Navigation: Loans > Loan Screens > Account Adjustment Screen >

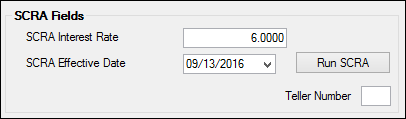

SCRA Fields field group

Use this field group to adjust the interest and payment values for Service Member customer accounts in compliance with the Service Members Civil Relief Act (SCRA). Your institution can use this field group if a customer is called to active duty.

The original and current parameters of a customer account following an SCRA adjustment can be compared on the Loans > History Analysis Screen.

The fields and buttons in this field group are as follows:

Field |

Description |

||

|

Mnemonic: LNRATE |

Use this field group to indicate the new interest rate to be used on the customer’s account. This rate will take effect as of the SCRA Effective Date (below) once

|

||

|

Mnemonic: M1SCRD |

Use this field to indicate the customer’s active duty date. This will also be used as the effective date of the

|

||

Run SCRA Button

|

Click this button to initiate the SCRA adjustment on the customer account.

This adjustment cannot be performed if the account is a precomputed loan. Loans must be converted to Interest Bearing before the SCRA adjustment can be run.

This transaction performs the following actions:

•The Interest Rate on the customer account will be switched over to the rate entered in the SCRA Interest Rate field (above). If the rate on the account is already less than the rate entered in the SCRA Interest Rate field, no change will occur. •The payment amount on the account will be recalculated based on the new rate. •The Reason for Payment Adj field will be set to “Service Member Civil Relief Act.” •The Service Member's Civil Relied Act field will be marked. •A Collection Comment of “Modified account – SCRA” will be added to the Loans > Marketing and Collections screen. •Late charge codes, fees, and rates will be removed from the account. •All miscellaneous loan fees and account maintenance fees will be waived on the account after the SCRA Effective Date. •Action Code 80 (FNMA 12 - Relief Provisions) is applied to the account.

After the SCRA adjustment has been performed on the account, the name of this button changes to

|

If you want to restrict certain employees from being able to run the SCRA transaction on accounts, use the Loans > System Setup Screen > Field Level Security Screen, and complete the following steps:

1.Select the person or profile for who you want to restrict the SCRA fields in the Name or Profile field group.

2.In the Record Type field, select "FMP1 - Miscellaneous Loan Record Fields."

3.Check the Restricted box for all of the following fields:

a.M1SCED - SCRA Effective Date

b.M1SCTD - SCRA Transaction Date

c.M1SCTT - SCRA Transaction Time

Now that employee or profile will be restricted from running the SCRA transaction.