Navigation: Deposit Screens > Retirement Screen Group >

The Retirement System is that portion of the Deposit System that contains the records and files for retirement accounts. It includes qualified retirement plans, beneficiary information, disclosure projections, and history on retirement and beneficiary files.

Retirement plans are strictly regulated by the federal government. What a retirement plan may consist of must fall within these government regulations in order to be considered a qualified retirement plan. Tax deductions for funds placed in a qualified plan are available up to specific limits.

|

Note: The information contained in this section is only designed to get you acquainted with various retirement plans and accounts. This information may change as federal regulations change. Please refer to current federal guide lines for the most up-to-date retirement information. |

|---|

Documents

In order for a plan to be considered a valid retirement program, the proper documents must be completed. The three documents that are required by the federal government are the plan agreement, the disclosure statement, and the financial disclosure statement. Three additional documents may be provided as well, namely, an adoption agreement, a beneficiary designation form and a deposit information form.

1.Plan Agreement and Adoption Agreement

The plan agreement is the primary document. This may be a trust agreement or a custodial agreement. It may contain the beneficiary designation as well. It is the legal contract between the institution and the retirement plan owner, and identifies the terms of the contract between the issuer and the individual establishing the IRA. These terms consist of the contribution limits, restrictions on IRA investments, distribution rules, the IRA owner’s responsibilities and the institution’s responsibilities, among others.

The adoption agreement is a document signed by the participant adopting the plan specified in the plan agreement. Every plan may vary in document types. Some adoption agreements provide a place for designation of beneficiaries. Some adoption agreements are contained on the same form as the plan agreement.

2.Disclosure Statement

When an individual opens an IRA, the institution is required to issue a disclosure statement in which all of the IRA rules are explained in plain, easily understood language. The disclosure statement is separate from the plan agreement.

3.Financial Disclosure

The Retirement system provides only the financial disclosure statement for you. This is done through Disclosure Projection tab on the Retirement Calculations screen. The Financial Disclosure Statement provides projections of growth in the account’s value to the IRA holder. The financial projection is based on the assumption that the plan owner will make an annual $1,000 deposit on the first day of each year, regardless of the actual contribution made.

A new financial projection is not required when making additional contributions to an existing IRA, or if the actual interest rate drops below the interest rate on the projection.

Account Types

Several types of retirement accounts are available. These are Traditional, SEPs, QRPs, Roth, Simple, ESA, and HSA.

1.Traditional Accounts

Traditional represents an Individual Retirement Account. It was established by Congress in 1974 to supplement retirement income. IRAs allow tax-deferred earnings on accounts, and the possibility of deductible contributions. Anyone who has earned income from working and has not reached age 70½ can open and contribute to an IRA. An IRA is a trust or custodial account administered by the institution.

The IRS periodically adjusts contribution limits for select IRAs. Refer to current federal guidelines for specifics concerning COLAs (cost of living adjustments), limits, and catch-up contribution information.

2.SEP Accounts

SEP stands for Simplified Employee Pension. It is a special type of retirement plan created by Congress to help employers provide retirement benefits for their employees. It is primarily used by the self-employed or small businesses. In this type of plan, employers make retirement contributions directly into an employee’s IRA account. The employer’s contributions are not taxed until withdrawn.

The employer is under certain obligations in this type of plan. Contributions to employees are not required to be made on a regularly-scheduled basis. However, when contributions are made, they must be made to all employees’ accounts in the same year.

SAR-SEPs are a type of SEP account that permits the employee to defer a portion of their wages into their IRA as SEP contributions. This is in addition to what the employer is contributing to the account.

3.QRPs

QRPs are Qualified Retirement Plans. These are employer retirement plans. The word "qualified" means that the plan meets the qualifications of the Internal Revenue Code, Section 401. Examples of QRPs are 401K, money purchase, and profit sharing.

Employers who maintain a qualified plan receive a tax deduction for contributions made to the retirement plan.

4.Roth IRA

Roth IRA is a nondeductible account that features tax-free withdrawals for certain distributions after a five-year holding period. Like a regular IRA you must have earned income; however, your income cannot exceed certain limits. The maximum contribution limit per year applies to the total contribution of both the traditional and Roth IRA combined. For example, if you contribute $5000 to Roth, only $500 can be contributed to a traditional IRA. Contributions to either IRA can be made on January 1 and/or the date your tax return is due for the year, typically April 15 of the following year.

The IRS periodically adjusts contribution limits for select IRAs. Refer to current federal guidelines for specifics concerning COLAs (cost of living adjustments), limits, and catch-up contribution information.

5.Simple Accounts

The Simple IRA plan consists of a deferral program for employees and a mandatory contribution made by employers. The simple IRA plan’s availability is limited to employers with 100 or fewer employees who earned at least $5,000.00 in the preceding calendar year; emphasizing its role as the plan for small business.

6.ESA Accounts

ESA (Coverdell Education Savings Account) allows parents and others to save for children’s (under 18) education. Anyone can contribute up to $500 to a child’s Education IRA, provided that the individual’s income level does not exceed the limits. A married person with an income of $150,000.00 or less, or a single person with an income of $95,000 or less, is eligible to contribute on behalf of a child.

7.HSA Accounts

Health Savings Accounts (HSAs) allow individuals covered by high-deductible health plans to receive tax-preferred treatment of money saved for medical expenses. Generally, an adult who is covered by a high-deductible health plan (and has no other first-dollar coverage) may establish an HSA. An HSA allows taxpayers to save money on their health-related expenses by contributing to the HSA using pre-tax dollars. This reduces the amount of taxable income by the amount contributed.

The IRS periodically adjusts HSA limits. Refer to current federal guidelines for specifics concerning HSA limits.

Withholding Information

Income tax withholding will be performed on distributions from retirement accounts unless a W-4P form is completed by the account owner each year. The W-4P form states that the customer does not want withholding to be performed. Unless the W-4P form is on file, withholding will be performed. The W-4P information must be provided each year.

W-4P Field

The Retirement system contains a field that allows the institution to indicate whether a W-4P form is on file for an account (W4P Form on File). Another field can be used to provide a date on which the customer was notified that a W-4P form was needed (Last W4P Notification Date). These fields are found on the Retirement Plan screen. When the fields on the Retirement Plan screen are changed, the change will be made throughout the system on all accounts associated with the retirement plan.

Distributions

Individuals with a retirement plan may not begin taking non-penaltied distributions from the plan until they reach the age of 59½, except under certain circumstances, such as permanent disability. However, individuals are required to begin taking distributions by the age of 70½, with the exception of the Roth IRA. If individuals do not take at least the minimum distributions by that age, substantial penalties will be incurred. The age (70½) is determined by the portion of the year in which the individual was born. For an individual born in the first half of the year, the 70½ birthday is considered to be December 31 of that year. For an individual born in the second half of the year, the 70½ birthday is considered to be June 30 of the following year. In both instances individuals must begin taking distributions from the retirement plan by April 1 of the year following the year in which they turned 70½.

Beneficiaries

Beneficiaries of retirement plans, and what percentage of the plan they are to receive, are designated by the plan owner. This designation is made either on the plan agreement or the beneficiary designation form. Two types of beneficiaries are entered—primary and contingent. Primary beneficiaries must be entered in the primary beneficiary part of the form. They cannot be continued down into the contingent beneficiary part of the form, as they would be considered contingent beneficiaries and not primary beneficiaries.

Primary And Contingent Beneficiaries

Primary beneficiaries are those beneficiaries designated to receive a percentage of the retirement plan on the death of the plan owner. Contingent beneficiaries are those beneficiaries designated to receive a percentage of the retirement plan if the primary beneficiaries die before the plan owner. For example, John Doe has a retirement plan. His primary beneficiary is his wife, Jane Doe. His contingent beneficiaries are his children, Mike and Sally. If John dies before Jane, Jane is the beneficiary of the retirement plan and Mike and Sally receive nothing. If Jane dies before John, Mike and Sally become the beneficiaries of the retirement plan when John dies.

Proof Of Death

It is the responsibility of the beneficiaries of a retirement plan to bring in proof of the death of the plan owner and complete the necessary paperwork to take over the retirement plan.

Distribution Of Retirement Plans To Beneficiaries

Beneficiaries have three, and in some cases four, options as to how they may take the money out of the retirement plan.

•They may take the funds in one lump sum on the death of the plan owner.

•They may take the funds out as death distributions over a period of five years. By the end of the fifth year following the death of the plan owner, the beneficiaries must have taken all of the funds out of the retirement plan. This option only applies if the IRA participant was under 70½.

•They may take distribution as originally started, as long as the participant was over 70½ and receiving mandatory required minimum distributions prior to death. Using the declining year method (as elected by the participant), the minimum required amount can continue, and will now be made payable and reported on behalf of the beneficiary.

•When the beneficiary is the spouse of the plan owner, the beneficiary is allowed to roll the retirement plan into their own retirement plan. This scenario will only apply when the beneficiary is the spouse of the plan owner.

Data Flow

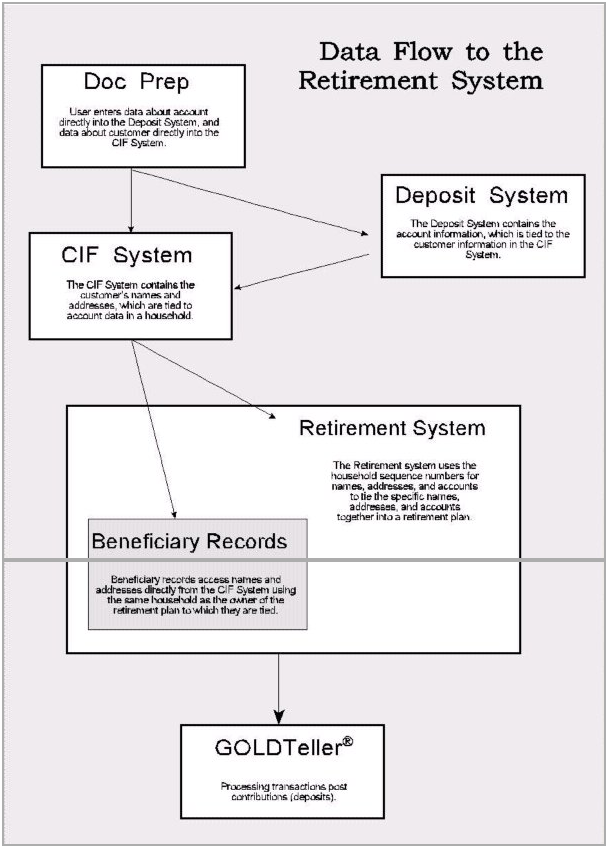

Most of the information necessary to administer the Retirement System is already contained in other systems. The Deposit System contains the masters for each account opened. The CIF System contains all the name and address information needed for each plan owner.

Doc Prep

New plans are initially entered into the Doc Prep system. Those files are then transferred to the CIF System. Prior to GOLDTeller transactions, your Retirement Plan screen (function 202) will need to be set up with information from the CIF System.

Therefore, the Retirement System simply makes use of these other systems and pulls the information it requires from them. Because of this, you may find that you need to enter information for beneficiaries into the household record for the plan owner so the Retirement System can have access to that information.

The chart below shows how data flows to the Retirement System. It is first entered directly into the CIF System and the Deposit System. The Retirement System then uses the household numbers in the CIF System to access data for household members, addresses, and accounts to create the retirement plan record.

Beneficiary records are separate parts of the Retirement System for a given retirement plan. They are directly tied to a retirement plan number. The information in these records comes from the retirement plan owner’s household in the CIF System. Therefore, any beneficiary of a retirement plan must be set up as a member of the plan owner’s household. Furthermore, if the beneficiary does not reside at the same address as the plan owner, the beneficiary’s address must also be added to the list of household addresses in order for the Retirement System to have access to that information.

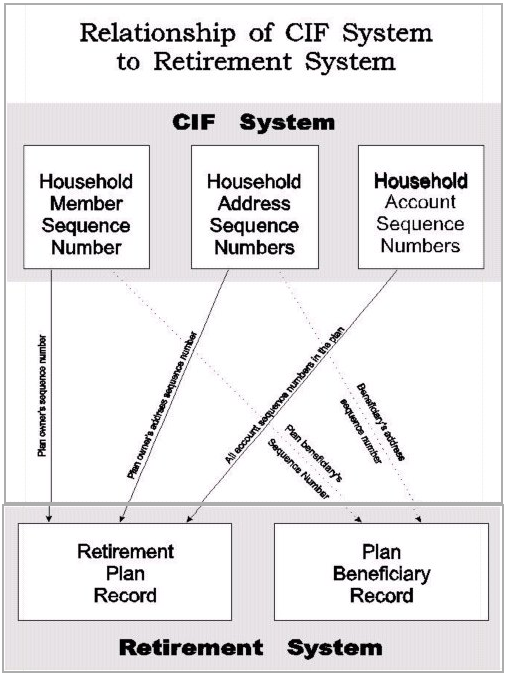

Relationship of CIF System to Retirement System

The chart below shows the relationships between the retirement plan records and the plan beneficiary records, as well as the household members, addresses, and account sequence numbers in the CIF System. The retirement plan and plan beneficiary records store the information on the plan owner, beneficiaries, and accounts in the retirement plan in the form of household sequence numbers from the CIF System.

All sequence numbers used in a given retirement plan must be from the same household number in the CIF System. It is not possible to combine two or more household numbers into one retirement plan.