Navigation: Loans > Loan Screens > Account Information Screen Group >

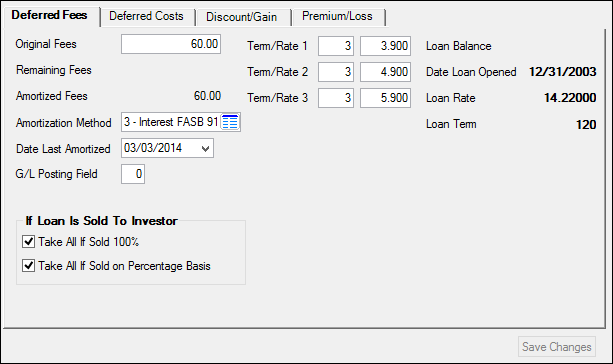

Use this screen to track and amortize deferred income items (fees, discounts/gains) or expense items (costs and premiums/losses) on the customer loan account.

See Deferred Fees Options for information about institution options that pertain to deferred fees. See Special Information for extra considerations concerning deferred fees on certain loans.

Loans > Account Information > Deferred Fees Screen

This screen contains four tabs, one for each type of deferred item: Deferred Fees, Deferred Costs, Discount/Gain, and Premium/Loss. Deferred items are initially applied to loans during origination (through GOLDTrak PC) but can be edited on this screen. The fields on each tab are identical and pertain to whichever deferred item type is selected.

The system processes the income or expense items monthly based on the cycle date determined by your institution (generally monthend). The result of this process will appear on the following reports:

•Deferred Loan Fees and Discount/Gain Amortization Report (FPSRP077)

•Deferred Loan Costs and Premium/Loss Amortization Report (FPSRP035)

•Deferred Loan Fees Short Trial Balance (FPSRP084)

•Deferred Costs Trial Balance (FPSRP081)

In addition, any file maintenance to the fields as a result of the amortization will appear in each loan’s history. Items that do not amortize will appear on the Afterhours Exception Report (FPSRP013). Also, if the “remaining” amounts are higher than the “original” amounts, they will appear on the Warning Report (FPSRP083).

The Deferred Fees/Cost Effective Rate Change Report (FPSRP287) is a daily report that identifies loans for which a new "effective rate" was automatically calculated and the "effective rate" was updated. In addition, any file maintenance to the fields as a result of the cycling will appear in each loan's history.

|

Note: Deferred income or expenses will not amortize if any of the following conditions exist on the loan:

•The loan is non-performing. An option (afterhours update function 59) is available that automatically changes performing loans to non-performing loans if the loan is 93 or more days delinquent (excluding loans with general categories 50 through 69 (securities)). This change takes place only at monthend. Each month, for all loans that exceed being delinquent by 93 days, the system puts a check in the Non-Performing field. If the loan becomes less than 93 days delinquent, the system unchecks the field at monthend. The system does not look at payment method 5, 9, or 10 loans with a zero principal balance. If you would like this option set up for your institution, send in a work order with your request. Action code 59 stops the field from changing.

•The General Category (from the Loans > Account Information > Account Detail screen) is 80 or higher.

•Asset Classification is "Doubtful" or "Loss" on the Loans > Account Information > Additional Loan Fields screen.

•Institution Option SADF will stop deferring if a loan is delinquent. When the loan becomes current, amortization will resume catching up for the delinquent months. The system uses the Payment Frequency (from the Account Detail screen) to determine whether the loan is delinquent. If it is more than three payment frequencies past due, it will not amortize. Example: Loan due date of 4-10 with a payment frequency of 1. It will amortize at 4-30, 5-30, and 6-30, but will not amortize 7-31.

•Institution Option UNPD is available that will use the number of days stored in Institution Option NPDY (number of days to set non-performing) instead of 3 payment frequencies to stop amortization if a loan is delinquent. (See item 5 above.)

•Action code 39 stops fees and premiums from amortizing up to the action date. This action code would generally be used if you have loans that have not been sold, but that you are planning to sell. |

|---|

The fields on this screen are as follows:

Field |

Description |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonics: LNFORG, LNCORG, LNDORG, LNPORG |

These fields contain the total amount or the net amount of loan fees, costs, discount/gain, or premium/loss on the loan. The system can supply this information for you from GOLDTrak PC; however, the field is also file maintainable if you have proper security. If GOLDTrak is not used, you must enter the data manually. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonics: LNFREM, LNCREM, LNDREM, LNPREM |

These fields contain the remaining (still unamortized) deferred fees, costs, discount/gain, or premium/loss on the loan. See below for more information.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonic: N/A |

These fields will show the amount of the fees, costs, discount/gain, and premium/loss that have been amortized to date. This is a calculated field that is determined by the amortization method used (see Amortization Method description). Since this is a calculated field, it is not available in GOLDWriter but can be calculated in GOLDWriter. See also: Remaining Fees (above). |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonics: LNFMET, LNCMET, LNDMET, LNPMET |

Use this field to indicate the amortization method for deferring fees. See Amortization Methods for more information. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonics: LNFAMD, LNCAMD, LNDAMD, LNPAMD |

These fields contain the date the deferred fees, costs, discount/gain, and premium/loss were last amortized. See below for more information.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonics: LNFGLP, LNCGLP, LNDGLP, LNPGLP |

This field enables your institution to post to different G/L numbers for different types of loans. For instance, you can post all consumer loans to one G/L while posting all mortgage loans to a different G/L. (Most institutions choose not to use this feature.) You can enter a General Ledger posting field of 1 through 99 which will direct the amortization through the G/L Autopost to the desired G/L account.

If your institution would like to post to the G/L using this feature, please submit a work order requesting that this field be made available. For more information on G/L Posting Fields to the Autopost, see section 6.3, Posting Fields, in the GOLD Services manual in DocsOnWeb. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonics: LNFTM1-3, LNCTM1-3, LNDTM1-3, LNPTM1-3, LNFRT1-3, LNCRT1-3, LNDRT1-3, LNPRT1-3 |

These fields indicate each term length and corresponding rate. The term is pulled from the Loans > Account Information > Additional Loan Fields screen. See below for more information.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonics: LNPBAL |

This field contains the current Principal Balance of the loan. It is pulled from the Loans > Account Information > Account Detail screen. See below for more information.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonics: LNOPND |

This field displays the date the loan was opened or funded. It is pulled from the Loans > Account Information > Additional Loan Fields screen. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonics: LNRATE |

This field displays the effective rate being used to amortize the deferred income or expense items. See below for more information.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonics: LNTERM |

This field contains the term of the loan in months, pulled from the Term in Months field on the Loans > Account Information > Additional Loan Fields screen. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mnemonics: LNTALL, LNCALL, LNDALL, LNPALL |

This checkbox field (in the If Loan Is Sold To Investor field group at the bottom-left of this screen) is used to determine if the total of the remaining deferred fees, costs, discount/gain, and premium/loss should be taken to income or expense (based on your G/L Autopost) or continue to amortize normally when the loan is 100% sold. A checked entry will take fees to income, whereas unchecked (default) will amortize normally. The funds will be taken to income at the same time the deferred fees cycle (generally at monthend), not on the date you sell the loan. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Take All if Sold on Percentage Basis

Mnemonics: LNTPER, LNCPER, LNDPER, LNPPER |

This checkbox field (in the If Loan Is Sold To Investor field group at the bottom-left of this screen) is used to determine if the total of the percent sold of the remaining deferred fees, costs, discount/gain, or premium/loss should be taken to income or expense or continue to amortize normally when the loan is sold on a percentage basis. See below for more information.

|

|

Record Identification: The fields on this screen are stored in the FPLN record (Loan Master). You can run reports for this record through GOLDMiner or GOLDWriter. See FPLN in the Mnemonic Dictionary for a list of all available fields in this record. Also see field descriptions in this help manual for mnemonics to include in reports. |

|---|

In order to use this screen, your institution must:

•Subscribe to it on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for it on the CIM GOLD tab of the Security > Setup screen. |