Navigation: Deposit Screens > Account Information Screen Group > Interest Fields Screen > Withholding Information tab >

Withholding Information bottom fields

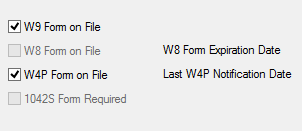

See the table below for information about the fields at the bottom of the Withholding Information tab of the Interest Fields screen. These fields mainly pertain to certain tax forms on file at your institution for the customer.

Field |

Description |

|

Mnemonic: DMW9FL |

Use this field to indicate whether a W9 form is on file for the customer account. If an account opens with a W9 form designation and it needs to be designated with the W8 Form status instead, leave this field blank so the W8 Form on File field is available to mark. |

|

Mnemonic: DMW8FL |

Use this field to indicate whether a W8 form is on file for the customer account. If a customer account was opened with a W9 or W4P form designation, those checkbox fields will have to be marked before this checkbox field becomes available to mark. If an account opens with a W9 form designation and it needs to be designated with the W8 Form status instead, leave W9 Form on File blank so that this field is available to mark. |

|

Mnemonic: DMW4FL |

Check this box to indicate whether a W-4P form is on file for the customer account. The W4P form may also be used to prevent income tax from being withheld from customers' payment(s) (except for eligible rollover distributions or payments to U.S. citizens delivered outside the United States or its possessions) or to increase the amount withheld. See the Withholding Information tab for more information. |

|

Mnemonic: DMS142 |

Use this field to indicate whether a 1042-S form is required for the customer account. This checkbox field is not available if the W9 Form on File, W8 Form on File, and/or W4P Form on File checkboxes are marked. 1042-S forms are used to report income and amounts withheld under Chapter 3 of the Internal Revenue Code. This generally applies to foreign persons with U.S. source income subject to withholding. Every person required to deduct and withhold any tax under Chapter 3 of the Code is liable for such tax. See the Tax Withholding Types on the IRS.gov website for more information. |

|

Mnemonic: DMDTW8 |

Use this field to indicate the date the W8 form expires for the customer account. If the W8 Form on File field is not marked, leave this field blank. |

|

Mnemonic: DMDTW4 |

Use this field to indicate the date of the most recent W4P notification for the customer account. If the W4P Form on File field is not marked, leave this field blank. |