Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Detail Screen > Bankruptcy POC dialog >

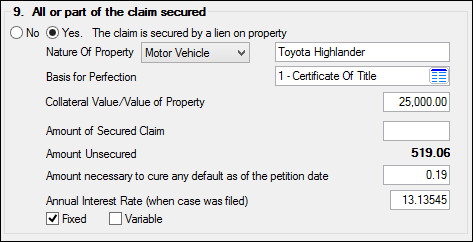

9. All or part of the claim secured

Use this step of the Bankruptcy Proof of Claim to indicate whether the claim is secured by a lien on property. Information entered in this step will affect the amounts in the Proof of Claim field group on the Bankruptcy Detail screen.

If you select the Yes radio button, the following information must be indicated about the property:

Nature of Property |

Select the nature of the property from the drop-down list. Possible entries are: No Asset, Real Estate, Motor Vehicle, or Other). If Other, use the text field to the right to explain. This field is required. |

Basis for Perfection |

Entries for this field are determined by your institution and set up using the Loans > Bankruptcy and Foreclosure screen > Setup > Basis For Perfection screen. Possible examples include Certificate of Title, Recorded Deed, UCC, and Judgment. |

Collateral Value/Value of Property |

Enter the value of the collateral or property securing the loan in this field, if applicable. Some loans do not require any collateral. The information you enter here will be reflected in the Proof of Claim field group on the Bankruptcy Detail screen. |

Amount of Secured Claim |

Enter the amount of the loan that is secured, if applicable. In other words, if the collateral on the loan has been repossessed and you can sell the collateral for a certain amount, enter that amount in this field.

This field is used to calculated the next field, Amount Unsecured (see below). |

Amount Unsecured |

This is the total Proof of Claim amount on the loan minus any amount entered in the Amount of Secured Claim field. This is calculated after the Bankruptcy transaction is run, and after you enter an amount (if applicable) in the Amount of Secured Claim. See the Proof of Claim field group for more information. |

Amount necessary to cure any default as of the petition date |

This is the total amount due as of the filing date. It is pulled from the Total Due as of Filing Date field on the Bankruptcy Detail screen. You can make changes to this field.

For Chapter 13 bankruptcies, this is the total amount of prepetition arrearages. |

Annual Interest Rate (when case was filed) |

Whether the rate is Fixed or Variable. The interest rate types available here (Fixed Only, Variable Only, or Both) can be indicated in the POC Defaults field group on the Loans > Bankruptcy and Foreclosure > Bankruptcy Options screen.

The numeric text field on the right displays the interest rate on the account as of the time bankruptcy was filed. If the interest rate at the time of bankruptcy filing was zero as a result of the account being charged off (depending the institution options enabled), this field will display the account's origination rate. If for some reason the account was originated with a zero rate, this field will display the account's original APR value. |