Navigation: Loans > Loan Screens > Bankruptcy and Foreclosure Screen Group > Bankruptcy Detail Screen > Claim Information dialog >

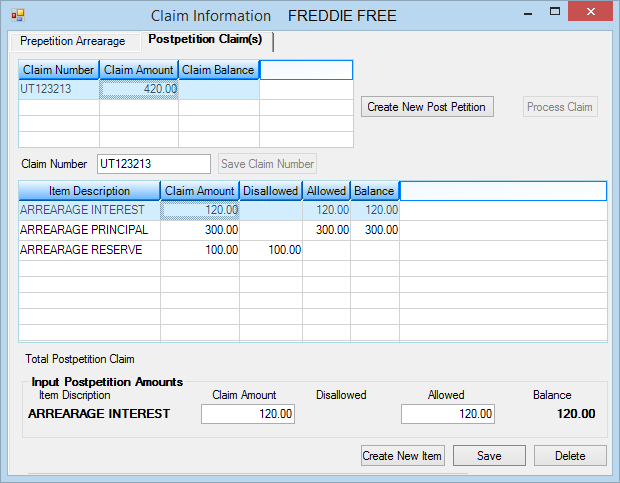

The Postpetititon Claim(s) tab on the Claim Information dialog box (shown below) allows you to enter postpetition claim amounts since the bankruptcy was filed. See the following example of this tab:

Postpetition arrearages occur when a Chapter 13 Bankruptcy has been processed, but the account owner gets behind in making the agreed upon payments. For example, if a borrower is making the monthly payment designated by the Chapter 13 bankruptcy but gets behind. The payment going to principal, interest, or any reserves would be considered post-petition arrears to distinguish from pre-petition arrears, which is the delinquent amount before filing bankruptcy.

To process a postpetition arrear:

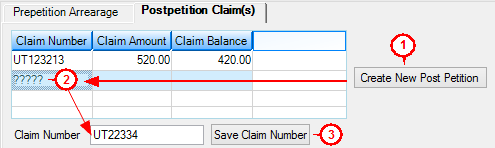

1.Click ![]() . Question marks will be displayed in the top list view (see below).

. Question marks will be displayed in the top list view (see below).

2.Select the row with the question marks in the table, and then in the Claim Number field, type the number of the claim filed with the Bankruptcy Courts for this postpetition arrears.

3.Click ![]() .

.

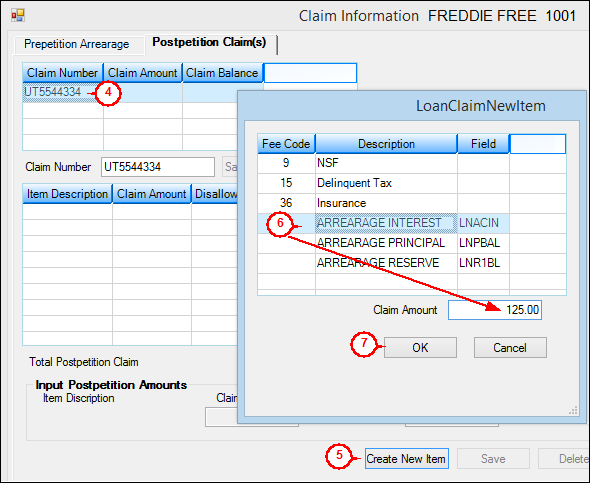

4.Select the claim number you just saved in the top list view table. This will enable the ![]() button to work.

button to work.

5.Click ![]() . The Loan Claim New Item dialog box appears with each of the available post-petition claims listed, as shown below:

. The Loan Claim New Item dialog box appears with each of the available post-petition claims listed, as shown below:

6.Select one of the listed arrearages. The amounts for that arrearage will be displayed in the Input Postpetition Amounts field group. The predetermined amounts are only shown automatically if the account owner has fallen behind in payments after a bankruptcy. In our example, that hasn't occurred, so we will manually enter the amount in the Claim Amount field.

7.Click <OK>. The Loan Claim New Item dialog box will close, and the post-claim information you just entered will be displayed in the Input Postpetition Amounts field group, as shown below. (You will need to select the Claim Number in the top list view table, then the Item Description in the bottom table in order to see the arrearage entered in steps 4-6 above.)

8.Enter the amount allowed for this post petition claim in the Allowed field. This is the amount the Bankruptcy Court has approved that the borrower owes to your company.

9.Click <Save>.

10. Click ![]() .

.

Once you have processed the claim, the system automatically assigns the account the applicable arrearage amount. You can view the arrearages on the Loans > Marketing and Collections screen > Delinquent Payments tab in the Miscellaneous Fees table. Note: Arrearages are not fees. You cannot assign arrearages using the <Assess Fee> transaction. However, they are listed in this table for your information.

Arrearage amounts are reported to the credit bureaus as part of the Amount Past Due (Base Field 22) on the Credit Reporting transmission (FPSRP184).

These are the possible arrearage descriptions:

•240 – Prepetition Income Fees

•241 – Prepetition Receive Fees

•242 – Prepetition Escrow Due

•243 – Prepetition Interest Due

•244 – Prepetition Principal Due

•247 – Post-petition Income Fee

•248 – Post-petition Reveive Fee

•249 – Post-petition Interest Due

•250 – Post-petition Escrow Due

•251 – Post-petition Principal Due

To pay the arrearage amounts, use the Petition Claim Payment transaction (tran code 2850-07) in CIM GOLDTeller.

See also: Prepetition Arrearage Tab