Navigation: Deposit Screens > Account Information Screen Group > Interest Fields Screen > Withholding Information tab >

Withholding Options field group

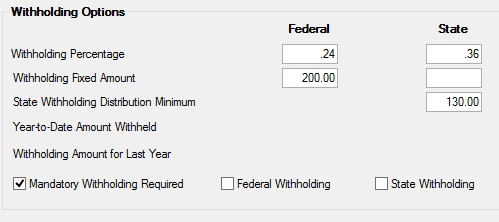

Use the Withholding Options field group on the Withholding Information tab to view and edit federal and state withholding options for deposit accounts that receive interest payments or retirement accounts that receive distributions. See also the Withholding Information tab topic for a general overview of tax withholdings and how they pertain to interest or retirement accounts.

Generally, your institution chooses between withholding based on Percentage or withholding based on a Fixed Amount. The system uses these settings during transactions to calculate tax withholding amounts. Once one withholding method is selected, GOLDPoint Systems recommends leaving the fields pertaining to the other withholding method blank. If information is entered in both Percentage and Fixed Amount fields, the system will use the Fixed Amount values.

Any account can be set up to withhold, including retirement accounts.

State withholding amounts vary from state to state. Your institution and the state regulations can best determine the amount to enter in this field. Accounts may have mandatory state withholding or can have withholding processed based on customer request. Your institution is responsible for knowing the withholding amounts required by the IRS and for retirement accounts. Your institution may receive a federally mandated withholding notice that explains withholding requirements in detail.

The fields in this field group are as follows:

Field |

Description |

|

|

Mnemonic: DMFWHP, DMSWHP |

Use these fields to enter percentage amounts to be withheld for purposes of Federal and/or State taxes for the account during transactions where withholding amounts are calculated. See below for more information.

|

|

|

Mnemonic: DMFWHA, DMSWHA |

Use these fields to indicate fixed amounts to be withheld for purposes of Federal and/or State taxes for the account during transactions where withholding amounts are calculated. The maximum possible value for this field is $99,999.99. Accounts may have Mandatory Withholding (see below) or can have withholding processed based on customer request.

Federal and state withholding taxes for the selected account are normally set prior to each transaction by request from the account owner and saved before running the transaction. The teller then returns to this tab, removes the settings, and saves those changes after the transaction is complete.

If the indicated withholding fixed amount for State is for less than the amount in the State Withholding Distribution Minimum State field below, then no state withholding occurs. |

|

State Withholding Distribution Minimum

Mnemonic: DMSWHM |

Use this field to indicate the minimum withdrawal transaction amount on which to perform state withholding for interest-bearing retirement accounts. If there is a value entered in this field, the system will not perform withholding on any transactions of amounts less than this value during transactions where state withholding amounts are calculated.

Withholdings for state taxes are established in either the Withholding Percentage State field or Withholding Fixed Amount State field above. |

|

|

Mnemonic: DMFDWH, DMSTWH |

These fields display the amount of Federal and State withholdings on the customer account for the current year. These amounts pertain to the current calendar year and are zeroed out during the year-end processing cycle.

The information in these fields is only changed through monetary transactions. |

|

Withholding Amount for Last Year

Mnemonic: DMYWHL |

This field displays the total value of last year's federal withholding on the customer account. |

|

Mandatory Withholding Required

Mnemonic: DMMDWH |

Use this field to Indicate whether mandatory withholding is required on the customer account. If this field is marked, the Withholding Percentage Federal field above is used to determine the withholding amount of the transaction.

The system taxes every interest payment to the account as specified.

|

|

|

Mnemonic: DMWFED |

Use this field to indicate whether money should be withheld for federal government taxes on the customer account (see federal withholding fields above). |

|

|

Mnemonic: DMWSTA |

Use this field to indicate whether money should be withheld for state taxes on the customer account (see state withholding fields above). |