Navigation: Loans > Loan Screens > Marketing and Collections Screen >

The Loan Disclosure History screen is accessed from the following screens:

•Loans > Marketing and Collections screen, Loan Disclosure History tab

•Original Loan Disclosure screen, then click <Show Disclosure History>.

•Purchase Disclosure screen, then click <Show Disclosure History>

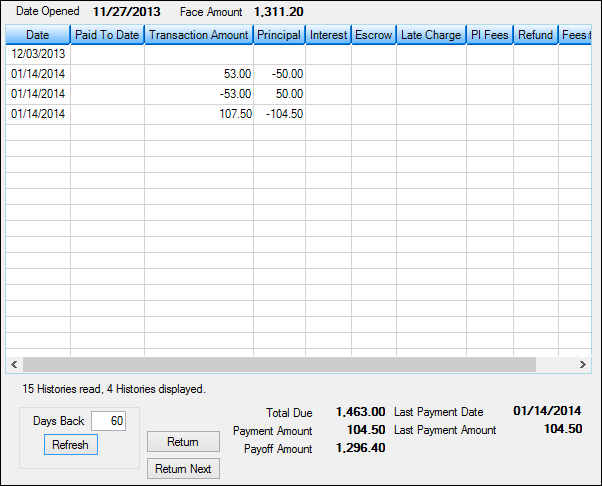

This tab displays important transaction information affecting the selected loan account. This history is slightly different from the history displayed on the Loans > History screen. This screen doesn't show all transaction history on the account, only important transactions. This is by design, so the information on the tab loads faster.

However, an option is available that will show even more transactions. This option is found on the Options > User Preferences > Options tab from the CIM GOLD main menu bar: Show all Open/Payoff in Disclosure History.

Loan Disclosure History tab

The list view table at the top of this screen displays transaction history involving the selected loan account. You can designate how far back you want history items displayed in this list by entering the number in the Days Back field (see table below) and then clicking <Refresh>. If "0" is entered in the Days Back field, all history will be displayed in the list view after you click <Refresh>.

Date: |

This is the date of the transaction.

|

Paid To Dt: |

This is the amount of payments made to the loan to date.

|

Tran Amount: |

This was the amount of the transaction paid toward the loan.

|

Principal: |

This is the amount of money for this transaction that was applied to reducing the principal for this loan.

|

Interest: |

This is the amount of money for this transaction that was used to pay the interest for this loan.

|

Late Chg: |

This was the amount of money, if any, for this transaction that went to pay for any late charges accrued on this loan.

|

Refund: |

This is the amount of refund, if any, due back to the customer after this transaction was processed.

|

Fee Bal: |

This is the amount of fees left to be paid, if any, for this loan after the transaction was run.

|

Balance: |

This is the amount of the loan still due after the transaction was processed.

|

Due Date: |

This is the due date of the loan payment.

|

Partial Payment: |

This is the amount of any partial payment made.

|

Description: |

Description: This is the description of the transaction.

|

Significant Field Changes: |

This column displays which significant fields were changed in this transaction.

|

Teller #: |

This column displays the teller number of the employee who processed the transaction.

|

Time: |

This column displays the time the transaction processed.

|

$$: |

This column displays how the money for the transaction was processed. Possible entries are:

CSH (cash transaction) CHK (check transaction) JNL (journal transaction) ACH (Automated Clearing House transaction) ATM (Automated Teller Machine transaction) |

Tran Code: |

This column displays the transaction code for this transaction. See the Loan Transaction Codes topic for a list of loan transaction codes. |

The fields on this screen are as follows:

Field |

Description |

||

|

Mnemonic: LNOPND |

This field displays the date the loan was opened, pulled from the Date of Loan field on the Loans > Original Loan Disclosure screen. |

||

|

Mnemonic: LNFACE |

This field displays the face amount, or face value, of the loan. The Face Amount is calculated by taking the original balance on the loan and subtracting any maintenance fees (at origination) and original unearned precomputed interest (if applicable).

This field is used in Credit Reporting to determine the High or original amount.

This field is used in many amortizing calculations, such as amortizing fees and precomputed interest.

Face Amount = Original Balance - Maintenance Fees (amortizing fees that are designated at loan origination) - Original Unearned Interest

Example: The Original Balance on a loan is $1,450.00. The loan is a precomputed loan with Original Unearned Interest of $150.00, as well as $45 in maintenance fees.

$1,450.00 - $150.00 - $45 = $1,255.00 |

||

Histories Read/Histories Displayed |

This field shows the number of histories read versus the numbers of histories displayed. Because the Loan Disclosure History tab was designed to only show specific transactions, usually the number of histories is read is greater than the number of histories displayed.

This is by design, so this history tab is easier to load and display. If you want a more detailed view of history, see the Loans > History screen > Detailed History tab. |

||

|

Mnemonic: N/A |

This field allows you to select how far back you want to view history. You can also set the default for the Days Back field through User Preferences accessed from the CIM GOLD Options menu.

Once you type a number in this field, click <Refresh> to pull history from the number of days specified. The information will appear in the list view above.

If "0" is entered in the Days Back field, all history will be displayed in the list view after you click <Refresh>. However, archived history (history older than two years) will not appear unless you also check the Read Archived History field below. |

||

|

Mnemonic: LNFEES + LNLATE + LNPBAL |

This is the sum of the total miscellaneous loan fees in addition to the late charges due on the loan and the current principal balance remaining on the loan. |

||

|

Mnemonic: LNPICN |

This field contains the portion of the regular payment that is divided between the amount to interest and amount to principal. |

||

|

Mnemonic: LHPOFF |

This is the total remaining balance on the loan in order for the loan to be completely paid off (including any fees, precomputed charges, etc.). |

||

|

Mnemonic: LNDTLP |

This field shows the date that the last payment was posted. If a payment reversal occurs, the system will look in the collection history for the previous last payment date and enter that date in this field. The last payment date is reported to the credit bureaus. This field is updated as payment activity occurs on the loan.

An option is available that causes the Last Payment Date to not be updated when a payment is made on a loan that is in deferment. Deferment payments are made in GOLDTeller through transaction code 2600-13 or through the Loans > Transactions > EZPay screen.

If you would like this option set up for your institution, send in a work order with your request or tell your GOLDPoint Systems customer service representative that you want Institution Option NDLP set to “Y.” |

||

|

Mnemonic: LNLPMA |

This is the amount of the last loan payment the account owner made on the Last Payment Date above. This field indicates the most recent amount paid on the customer account. Each time a payment transaction is run on the account, this field is updated with the amount of the transaction.

For loans that are boarded through GOLDAcquire Plus or GOLD Loan Gateway, an institution option is available that affects whether an amount is transferred into the Last Payment Amount field.

If this institution option (OP30 UOLP – Use Origination Payment Amount) is set, when a loan is boarded through GOLDAcquire Plus or GOLD Loan Gateway, the Origination Tracking Final Payment amount (OTLPAM) will transfer into the Last Payment Amount field (LNLPMA) for the loan.

Without this option set, the Open Loan transaction (tran code 680) clears the amount in LNLPMA. If UOLP is set, then the CSOT record will be read and populate LNLPMA with OTLPAM.

The Final Payment amount field (OTLPAM) is found on the Loans > Purchase Disclosure or Original Loan Disclosure screens. |

||

|

Mnemonic: N/A |

Check this box if you want history items that are more than two years old to appear in the list view above. In order to display archived history, the Days Back field above should be set to a number more than 730 days, or enter "0" in the Days Back field. Click <Refresh> and the archived loan transaction items will also appear in the list view.

|