Navigation: Loans > Loan Screens > Account Adjustment Screen >

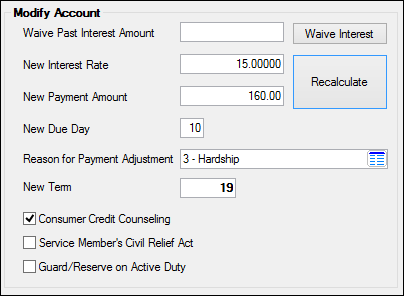

Modify Account field group

The fields in the Modify Account field group on the Account Adjustment screen may or may not be file maintainable, depending on the options set up for your institution. If the fields are file maintainable, these fields allow you to adjust the loan's interest rate, regular payment amount, due date, and term. You can also indicate a reason for the loan adjustment.

If modifying an account using this field group, the following criteria must be met (unless a certain institution option is set, see GOLDPoint Systems Only note at the bottom of this help page).

•The New Payment Amount must be at least half of the previous payment amount (PI Constant).

•The New Payment Amount must be greater than the minimum payment based on the New Interest Rate.

•The New Interest Rate cannot be greater than the Original Interest Rate.

•The New Payment Amount cannot be greater than the Original Payment Amount.

•If determining a New Payment Amount based on a desired New Term, the system will determine the minimum payment amount of the New Payment Amount so that the loan can be paid off according to the New Term.

•For accounts in bankruptcy, the New Payment Amount must be greater than $20, unless the RCNP option is set (see GOLDPoint Systems Only note at the bottom of this help page).

Click ![]() and the newly entered information will appear in the applicable fields in the Current Account Information field group.

and the newly entered information will appear in the applicable fields in the Current Account Information field group.

Open the link below for information about the <Waive Interest> and <Recalculate> buttons in this field group.

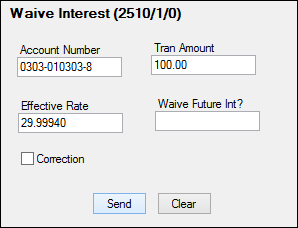

<Waive Interest> Clicking this button activates the Waive Interest transaction (tran code 2510-01) in GOLDTeller, which allows you to waive interest for this account. The interest you want to waive is determined by your institution. Note: You should already be logged on to GOLDTeller before clicking this button. However, if you are not already logged on, the system will log you on after you click <Waive Interest>.

<Recalculate> To recalculate a loan, enter either a new Payment Amount, Interest Rate, or Term in this field group, then click <Recalculate>. The system will either calculate a new term (if you entered a New Payment Amount and/or New Interest Rate) or a new payment amount (if you entered a New Term and/or New Interest Rate). After you click <Save Changes>, the new payment amount will appear in the Current PI Constant field, the new term will appear in the Term in Months field (on the Loans > Account Information > Account Detail screen), and the new interest rate (if applicable) will appear in the Current Interest Rate field.

This button can be restricted for individual users. To restrict users from clicking this button, complete the following steps:

1.Access the Security > Setup screen in CIM GOLD. 2.Click the Field Level tab, and in the Name field, click the list icon 3.In the All Fields field group, click the list icon in the Record Type field and select “FPFS – Miscellaneous Function Security.” 4.In the list view below that field, mark the box next to FSRCAL (Acct Adj Recalculate). 5.Click That user will now be restricted from recalculating loans from the Account Adjustment screen.

The following is an example of how the Security > Setup screen > Field Level tab would be set up, as described in the above steps.

|

The fields in this field group are as follows:

Field |

Description |

||||

|

Mnemonic: IBREC2 |

This field is used in connection with the Waive Interest transaction (tran code 2510-01) in GOLDTeller. Type the amount of interest you want waived in the Waive Past Interest Amount field, then click the <Waive Interest> button (see above) to activate the Waive Interest transaction in GOLDTeller. Note: You should already be logged on to GOLDTeller before clicking this button. However, if you are not already logged on, the system will log you on.

The system will bring up the Waive Interest transaction, as shown below:

The account number and amount you entered in the Waive Past Interest Amount field will be carried over on the transaction. You can leave the Effective Rate and Waive Future Int? fields blank. They only apply if you plan on waiving future interest. See the Waive Interest transaction (tran code 2510-01) for information on waiving future interest.

Click <Send> to process the transaction and waive the interest amount. You can only waive interest up to the amount in the Amount of Interest Due field. For example, if 100.00 is in the Amount of Interest Due, you can waive interest amount from 0.01 to 100.00.

Processing the Waive Interest transaction affects the Date Interest Paid To field. It will reflect the date the interest has been paid to using this transaction.

The history description for this transaction is "Waive Interest."

|

||||

|

Mnemonic: LNRATE |

In this field, enter the new interest rate you want applied to this loan. Once you've typed in the new interest rate, click <Reclaculate> (see above), and the new payment amount calculated with the new interest rate will appear in the New Payment Amount field below.

When you click <Save>, the new interest rate will appear in the Current Interest Rate field.

Field-level security options are available to restrict users from file maintaining this field.

|

||||

|

Mnemonic: LNPICN |

This field has multiple uses. You can enter new information in the New Term field below to recalculate a new payment amount that will show in this field. You can also enter a new payment in this field to recalculate a new term. The amount in this field is the portion of the regular payment that is divided between the amount to interest and amount to principal. Open the link below for more information.

New Payment Amount details

Click <Recalculate> (see above) and the new amount or term will appear (depending on which field was entered).

When you click <Save Changes>, any changes you made to the New Payment Amount field will appear in the P/I Constant field in the Current Account Information field group.

If modifying an account, the following criteria must be met (unless a certain institution option is set, see GOLDPoint Systems Only note at the bottom of this help page):

•The New Payment Amount must be at least half of the previous payment amount (P/I Constant). •The New Payment Amount must be greater than the minimum payment based on the New Interest Rate above. •The New Interest Rate cannot be greater than the Original Interest Rate. •The New Payment Amount cannot be greater than the Original Payment Amount. •If determining a New Payment Amount based on a desired New Term, the system will determine the minimum payment amount of the New Payment Amount so that the loan can be paid off according to the New Term. •For accounts in bankruptcy, the New Payment Amount must be greater than $20, unless the RCNP option is set (see GOLDPoint Systems Only note at the bottom of this help page).

If any partial payments exist on the loan and you try to adjust the payment amount of a loan for less than the amount of partial payment (see Applied To Payment field description), the following message appears:

"The new P&I of $XXX.XX is less than the partial payments made ($XX.XX). Would you like to automatically advance the due date and reduce the partial payment amount by the new P&I?"

•If you click <Yes>, the system will reduce the Applied To Payment (also known as Partial Payments) amount by the amount entered in the New Payment Amount field. The system will also advance the Due Date by one frequency.

•If you click <No>, the system will close the message and clear the amount you entered in the New Payment Amount field.

To change the payment and the term:

1.In the New Term field, enter a new total term minus the number of payments already made. 2.Click <Recalculate>. The adjusted payment amount will appear in the this field. 3.Enter a reason in the Reason for Payment Adjustment field below. 4.Click <Save Changes>.

To calculate a new term:

1.Enter a new payment in this field. 2.Click <Recalculate>. 3.Enter a reason in the Reason for Payment Adjustment field. 4.Click <Save Changes>.

Field-level security options are available to restrict users from file maintaining this field.

|

||||

|

Mnemonic: LNDUDY |

In this field, enter the new due day you want applied to this loan. Enter the due date of the next regular payment when you want to have the Due Date be the last day of the month and the end of the current month is less than 30 days. See below for more information.

|

||||

|

Mnemonic: OTRPRC |

From this drop-down selection, enter the reason for why you are adjusting this loan. See below for more information.

|

||||

|

Mnemonic: LNTERM |

This field has multiple uses. You can enter new information in the other fields to calculate a new term that will show in this field. You can also enter a new term in this field to calculate new information that shows in other fields. See below for more information.

|

||||

|

Mnemonic: MLCCC |

The three checkbox fields in this field group deal with reporting account adjustments to the Credit Bureaus. If you mark any of these checkboxes, a Special Comment Code (as explained in help for the Loans > Credit Reporting screen) is attached to the account and is sent to the Credit Bureau at monthend. When Consumer Credit Counseling is selected, the special comment code is B.

If both Guard/Reserve on Active Duty (below) and Consumer Credit Counseling are marked, the Special Comment Code reported will depend on the code's priority (as set up on the Loans > System Setup Screens > Special Comment Code screen). |

||||

Service Member's Civil Relief Act

Mnemonic: MLSASA |

The three checkbox fields in this field group deal with reporting account adjustments to the Credit Bureaus. Marking this field does not assign a Special Comment Code, however, Action Code 80 (FNMA 12 - Relief Provisions) is applied to the account. See SCRA Fields field group for more information. |

||||

|

Mnemonic: MLGRAD |

The three checkbox fields in this field group deal with reporting account adjustments to the Credit Bureaus. If you mark any of these checkboxes, a Special Comment Code (as explained in help for Credit Reporting screen) is attached to the account and is sent to the Credit Bureau at monthend. When Guard/Reserve on Active Duty is selected, the special comment code is AI.

If both Guard/Reserve on Active Duty and Consumer Credit Counseling (above) are marked, the Special Comment Code reported will depend on the code's priority (as set up on the Loans > System Setup Screens > Special Comment Code screen). |

To set up options allowing or disallowing the use of these fields, please contact your GOLDPoint Systems account manager.

|

GOLDPoint Systems Only: Set institution option OP11 RCNP to "Y" (yes) to allow users to enter a new payment amount without restricting the amount of the new payment to be at least half of the previous amount (PI Constant) and greater than the minimum payment based on the New Interest Rate.

For bankrupt accounts, the new payment amount must be at least $20 unless this option is set to "Y."

See the OPCO institution options to see how changing the Interest Rate, P/I Constant, Term, and Due Date affect how the system applies the Special Comment Code for credit reporting purposes. |

|---|