Navigation: Deposits > Deposit Screens > Account Information Screen Group > Restrictions & Warnings Screen >

Use this tab to view and enter hold/action codes on the customer deposit account. These holds designate an action (generally an override) that must occur before certain account activity will be allowed.

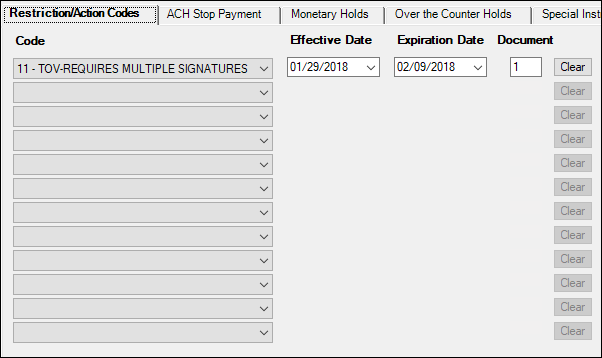

Deposits > Account Information > Restrictions & Warnings Screen > Restriction/Action Codes Tab

Hold/action codes are selected for use on the customer account in the Code field (see table below). Your institution can create your own hold/action codes using the Deposits > Definitions > Hold Code Definitions screen. Code numbers 1-199 are defined by GOLDPoint Systems, while numbers 200 and up are available to be defined by your institution.

Field Descriptions

Field |

Description |

||

|

Mnemonic: DMHACC |

Use these fields to indicate hold/action codes to place on the customer account. These codes can be reminders of a manual action that needs to take place on the account, or they may indicate a future automatic process by the system or conditions pertaining to the account or the customer.

There are six categories of hold/action code that can be placed on the customer account. These categories relate to the kind of override required to allow the designated action to occur. These categories are represented by a three-letter acronym and appear before the hold/action code description in this field:

•NOV- No Override, No Instruction •MOV- Message Override: Message only. Transaction can still process without an override clearance. •TOV- Teller Override. Transaction can process after a user with Teller credentials enters their user name and password. •SOV- Supervisor Override. Transaction can process after a user with Supervisor credentials enters their user name and password. •OOV- Officer Override. Transaction can process after a user with Officer credentials enters their user name and password. •POV- Override Prohibited. Transaction cannot process on an account with POV. The POV must be removed before transactions can process.

Users are assigned specific override level credentials in the Opers.dat file, which can be accessed under Teller System > Administrative > Operator Information tab using the Override Authority field.

Once a restriction/action code is set up on an account, the system requires that someone with that override credential to enter their user name and password before the transaction can be processed on the account. Twelve hold/action code fields are available to each customer account on this screen.

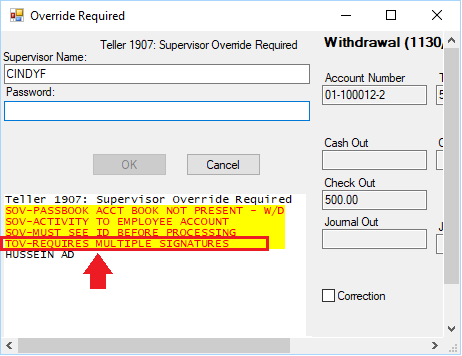

For example, if you set a Teller Override action code requiring all withdrawals to have multiple signatures (Code 11 —TOV-REQUIRES MULTIPLE SIGNATURES), when a transaction is run on this account, the Override Required dialog box is displayed showing the override required (see below). Notice on the screen example below that the override we set up in the example is shown, but so are other overrides and restrictions. Other overrides can also be added based on transactions (see Transaction Condition Overrides tab help topic) and Special Instructions.

Override Required Dialog in CIM GOLDTeller After a Transaction is Run on an Account with a Restriction/Action Code

You can also give the action code an expiration date, so that the override is no longer required after the expiration date.

Hold/action codes are created and maintained for your institution on the Deposits > Definitions > Hold Code Definitions screen. Code numbers 1-199 are defined by GOLDPoint Systems, while numbers 200 and up are available to be defined by your institution. |

||

|

Mnemonic: DMHACF |

Use this field to indicate the date that the corresponding hold/action Code becomes effective on the customer account. The date entered in this field must be today's date or a date in the future date. In the afterhours of this date, the override will then be shown/required after each transaction is run in CIM GOLDTeller.

|

||

|

Mnemonic: DMHACX |

Use this field to indicate the date that the corresponding hold/action Code expires on the customer account. The date entered in this field must be a future date. The hold/action is removed from the customer account automatically in the afterhours on the date entered in this field. Leave this field blank to indicate that the hold/action will never expire.

If your institution uses the Account Holds event, an event letter record will be processed for this account. Someone at your institution responsible for generating and printing event letters will print the letter and send it to the account owner indicating a hold/action has been placed on their account. Your institution is responsible for creating the wording of the Account Hold event letter, as well as printing letters and sending them to your account owners.

Account Hold event letter records can be created either daily or monthly (see the Deposit Event Descriptions topic in the GOLD EventLetters User's Guide). Also see these topics in the GOLD EventLetters User's Guide:

•Setting Up GOLD EventLetters (Deposits) |

||

|

Mnemonic: DMHACV |

Use this field to indicate the letter number used to created the Account Holds event letter. Someone at your institution responsible for generating and printing event letters will print the letter and send it to the account owner indicating a hold/action has been placed on their account. Your institution is responsible for creating the wording of the Account Hold event letter, as well as printing letters and sending them to your account owners.

Document (letter) numbers are institution-defined. Use the Event Letter Generation Report (FPSDR500) to view event letters records that were generated for accounts.

Valid letter numbers for the Account Holds event are 1070 and 1170 (see Note below).

|