Navigation: Deposit Screens > Account Information Screen Group > Account Information Screen > Incoming ACH tab >

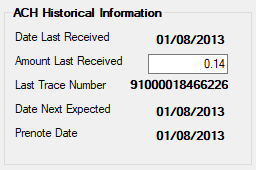

ACH Historical Information field group

This field group contains historical information concerning the selected ACH transaction on the customer account (select the ACH transaction from the list view table above).

The fields in this field group are as follows:

Field |

Description |

|---|---|

|

Mnemonic: DADLAR |

The date the incoming ACH transaction selected in the Incoming ACH list view was received. |

|

Mnemonic: DAACAM |

This field contains the amount of the most recent incoming ACH transaction received from the originator selected in the Incoming ACH list view. |

|

Mnemonic: DATRC |

The trace number from the last time the incoming ACH transaction selected in the Incoming ACH list view came in. |

|

Mnemonic: DADLAR |

The date the incoming ACH transaction selected in the Incoming ACH list view is next expected. |

|

Mnemonic: DADTAP |

The date the prenotification was sent for the incoming ACH transaction selected in the Incoming ACH list view. A prenote is the commonly used term for an Automated Clearing House (ACH) prenotification.

Prenotes are optional for an originating company, but they are not optional for the receiving institution (the RDFI, or receiving depository financial institution) once the originating company sends one. Under the ACH rules’ National System of Fines, an RDFI can be fined if they do not validate prenotes sent to them.

Under NACHA Operating Rules (also known as ACH rules), a prenote’s purpose is to "validate" the routing number and account number of the receiving financial institution.

This information is entered by the system when an ACH transaction is cleared during the afterhours. |