Navigation: Loans > Loan Screens > Account Adjustment Screen >

Write Off field group

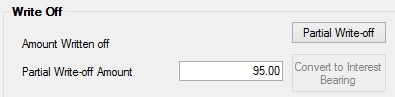

The fields in the Write Off field group on the Account Adjustment screen are used for writing off (reducing) the principal balance on a loan (mnemonic LNPWOA).

When a loan becomes seriously delinquent or in default and is determined to be noncollectable, your institution may choose to charge off the outstanding principal amount, or part of the principal amount, as an expense or a loss. You can also reduce the principal balance of the loan, then charge a certain amount of interest to the rest of the loan. Many options are available for dealing with delinquent loans. The fields in this box deal with partially writing off the loan.

If you click <Partial Write-off>, GOLDTeller will activate the Partial Write-off transaction (tran code 2510-00). You must be logged in to GOLDTeller for this button to work. To log into CIM GOLDTeller, simply access the Teller System > GOLDTeller screen from the left tree navigation in CIM GOLD, and CIM GOLDTeller will automatically log you in.

The Partial Write-off transaction reduces the principal balance by the amount of the transaction. It is used when you are charging off only a portion of the actual principal balance rather than the full principal balance. It would be used, for example, if you needed to reduce the principal balance so it would be below the state limit for filing small claims. For example, if the state limit for filing a small claim is $3,000, and your loan balance was $3,200, you would run the transaction for $200; leaving a principal balance of $3,000.

This transaction automatically debits the Unearned Interest General Ledger account by the amount of the transaction, and credits that amount to the principal balance. The Unearned Interest number is pulled from the GOLD Services > General Ledger > G/L Account By Loan Type screen. The history description for this transaction is "Prtl W/Off Cr."

If you need to do a full charge off, process the Charge-Off transaction (tran code 2022-01).

Once the partial write-off transaction has been processed, the Partial Write-off Amount field is updated with the information entered in the transaction (this amount is not used in any regulatory reporting. If you report to the OTS or FDIC, use the Partial Charge Off fields (tran code 860). The accumulated amount of partial write-offs is displayed in the Amount Written off field.

Institution Option ANAC allows a partial charge-off if a loan is not in a non-accrual status.

Converting Precomputed to Interest Bearing

If this is a precomputed loan (payment method 3), you must first convert it to a simple-interest bearing loan (payment method 6), so the system will handle the unearned precomputed interest. Clicking <Convert to Interest Bearing> opens the Convert Precomputed to Simple screen. Use this screen to convert a precomputed interest bearing account (payment method 3) to a simple interest bearing account (payment method 6).

Remember: The transaction run from the Convert Precomputed to Simple tab only converts a customer's account from precomputed to simple (interest bearing) if the the account's original interest rate (as indicated on the Loan Origination Tracking dialog) is less than 100%. If the original interest rate on the customer account is greater than or equal to 100%, this transaction will convert the account from precomputed to a signature (payment method 16) loan instead.