for multiple promises information. |

Total Paid

Mnemonic: QPPRAT

|

This is the total amount of payments made by this borrower from the date the promise was made (Promise Made) and within sever days after the follow-up date (Promise Date). If the borrower makes more than one payment in that time frame, this will be the total of all payments made.

Note: If your institution uses the Use Promise To Pay Grace Days option on the Collection Institution Options screen (under Loans > System Setup Screens), then the system will calculate all payments made between the Promise Made and the number of days designated in that option after the Promise Date.

For example, if Use Promise To Pay Grace Days is selected and the number of days is set to "3," then the payments made within three days after the Follow-up Date will be totaled and displayed in this column. |

Kept/Broken Date

Mnemonic: QPKDTE |

This column displays the date the promised payment was kept or broken. This would be the date the payment was made by the borrower if a payment was made; or the Follow-up Date + seven days after if the promise is broken. Note: If your institution uses the Use Promise To Pay Grace Days option on the Collection Institution Options screen (under Loans > System Setup Screens), then the system will use that date to calculate the Broken Date.

For example, the Use Promise To Pay Grace Days option is set to "2." A promised payment is made on 12-13 with a follow-up date of 12-17. The borrower still hasn't made a payment by 12-19. Therefore, on the Promise Tracking screen, the Broken Date will show 12-19 (two days after the Promise Payment Date). Without this option set, it would show the Broken Date as 12-24 (seven days after the Follow-up Date).

See the Promise Options help page for information on options that will affect whether promises are kept or broken. This column is updated in the afterhours. |

Kept Amount

Mnemonic: QPKAMT |

This is the amount of the loan payment the borrower made after an employee contacted them about making loan payments. This column will total and display any loan payments made to this account from the Promise Made date to the Follow-up Date + seven days after. Note: If your institution uses the Use Promise To Pay Grace Days option on the Collection Institution Options screen (under Loans > System Setup Screens), the system will use that number as the grace days.

For example, an employee contacts a borrower on 9-01 about making a loan payment of $300. The borrower promises to make a payment by 9-15, but only for $150. The employee logs that information on the Contact tab of the Marketing and Collections screen. On 9-08, the borrower makes a loan payment of $100. On 9-12, the borrower makes another payment of $50. The Kept Amount column would display $150.

Funds are counted in the total if borrowers pay any amount by the Follow-up Date + collection grace days, regardless of whether the borrower pays less than the promised amount. |

Promise Date 2

Mnemonic: QPKDTE |

This column displays the date by which the borrower promised they could make a second payment. The employee enters this date in the Date of Promise 2 field on the Multiple Promises dialog (click <Multiple Promises> on the Contact tab of the Marketing and Collections tab).

Note: Your institution must have the Use Multiple Promise to Pays option selected on the Collection Institution Options screen in order for more than one Promise to Pay date. See the Promise Options help page for multiple promises information. |

Promise Amount 2

Mnemonic: QPPRAT |

This field displays the promised amount the borrower agreed to pay by the second promised date.

This amount is entered in the Amount Of Promise 2 field on the Multiple Promises dialog (click <Multiple Promises> on the Contact tab of the Marketing and Collections screen).

Note: Your institution must have the Use Multiple Promise to Pays option selected on the Collection Institution Options screen in order for more than one Promise to Pay date. See the Promise Options help page for multiple promises information. |

Kept Date 2

Mnemonic: QPKDTE

|

This column displays the date the second promised payment was kept. This would be the date the second payment was made by the borrower.

Note: Your institution must have the Use Multiple Promise to Pays option selected on the Collection Institution Options screen in order for more than one Promise to Pay date. See the Promise Options help page for multiple promises information. |

Amount Paid 2

Mnemonic: QPKAMT |

This is the amount of the loan payment the borrower made after an employee contacted them about making loan payments. This column will total and display any loan payments made to this account from the Promise Made date to the Follow-up Date + seven days after. Note: If your institution uses the Use Promise To Pay Grace Days option on the Collection Institution Options screen (under Loans > System Setup Screens), the system will use that number as the grace days.

For example, an employee contacts a borrower on 9-01 about making a loan payment of $300. The borrower promises to make a payment by 9-15, but only for $150. The employee logs that information on the Contact tab of the Marketing and Collections screen. On 9-08, the borrower makes a loan payment of $100. On 9-12, the borrower makes another payment of $50. The Amount Paid 2 column would display $150.

Funds are counted in the total if borrowers pay any amount by the Follow-up Date + collection grace days, regardless of whether the borrower pays less than the promised amount.

Note: Your institution must have the Use Multiple Promise to Pays option selected on the Collection Institution Options screen in order for more than one Promise to Pay. See the Promise Options help page for multiple promises information. |

Promise Date 3

Mnemonic: QPKDTE |

This column displays the date by which the borrower promised they could make a second payment. The employee enters this date in the Date of Promise 3 field on the Multiple Promises dialog (click <Multiple Promises> on the Contact tab of the Marketing and Collections tab).

Note: Your institution must have the Use Multiple Promise to Pays option selected on the Collection Institution Options screen in order for more than one Promise to Pay date. See the Promise Options help page for multiple promises information. |

Promise Amount 3

Mnemonic: QPPRAT |

This field displays the promised amount the borrower agreed to pay by the second promised date.

This amount is entered in the Amount Of Promise 3 field on the Multiple Promises dialog (click <Multiple Promises> on the Contact tab of the Marketing and Collections screen).

Note: Your institution must have the Use Multiple Promise to Pays option selected on the Collection Institution Options screen in order for more than one Promise to Pay date. See the Promise Options help page for multiple promises information. |

Kept Date 3

Mnemonic: QPKDTE |

This column displays the date the third promised payment was kept. This would be the date the third payment was made by the borrower.

Note: Your institution must have the Use Multiple Promise to Pays option selected on the Collection Institution Options screen in order for more than one Promise to Pay date. See the Promise Options help page for multiple promises information. |

Amount Paid 3

Mnemonic: QPKAMT |

This is the amount of the loan payment the borrower made after an employee contacted them about making loan payments. This column will total and display any loan payments made to this account from the Promise Made date to the Follow-up Date + seven days after. Note: If your institution uses the Use Promise To Pay Grace Days option on the Collection Institution Options screen (under Loans > System Setup Screens), the system will use that number as the grace days.

For example, an employee contacts a borrower on 9-01 about making a loan payment of $300. The borrower promises to make a payment by 9-15, but only for $150. The employee logs that information on the Contact tab of the Marketing and Collections screen. On 9-08, the borrower makes a loan payment of $100. On 9-12, the borrower makes another payment of $50. The Amount Paid 3 column would display $150.

Funds are counted in the total if borrowers pay any amount by the Follow-up Date + collection grace days, regardless of whether the borrower pays less than the promised amount.

Note: Your institution must have the Use Multiple Promise to Pays option selected on the Collection Institution Options screen in order for more than one Promise to Pay. See the Promise Options help page for multiple promises information. |

Due Date Before

Mnemonic: QPDTDU |

This is the loan account's Due Date of the loan payment for this account before the Promise To Pay record was made by the employee (using the Contact tab of the Marketing and Collections screen). |

Due Date After

Mnemonic: QPNDUD |

This is the Due Date of the loan payment for this account after the borrower made a payment due to this employee's collection activities. |

Del Cat Before

Mnemonic: QPDCAT |

This is the delinquency category on the loan account before any payments were made by the borrower due to collection efforts by this employee. Note: See the Promise Options help page for information about an option that must be set in order for accounts to show up in this column.

Some institutions use special delinquency grading when considering whether an account is delinquent. See Special Delinquency Calculations for Consumer Loans for more information on delinquency grading and late charge assessment. |

Del Cat After

Mnemonic: QPNDCT |

This is the delinquency category on the loan account after payments were made by the borrower due to collection efforts by this employee. Note: See the Promise Options help page for information about an option that must be set in order for accounts to show up in this column.

Certain institution options may affect what delinquency category an account qualifies. Some institutions use special delinquency grading when considering whether an account is delinquent. See Special Delinquency Calculations for Consumer Loans for more information on delinquency grading and late charge assessment. |

Comment Code

Mnemonic: QPHACD |

Note: This column is only displayed starting in CIM GOLD version 7.9.4 and above.

If a Collection Comment Code that starts with "PP" is entered on a customer loan account (on the Loans > Marketing and Collections screen > Contact tab or Queues > Collection Queues > Collection Queues screen), that comment code appears in the Comment Code column on the Promise Tracking screen.

This column helps you better track what type of Comment Codes are successful and not successful. For example, you could set up a PPTEXT comment code, and see how many promises are kept due to text messages.

Note: If you want to include special comment codes such as PPHONE (for promised payment by phone), PPMAIL (promised payment via mail), or PPTEXT (promised payment via text), you will need to add those special promised payment comments to the Loans > System Setup Screens > Collection Comment Codes screen. Make sure the collection comment code starts with "PP." The system will not include it in the Comment Code column if it only starts with one P or another number or letter. |

Click any column header to organize the list view by that column's information type.

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |

|

Record Identification: The fields on this screen are stored in the FPQP record (Promise Tracking). |

|---|