Navigation: Loans > Loan Screens > Transactions Screen Group > EZPay Screen > EZPay Settings and Options > EZPay IMAC Table >

|

GOLDPoint Systems Only: These options are set up for individual institutions on the GOLDPoint Systems > EZPay IMAC Table screen in CIM GOLD. Select the institution in the list at the top of the screen to edit that institution's EZPay information in the fields below (if the institution's name or production URL is not listed, they need to be set up by programmers). The Use EZPay option on the General tab must be marked in order for an institution to use the EZPay screen.

IMPORTANT: Many of the options on the EZPay IMAC Table no longer control options for payments on the institution's website (GOLD Account Center). Therefore, if an institution wants to make changes to EZPay, verify whether they also want the change applied to their website (GAC). If they do, contact a member of the Web Team to set up the accompanying option for GAC. |

|---|

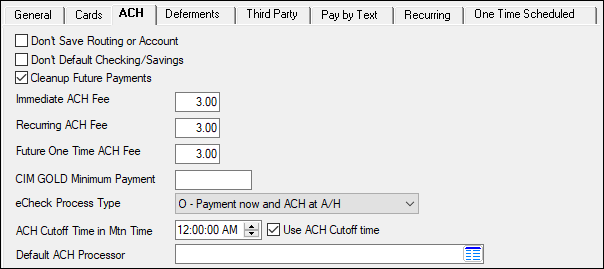

This help topic describes the EZPay options which can be set up for your institution on the ACH tab of the EZPay IMAC Table (shown below). Your institution cannot access this tab (it must be managed on your behalf by GOLDPoint Systems), but you can read through the descriptions of available options to see if you want any of them implemented.

GOLDPoint Systems > EZPay IMAC Table > ACH tab

Option |

Description |

||

|---|---|---|---|

Don't Save Routing or Account

(EZDSRA) |

Set this option if you do not want the routing number and account number to be saved with the loan record when setting up recurring fees. This will cause employees to manually enter routing and account numbers on transactions, rather than the system already remembering them and automatically entering them for accounts with recurring payments.

|

||

Don't Default Checking/Savings

(EZDDCS) |

Set this option if your institution does not want to default the checking/savings account of the borrower in the Payment Account field.

|

||

Cleanup Future Payments

(EZCUFP) |

Set this option if the institution wants all future payment records for a customer (FPRA, FPAS) removed from the system if that customer's stored ACH payment information (FPEA) is deleted.

If this option is used, a prompt will appear in CIM when a user attempts to delete an ACH profile. This prompt will inform the user that any future payments using the selected routing and account numbers will be removed from the system and that the customer will need to re-schedule the recurring payments if desired. This prompt will not include ACH profiles with the Stop Loan Autopay (RASLAP/ASSLAP) option marked.

If this option is not used, a different prompt will appear in CIM when a user attempts to delete an ACH profile. This prompt will inform the user that all future payments will process normally and will need to be removed individually if desired. |

||

Immediate ACH Fee

(EZOCFE) |

Enter the fee amount this institution wants to charge customers for making payments using immediate ACH (e-check, external checking or savings account). If the institution has the Use Convenience Fee Table option (EZFTBL) set, this field is ignored and the fee amount set up on the Loans > System Setup Screens > EZPay Convenience Fee is used instead.

If an amount is entered here, when making an immediate payment, the Fee amount will be displayed in the provided field.

See the Fees topic for more information about charging fees in EZPay.

|

||

|

(EZRAHF) |

Enter the fee amount this institution wants to charge customers for making payments using ACH (e-check, external checking or savings account). If the institution has the Use Convenience Fee Table option (EZFTBL) set, this field is ignored and the fee amount set up on the Loans > System Setup Screens > EZPay Convenience Fee is used instead.

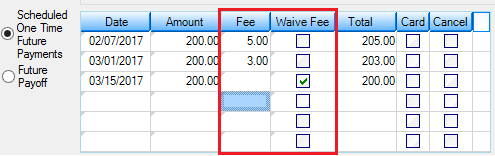

If an amount is entered here, when making a recurring ACH payment, the Fee amount will be displayed in the provided field, as shown below:

See the Fees topic for more information about charging fees in EZPay.

|

||

Future One Time ACH Fee

(EZFOTF) |

Enter the fee amount that will be charged for each one-time ACH payment. If the institution has the Use Convenience Fee Table option (EZFTBL) set, this field is ignored and the fee amount set up on the Loans > System Setup Screens > EZPay Convenience Fee is used instead.

See the Fees topic for more information about charging fees in EZPay.

|

||

CIM GOLD Minimum Payment

(EZPMIN) |

This affects all payment transactions: e-Check, one-time, and recurring. If the minimum payment amount is not met (as set up in this option), an error occurs when a user tries to process a loan payment that is less than this minimum amount. The error message, "A minimum payment of $XX.XX is required" appears and the payment is not processed. |

||

eCheck Process Type

(EZECHK) |

This option sets the e-check process type to one of the following:

•If this option is set to "3," e-Check is paid by a third party. This is real-time payment made on the host, and ACH is originated by a third-party vendor (such as NetDeposit).

•If this option is set to "O," e-Check is paid online. The loan payment is made immediately, and the ACH is scheduled for the following afterhours processing cycle.

|

||

ACH Cutoff Time in Mtn Time/Use ACH Cutoff Time

(EZACOT/EZUACO) |

Set this option to stop employees from reversing payments past a certain time during the day, but allow employees to post payments after the cutoff time and be able to reverse them. The cutoff times are in 24-hour increments.

If your institution has set the ACH Cutoff Time in Mtn Time (EZACOT) option to 3:30 p.m. and has set the Use ACH Cutoff Time (EZUACO) option, ACH payments are able to be reversed until 3:30 p.m. For example, if an ACH payment is made on 1/28 at 1:00 p.m., that payment can be reversed until 3:30 p.m. on 1/28. If an ACH payment is made on 1/28 at 3:32 p.m., that payment can be reversed until 3:30 p.m. on 1/29. |

||

Default ACH Processor

(EZCACP) |

Use this field to indicate the institution's default ACH transaction processor (if applicable). ACH processors are set up by the Web Team. If the ACH processor does not appear in this list, contact a member of the Web Team. |