Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Detail Screen > Claim Information dialog >

Arrearages are court-approved amounts that allow borrowers to catch up on missed payments. As long as the borrower is making these payments, your institution cannot repossess the secured personal property (car, motorhome, boat, etc.). This allows the borrower to reset to a fresh start.

The total amount of prepetition arrearages is the same as the Total Due as of Filing Date, and it is fed to Part 9 of the Bankruptcy POC (see Amount necessary to cure any default as of the petition date field).

You can process pre-petition and post-petition arrearages using the Loans > Bankruptcy > Bankruptcy Detail screen, as described below. Pre-petition arrearages are determined before the final bankruptcy date. Post-petition arrearages are made after the bankruptcy date.

The system automatically calculates any arrearages due on the account when you complete the following steps:

|

Note: If the loan is due for payoff (meaning 100% in arrears), the system will not calculate a prepetition arrearage for the Principal amount. |

|---|

1.First, process a bankruptcy transaction (see Placing a Customer in Bankruptcy for more information). You must be set up as a teller to do this.

2.The system automatically calculates any arrearages for the loan and displays them in the Claim Information dialog box (click the Claim Information link at the bottom of the screen). This information needs to be supplied to the Bankruptcy Courts. See Figure 2 below for what the Claim Information dialog box looks like.

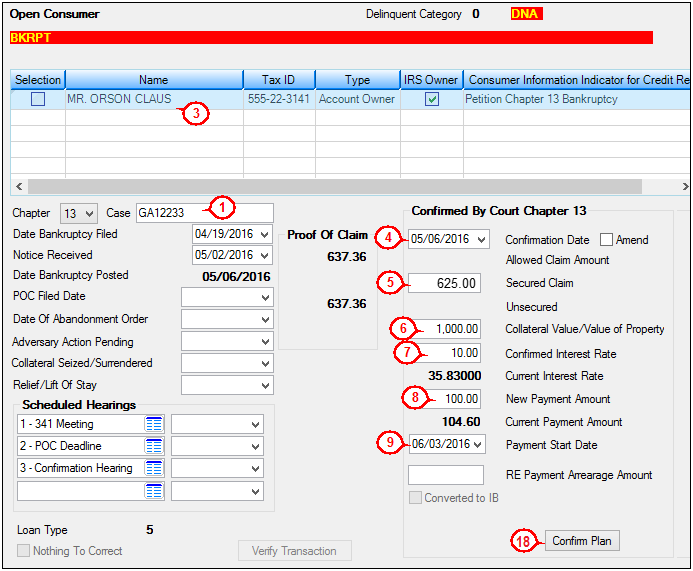

3.Once bankruptcy documents are sent to your institution notifying you of the details of the bankruptcy, select the bankruptcy from the list view table on the Bankruptcy Detail screen.

4.Select the date the Bankruptcy Courts confirmed the bankruptcy in the Confirmed By Court Chapter 13 field group.

5.Enter the amount of the secured claim in the Secured Claim field. This could be the total amount of the loan or the amount allowed by the Bankruptcy Courts.

6.Enter the amount of the value of the collateral in the provided field.

7.Enter the percentage allowed by the Bankruptcy Courts for the interest rate in the Confirmed Interest Rate field. This is the interest amount your institution is allowed to charge to the customer during and after bankruptcy.

8.Enter the New Payment Amount the Bankruptcy Courts has allowed the borrower to pay going forward.

9.Enter the Payment Start Date of when the borrower will start making payments according to the Chapter 13 guidelines.

10.Click <Save Changes>. Important: Don’t skip this step. Always save changes before going onto the next step. See Figure 1 below for an illustration of these steps.

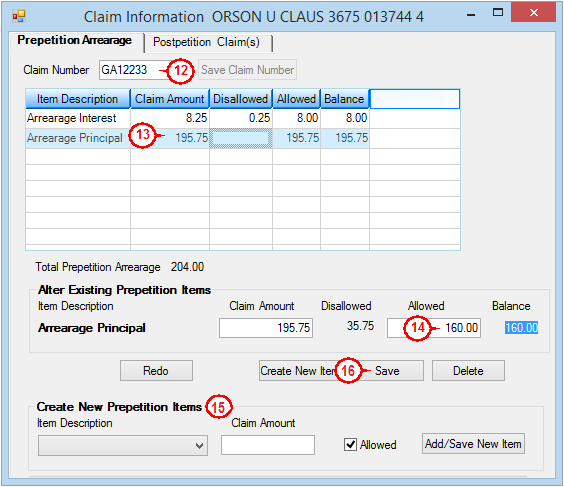

11.Click the Claim Information link at the bottom of the Bankruptcy Detail screen. The Claim Information dialog box is displayed. See Figure 2.

12.Enter the Claim Number for the bankruptcy in the provided field.

13.Select the first arrearage listed in the automatically calculated Arrearage list view table. The fields below the table will show the detail amounts of the selected arrearage.

14.Enter the amount the Bankruptcy Courts have allowed for that arrearage in the Allowed field. Repeat this step for as many arrearages in the table.

15.Additional prepetition arrearages can be created and added to the claim using the Create New Prepetition Items field group. Indicate an Item Description and Claim Amount (mnemonic PTCLMA) and use the adjacent checkbox field to indicate whether the full prepetition amount is Allowed (mnemonic BACEP1). When <Add/Save New Item> is clicked, the new prepetition item will be added to the list of arrearages at the top of this dialog. Repeat this step for as many new arrearages as needed. Note that the ability to add prepetition items using this method will be disabled if the plan has been confirmed.

|

GOLDPoint Systems Only: The Item Descriptions available in this field are charge/fee descriptions pulled from IMAC Table 62. |

|---|

16.When all prepetition arrearage information is in order, Click <Save> to close the Claim Information dialog box.

|

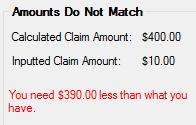

Note: If an amount is manually entered into the Allowed Claim Amount field that does not match the allowed amount indicated on this tab, this tab will open (displaying an error message similar to the example screenshot below at the top-right of the dialog) and a warning indicator will appear next to that field. The original claim amount must then be adjusted on this tab before the plan can be confirmed.

|

|---|

17.Click <Save Changes> on the Bankruptcy Detail screen.

18.Click ![]() .

.

Figure 1

Figure 2

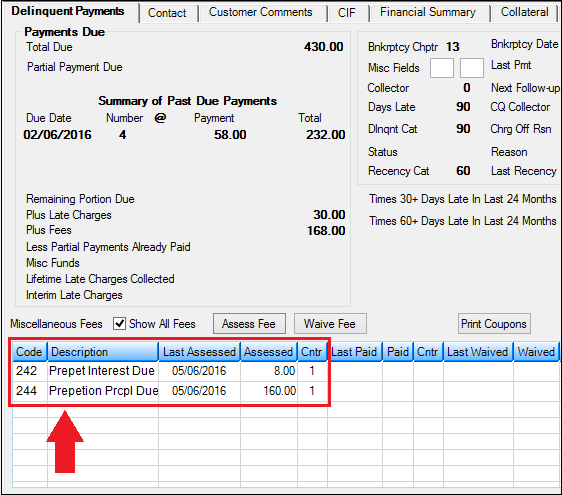

Once you have confirmed the plan, the system automatically assigns the account the applicable arrearage amount. You can view the arrearages on the Loans > Marketing and Collections screen > Delinquent Payments tab in the Miscellaneous Fees table (see Figure 3 below). Note: Arrearages are not fees. You cannot assign arrearages using the <Assess Fee> transaction. However, they are listed in this table for your information.

These are the possible arrearage descriptions:

•240 – Prepetition Income Fees

•241 – Prepetition Receive Fees

•242 – Prepetition Escrow Due

•243 – Prepetition Interest Due

•244 – Prepetition Principal Due

•247 – Post-petition Income Fee

•248 – Post-petition Reveive Fee

•249 – Post-petition Interest Due

•250 – Post-petition Escrow Due

•251 – Post-petition Principal Due

Figure 3: Loans > Marketing and Collections Screen

To pay the arrearage amounts, use the Petition Claim Payment transaction (tran code 2850-07) in CIM GOLDTeller.

Arrearage amounts are reported to the credit bureaus as part of the Amount Past Due (Base Field 22) on the Credit Reporting transmission (FPSRP184).

See also: Postpetition Claims Tab