Navigation: Deposit Screens > Account Information Screen Group > Account Information Screen > Incoming ACH tab >

ACH Stop Fields field group

Use the ACH Stop Field field group on the Incoming ACH tab to stop any ACH transactions from processing. This field group is best used to stop recurring withdrawals/deposits. Use this when an ACH withdrawal or deposit are to be discontinued from an account for processing.

For example, a customer has recurring transactions set up with an insurance company where a monthly payment is withdrawn from their deposit account, but then they change insurance carriers. The customer calls your institution to make sure future debits (payments) from the old (current) insurance company are stopped.

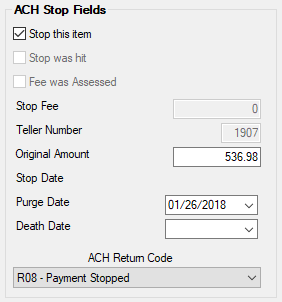

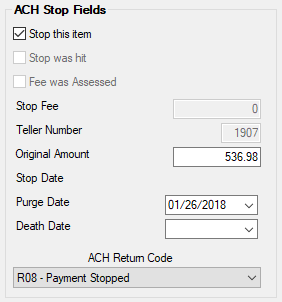

The following example shows the ACH Stop Field field group on the Incoming ACH tab:

|

WARNING: The system will automatically stop an ACH transaction from posting if a stop is set up and the incoming ACH transaction matches the following four fields:

1.Originator Name 2.Originator Company ID

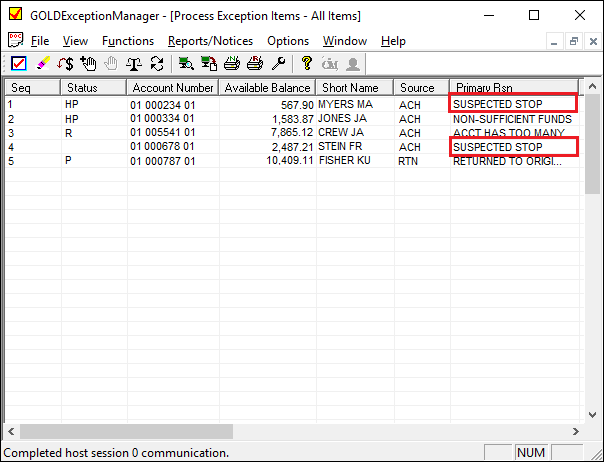

If any less than all four fields match (e.g., only the Original Amount field matches the stop record), the system will still post the incoming ACH item to the account, but it will also send the ACH transaction to GOLD ExceptionManager with the reason of "Suspected Stop," as shown below:

You can reverse the ACH transaction from the account by returning it to the originating institution, as explained in the Create a Return Item section in GOLD ExceptionManager. |

|---|

This help topic contains the following information:

Stopping Recurring ACH Transactions

Stopping ACH Transactions for Deceased Persons

Stopping a New ACH Transaction

|

Important Tip: If you are creating a stop for an ACH transaction, you must first be logged into GOLDTeller as a teller. Setting a stop on an ACH item is a transaction (tran code 1900), and the Teller Number and stop are required in order for stopped ACH transactions to go to GOLD ExceptionManager. Also, the system opens the Stop Fee field for file maintenance if you are logged on as a teller. |

|---|

Stopping Recurring ACH Transactions

To stop a future recurring ACH deposit/withdrawal from processing on the account:

1. |

Select the ACH transaction you want stopped in the list view to the left. If the ACH transaction is not listed, then you will need to create a new ACH transaction for tracking purposes, as described in the Stopping a New ACH Transaction section below. |

||

2. |

Check the Stop this item box. This system will automatically enter the Stop Fee (if your institution charges a fee for putting stops on ACH transactions), Teller Number, Original Amount, and ACH Return Code.

|

||

3. |

Click <Save Changes>. Now when an ACH transaction comes in for that exact amount, Originator Name, Company ID, and Individual Name, the system will stop that ACH transaction from posting and return it back to the originator using the ACH Return Code of "R08 - Payment Stopped."

If an ACH transaction comes in that doesn't exactly match all those fields, but it does match one or two of the fields, the system will still post the incoming ACH item to the account, but it will also send the ACH transaction to GOLD ExceptionManager with the reason of "Suspected Stop." |

Stopping ACH Transactions for Deceased Persons

You can use the ACH Stop Fields to stop future ACH deposits/withdrawals if the customer has died. Instead of using the ACH Return Code of "R08 - Payment Stopped," use code "R15 - Beneficiary/Account Holder Deceased," as well as entering the Death Date of when the customer died.

|

Note: Deceased persons require special account processing. Your institution may have specific requirements for how to handle accounts when one of the owners has died. Consult your institution's policies and regulations whenever modifying accounts with a deceased owner. |

|---|

Stopping a New ACH Transaction

Sometimes a customer may call your institution asking for help in stopping an ACH transaction that has never been cleared to their account before. For example, perhaps the customer made a Paypal payment to a stranger and now realizes that may have been a mistake.

Stopping a new ACH transaction is much trickier. Because you likely won't know the four things required for an automatic stop (originator Name, originator Company ID, Individual Name, and Original Amount), you can still enter information in any of those fields that you do know. Then when the system receives an ACH transaction matching those fields you did enter, it will still post the ACH transaction to the account, but it will also send the ACH transaction to GOLD ExceptionManager with the Primary Reason of "Suspected Stop" (see warning above).

Once you log onto GEM and see the transaction, you can either return the transaction back to the originator and charge a fee to the account owner, return the ACH transaction without a fee, or disregard the ACH transaction. See the Post, Return, Disregard topic in the GOLD ExceptionManager User's Guide for more information on how to return ACH transactions in GEM. (You could also post the transaction, but it has likely already been posted. If you want to ignore the ACH item's suspected stop, you would just disregard the ACH transaction).

|

Note: Because stopping a new ACH transaction requires manual intervention and close scrutiny, most institutions do charge for stopping these types of ACH transactions. The charge is usually applied when returning the transaction in GOLD ExceptionManager. |

|---|

1. |

Click <Create New>. |

||

2. |

Fill out the Originator Information Name. This field is important, but it may be hard to guess at. For example, if you know the ACH transaction is coming from Paypal, you may not know if the system knows it as "Pay Pal" or "Paypal" and if it doesn't find it exactly, it will not place an automatic stop payment.

|

||

3. |

In the Individual Name field, enter the person's name the ACH transaction is intended for. You can leave this field blank as well, unless you know the exact spelling of the person's name. For example, if the Paypal payment went to a JAIME JONES, make sure the spelling exactly matches (e.g., not JAMIE or JAMEY). |

||

4. |

Check the Stop this item box. Other fields will open up for entry, including ACH Transaction Code. |

||

5. |

From the ACH Transaction Code drop-down field, select whether the ACH transaction you are trying to stop is for a checking deposit or withdrawal, or if it's for a savings deposit or withdrawal. |

||

6. |

In the Original Amount field in the ACH Stop Fields field group, enter the exact amount of the ACH transaction you want to stop. This will likely be the one transaction you know. The system will stop any entry with this amount if you do not enter information in steps 2-5. |

||

7. |

Decide if you want to enter a purge date for this ACH stop record in the Purge Date field. If you do not, the system will keep the stop on ACH transactions matching the description for 6 months. For example, if the only thing you know for sure about this ACH transaction is that it's in the amount of $100, the system would suspect stop every ACH transaction in the amount of $100 for the next 6 months. But if you enter a Purge Date of one week, $100 ACH transactions will only be send to GEM as a suspected stop for one week, and then they will no longer be sent to GEM. |

||

8. |

Click <Save Changes>. |

Field |

Description |

||

|---|---|---|---|

|

Mnemonic: DASTPA |

After selecting an ACH transaction in the list view table, this box opens up for file maintenance purposes. You can check this box if you want to stop future ACH payments matching the details of this ACH transaction. If a transaction has already been posted and you want to return it, you will need to return the ACH transaction in GOLD ExceptionManager (GEM), then set a stop for any future payments from that ACH originator.

•Automatic stops: If this field is marked and an incoming ACH transaction is processed that matches the selected transaction's originator Name, originator Company ID, Individual Name, and Original Amount, the transaction will be rejected and sent to the exception file as an unposted ACH stop.

•Suspect stop sent to GEM: If only one or two of any of these four fields match (originator Name, originator Company ID, Individual Name, and Original Amount), the ACH transaction will be posted to the customer account, but it will also be sent to the exception file as a stop suspect. From GOLD ExceptionManager, you can return the suspected stop.

TEL (telephone), WEB (Internet), ARC (accounts receivable check), RCK (represented check), and POP (point of purchase) ACH transactions also check stop payments against the Check Stop Payment tab on the Deposits > Account Information > Restrictions and Warnings screen. |

||

|

Mnemonic: DAACHH

|

This field indicates whether the incoming ACH transaction selected in the Incoming ACH list view has arrived and been stopped because the Stop this item box is checked. This field will remain blank, indicating that the stop is still active, until it is purged from the system. Stops are automatically purged six months after the date they are set; however, you can set a different date using the Purge Date field in this field group.

For example, if an ACH transaction comes in monthly and the customer wants to stop it in January, the stop is placed by checking the Stop this item box. When the ACH transaction comes in for January, the Stop was hit box will already be checked indicating that the transaction has been stopped. The stop remains in place and active. If the originator of the ACH transaction sends the ACH transaction again later in February, the payment will again be rejected.

Stop payments are only effective on one record at a time. If a transaction comes through with some information altered so that it creates multiple records in the Incoming ACH list view, three options are available:

•Placing a stop payment on each record.

•Deleting all records except one. The system will check every transaction coming through and either suspect or stop it.

•Placing a Hold Code on the customer account to suspect all incoming ACH transactions. This option allows the user to review each transaction to see if it is a record that needs to be stopped. You may need to define this hold code first using the Deposits > Definitions > Hold Code Definitions screen. Once the Hold Code has been defined, you can assign it to an account using the Deposits > Account Information > Restrictions & Warnings screen > Restriction/Action Code tab. Rejected ACH payments can be viewed and handled in GOLD ExceptionManager or the Exception Items Report (FPSDR096). |

||

|

Mnemonic: DAFEE |

This field indicates whether a fee was assessed when the stop ACH payment request was entered. See the Stop Fee field description below. |

||

This field contains the stop payment fee amount if the ACH transaction was assessed a fee when created. The fee is automatically pulled in from the STFN institution option when users check the Stop this item box. Your GOLDPoint Systems account manager can set up the amount in institution option STFN.

If you have proper security, you can delete this fee amount, if your institution does charge a fee. Note: You must be logged onto GOLDTeller in order for this field to be file maintainable. |

|||

This field is automatically entered when users check the Stop this item box. The teller number of the user who checked that box will be pulled into this field.

|

|||

|

Mnemonic: DAOSPA |

Enter the amount of the ACH transaction for which the customer wants stopped.

•If this is a recurring ACH payment or withdrawal you are stopping, it will likely be pulled in from the Amount Last Received field in the ACH Historical Information field group. See the Stopping Recurring ACH Transaction section above.

•If this is a new ACH transaction, enter the exact amount of the ACH item that is to be stopped. See the Stopping New ACH Transaction section above.

This is a very important field when stopping a recurring or new ACH transaction. If an ACH transaction comes in that matches this amount, the system will either automatically stop the transaction (if the other three fields match: originator Name, originator Company ID, Individual Name) or it will post the ACH transaction but also send it to GOLD ExceptionManager with the Primary Reason of "Suspected Stop." Using GEM, you can return the ACH transaction back to the originating institution (as explained in the Create a Return Item topic in the GOLD ExceptionManager User's Guide.) |

||

|

Mnemonic: DADTAS |

This field indicates the date a stop payment was placed on the incoming ACH transaction selected in the Incoming ACH list view. This date is assigned by the system when the stop payment is actually made on the ACH transaction. |

||

|

Mnemonic: DADLPA |

Use this field to indicate the date the system should purge the stop on this ACH transaction. After a stop is placed on an incoming ACH transaction, the purge date is automatically set for six months from the date of the stop. However, any date greater than or equal will be accepted in this field. |

||

|

Mnemonic: DADTDT |

Use this field to indicate the death date of the customer selected in the Incoming ACH list view (if the customer has died). When a date is entered in this field, a stop is automatically placed on incoming ACH transactions on the customer account. If "R15 - Beneficiary/Account Holder Deceased" is selected in the ACH Return Code field, a date must be entered in this field.

|

||

|

Mnemonic: DAACRT |

When setting up a stop on an ACH transaction, this field will default to "R08-Payment Stopped." You can change this to a different reason for stopping the ACH transaction by selecting it from the drop-down list. See Incoming ACH Return Codes for a list of all possible ACH return codes in CIM GOLD.

If "R15 - Beneficiary/Acct Holder Deceased" is selected, a date must be entered in the Death Date field (see above).

This information will be routed through the FRB and back to the institution that sent the ACH transaction. ACH Return Codes are defined and designated by the FRB. |