Navigation: Loans > Loan Screens > Statistics and Summaries Screen Group >

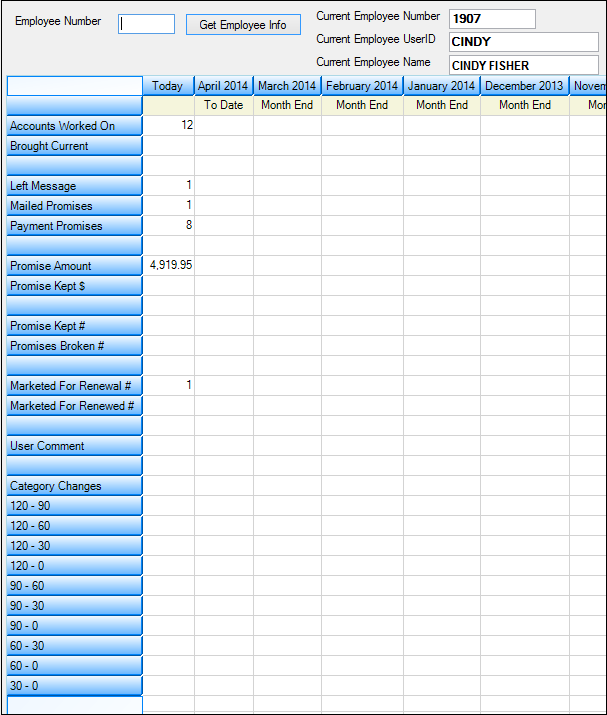

The list view on this screen displays information about an employee’s collection activity performance for the day, month to date, and any of the last 12 months the employee has been on the system.

Use the Employee Number field (mnemonic EMPNUM) to indicate which employee's information to view in the fields on this screen when <Get Employee Info> is clicked. The selected employee's Number, UserID, and Name will appear in the fields on the top of this screen (mnemonic EMPUID/EMPFNM).

Loans > Statistics and Summaries > Employee Performance Screen

Institution Option VARQ must be enabled in order to use this screen. Other institution options affect this screen as well. See Promise Kept below for more information.

The list view on this screen displays the following information about the selected employee at your institution.

COLUMNS |

|

Today |

This column displays information pertaining to the employee's collection efforts for the current day. This column clears out in the afterhours and is added to the month-to-date figures.

|

Month to Date |

This column displays information pertaining to employee's collection efforts from the first of the month to today (as of last night).

|

Month End Column |

This column displays the employee's performance for the given month. At monthend, the information stored in the Month To Date column is stored in a special file. Up to 12 files can be stored. Information is pulled from this file. As the 13th month ends, this information replaces the oldest file. Thus, you will always have the last 12 months of files to display employee performance information.

|

ROWS |

|

Accounts Worked On |

This field displays the number of accounts on which the employee has entered comments during online time and queue processing.

|

Brought Current |

This field looks at accounts on which promises have been taken. (Employees enter amounts that customers promise to pay on the Contact tab of the Loans > Marketing and Collections screen.) It displays the accounts where a customer paid the promised amount to bring the account current. The Today column will always be blank. It is updated in the afterhours.

|

Left Message |

This field displays the number of messages the collector leaves. It is updated when an employee enters any "L" Comment Codes on the Contact tab of the Loans > Marketing and Collections screen.

|

Mailed Promises |

This field displays the number of "promises to mail" responses from borrowers. It is updated when an employee enters the mailed promise code (MP) in the Comment Codes field on the Contact tab of the Loans > Marketing and Collections screen.

This code is used in connection with the Follow-up Date to track whether or not the promise to pay that amount was kept (see Promise Kept # below).

|

Payment Promises |

This field displays the number of payment promises this employee processed on accounts for a given amount of time. It is updated when an employee enters the payment promise code (PP) in the Comment Codes field, as well as a dollar amount in the Promise Amount field on the Contact tab of the Loans > Marketing and Collections screen.

This code is used in connection with the Follow-up Date to track whether or not the promise to pay that amount was kept (see Promise Kept # below).

|

Promise Amount |

This field totals up all the promised amounts this employee processed for accounts on this day, month to date, and each monthend for the past 12 months.

This amount is calculated when an employee selects "PP - Promised Payment" from the Comment Codes field and enters an amount the account owner promises to pay in the Promise Amount field on the Contact tab of the Loans > Marketing and Collections screen.

|

This field displays the total amount received by your company from account owners who were contacted by your employees using the Contact tab of the Loans > Marketing and Collections screen.

The employee must have selected "PP - Promised Payment" from the Comment Codes field and entered an amount the account owner promised to pay in the Promise Amount field in order for the account to be counted in this total.

Promises are counted as kept depending on some options set up for your institution. You can set up parameters to determine what is required for a loan to be counted as kept or broken based on grace days and amount of the payment. These options are found on the Loans > System Setup Screens > Collection Institution Options screen.

•If the Payment Satisfies Promise Amount box is checked, then only when the customer pays the entire promised amount is the promise considered kept. If this box is not checked, then any amount the customer pays counts as the promise being kept.

•If the Use Promise To Pay Grace Days box is not checked, the system defaults to seven days. So if customers pay the promised amount (or less depending on the Payment Satisfies Promise Amount option) up to seven days past the follow-up date, the loan will be counted as kept. If the customer pays the promised amount eight or more days after the grace days, it is not considered kept.

•If the Use Promise To Pay Grace Days box is checked, you should also enter a number to the right of it, as shown below.

This number can be anywhere from 0 to 99. If you enter 0, then there are no grace days, and if the borrower doesn't pay the promised amount (depending on the Payment Satisfies Promise Amount option) by the follow-up date, the loan is not considered kept. If you enter a number such as 10, the borrower has up to 10 days after the follow-up date to make a payment, and then the promise is considered kept. If the payment is made any days after 10, it would not be considered kept.

The amount of money received is displayed and accumulated in the Month To Date column. This field will always be blank in the Today column. It is updated in the afterhours. |

|

Promise Kept # |

This field displays the number of accounts for which money has been received following the promised payment entry (PP) in the Comment Codes field on the Contact tab of the Loans > Marketing and Collections screen.

This field will always be blank in the Today column. See the Promise Kept $ definition above for information concerning options that affect the number of promises kept.

|

Promises Broken # |

This field displays the number of accounts that have a promised payment but have not received any money. This field will always be blank in the Today column. It is updated in the afterhours.

See the Promise Kept $ definition above for information concerning options that affect the number of promises broken.

|

Marketed For Renewal # |

Each time this employee asked customers whether they would like to renew their loan and then logged that information during his or her processing of collections, the number in this field increased by one. The employee must have selected "MK - Marketed for Renewal" from the Comment Codes field on the Contact tab of the Loans > Marketing and Collections screen.

|

Marketed For Renewed # |

This field displays the number of loans this employee renewed for the given month (a payoff was run with the Renewal box checked). Loans are renewed through GOLDTrak PC.

This field will always be blank in the Today column. It is updated in the afterhours.

|

User Comment |

This indicates the number of user-defined comment codes the employee used during collection efforts on accounts.

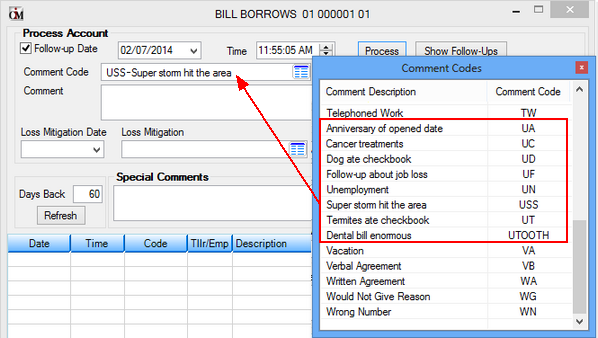

User-defined collection comment codes are initially set up using the Loans > System Setup Screens > Collection Comment Codes. Once set up on that screen, employees attach the user-defined comment codes using the Comment Codes field on the Contact tab of the Loans > Marketing and Collections screen, or from the Options > Show Collections Comments screen on the top menu bar in CIM GOLD, as shown below: |

Category Changes

120-90 120-60 120-30 120-0 90-60 90-30 90-0 60-30 60-0 30-0 |

If the employee's collection efforts brings loans from being late to less late or not-at-all late, these columns will reflect that. For example, if a loan is more than 90 days late, and the employee is able to contact the borrower and have the borrower make one payment, bringing the borrower to only 60 days late, then the 90-60 category will be increased by one. |

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |