Navigation: Deposit Screens > Account Information Screen Group > Interest Fields Screen >

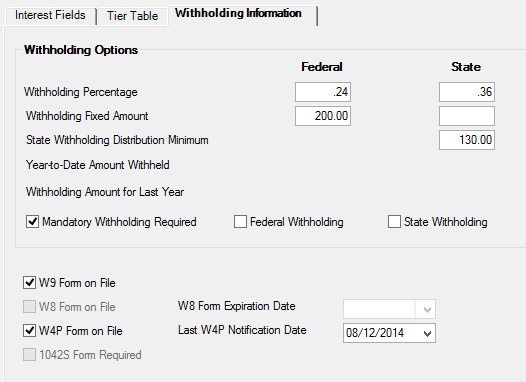

Use this tab to view and edit fund withholding options for deposit accounts when interest payments (see Interest Destination) or retirement distributions (see the Retirement Overview help topic) are made.

This tab is for tax withholding purposes. See below for information about general guidelines for tax withholding.

For regular interest accounts:

•Regular interest accounts do not require that taxes be withheld from interest postings. At year-end, the system will send the account owner a 1099-INT form providing them with the total amount of interest earned, as well as a copy to the IRS. It is then the account owners responsibility to pay any taxes owed to both federal and state.

•Mandatory Backup Withholdings: If the account qualifies for backup withholdings (due to an account owner not meeting the rules regarding taxpayer identification numbers), the custodian of the account (your institution) may be required to remit the amount mandated by the backup withholding tax to the Federal government, providing the IRS with the required funds immediately but leaving the account owner with less short-term cash flow. The system saves the withholdings to a General Ledger account, and your institution will need to send the withholding amounts to the IRS on the account owners' behalf. The IRS suggests withholding a 28% rate in these situations. Consult the state in which you do business for the amount to be withheld for state taxes. Your institution can determine the appropriate amount. See Tax Topic 307, Backup Withholding, on the IRS GOLD website for more information.

For retirement accounts:

•Your institution is required to apply federal income tax withholding rules to a traditional IRA distribution when more than $200 is distributed from account owner's IRA in a year. Roth IRA distributions generally are not subject to withholding. Your institution must provide account owners with a withholding notice explaining the rules prior to the distribution. Usually the withholding choices are 0%, 10%, or more than 10%. If account owners do not make a choice (by not returning their W-4P form), your institution must withhold 10% for federal taxes (consult the state you are doing business for requirements for state withholdings). Each year account owners should file a W-4P form indicating the amount they want withheld for income tax purposes. See the W4P Form on File field.

If the account requires mandatory withholdings (see Mandatory Withholding Required in the table below), the account should be set up to withhold at least the minimum amount required by the federal and state government.

If the retirement account has a distribution of less than the amount entered in the State Withholding Distribution Minimum (see table below), the account is not required to withhold the State tax percentage or fixed amount. This field is only used with retirement distributions, not interest payments. |

Deposits > Account Information > Interest Fields screen, Withholding Information tab

These fields are only file maintainable if the customer account uses the interest feature (the Interest field on the Deposits > Account Information > Account Information screen is marked and IN appears in the Features list at the top of most CIM GOLD screens). Interest features can also be adjusted for individual customer accounts in the Interest Fields field group on the Account Information screen.

There are two main field groups on this tab: The Withholding Options field group and the unlabeled group of fields at the bottom of the tab. Follow the links below for more information about these field groups.

Withholding Options field group