Navigation: Deposits > Deposit Screens > Definitions Screen Group >

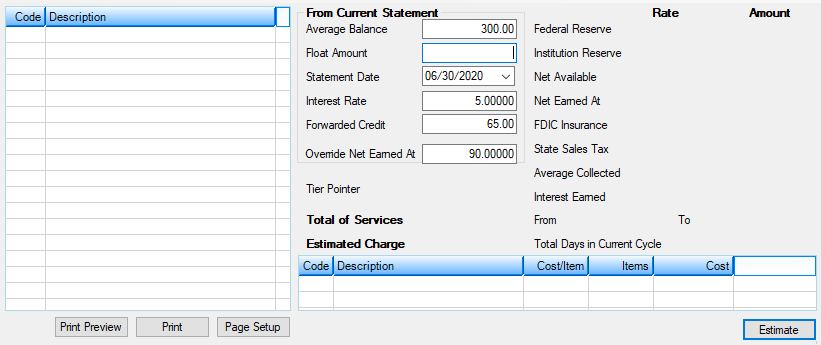

The Deposits > Definitions > Commercial Analysis Estimate screen is used to calculate the estimated analysis for new commercial accounts based on the data entered in the available fields. It gives the customer an idea of the charges that will be assessed on his or her commercial account.

Available analysis default numbers can be seen in the main list view on the left side of this screen. These defaults must first be set up on the Deposits > Definitions > Commercial Analysis Defaults screen. When a default is selected in this list, the costed item codes associated with it appear in the list view at the bottom of the screen.

The fields on this screen are as follows:

Field |

Definition |

Average Balance

Mnemonic: WKAVBL |

This field is the average balance of the account. For the sample analysis, this value can be taken from the customer’s most recent statement. In order to compute a sample analysis charge, a value must be entered in this field. |

Float Amount

Mnemonic: WKFLOT |

This field is the float amount for the account. For the sample analysis, this value can be taken from the customer’s most recent statement. The float amount varies in the actual analysis based on the check deposits a customer has made to the account, and how your institution will calculate the actual float. For this estimate, enter a current approximation of this value. |

Statement Date |

This field contains the current date. It is used to calculate the cycle start and next cycle dates for a statement period of one month. You can enter another date to calculate a different number of days for a cycle (e.g. Jan 1 to Feb. 1 is 31 days, but Nov. 1 to Dec. 1 is 30 days). If an invalid date is entered, it will be replaced with the current date. |

Interest Rate

Mnemonic: WKRATE |

This field contains the estimated interest rate that will be paid to this account. If it is not going to be an interest-bearing account, or the interest will not be used in the analysis, enter zero in this field. |

Forwarded Credit

Mnemonic: WKFRWD |

This amount field is used to apply credit amounts from prior statements against new charges for the current and future statement cycles. For example, suppose last month’s statement yielded a $5.00 credit. That amount would be placed in this field. When this month’s statement is processed and yields a $9.00 charge, the $5.00 credit is applied to the charge reducing it from $9.00 to $4.00. The amount in this field is then cleared. When consecutive credit statements are processed, this field accumulates the credits and applies them when they are needed. This field can be cleared periodically, according to how the Credit Clear Cycle field on the Commercial Analysis Defaults screen is set. |

Override Net Earned At

Mnemonic: WKOVNT |

Use this field to indicate an override amount for the Net Earned At field (see below). The rate entered in this field will be used in this calculation:

Net Available x the earned or charge rate ÷ 365 x days in current cycle

The number of days in the current cycle is based on the month entered in the Statement Date field (see above). |

Tier Pointer

Mnemonic: AITPTR |

This field will be used to tier the positive interest rate, using the Positive Balance Rate Pointer field. When calculating the rate to use on the positive balance credit, the current tier level will be based on the calculated Net Available amount (see below). |

Total of Services

Mnemonic: WKTOT1 |

This field displays the total of all services provided for the account. This is a summation of all categories used in this analysis default. |

Estimated Credit

Mnemonic: WKTOT2 |

This field displays the resulting charge or credit calculated. |

Federal Reserve

Mnemonic: WKFDRT, WKDFAM |

The Rate field displays the rate your institution uses for calculating a Federal Reserve requirement on the account. This value comes from the Deposits > Definitions > Rate Table screen. As rates are changed in the institution table, they are also reflected in the account analysis calculation based on the pointer.

The Amount field displays the calculated Federal Reserve amount. This amount is calculated by multiplying the average collected balance by the Federal Reserve rate. |

Institution Reserve

Mnemonic: WKINRT, WKINAM |

The Rate field displays the rate your institution uses for calculating the institution reserve requirement on the account. This value comes from the Deposits > Definitions > Rate Table screen. As rates are changed in the institution table, they are also reflected in the account analysis calculation based on the pointer.

The Amount field displays the calculated institution reserve amount charged to the account. This amount is calculated by multiplying the average collected balance by the Institution Reserve rate. |

Net Available

Mnemonic: WKNETA |

This Amount field displays the net available balance. It is calculated by subtracting the Federal Reserve and Institution Reserve amounts from the average collected balance. This is the amount that will earn a positive balance percentage (if the result is positive) or be charged a negative balance percentage (if the result is negative). |

Net Earned At

Mnemonic: WKNTRT, WKNTAM |

This Rate field displays the rate at which the account earns credit or is assessed additional charges, if the net amount is negative. This rate is either the cost of funds rate (for positive net amount) or the negative balance rate (for negative net amount) from the Deposits > Definitions > Commercial Analysis Defaults screen.

This Amount field displays the earnings credit or additional charge amount. This is calculated by multiplying the net available balance by the earned or charge rate. |

FDIC Insurance

Mnemonic: WKFDICRT, WKFDICAM |

This Rate field displays the rate your institution will charge for FDIC insurance on the account. This value comes from the Deposits > Definitions > Rate Table screen. As rates are changed on the Rate Table, they are also reflected in the account analysis calculation based on the pointer.

This Amount field displays the amount of FDIC insurance that will be charged to the account. It is calculated by multiplying the average collected balance by the FDIC insurance rate. |

State Sales Tax

Mnemonic: WKSSRT, WKSSAM |

This field displays the Rate used by your institution for state sales tax on the account analysis service charge amount. The sales tax Amount will be charged separately from the costed services amount and show as an additional item in customer history and on statements. |

Average Collected

Mnemonic: WKAVCL |

This field displays the average collected balance Amount. It is calculated by subtracting the float amount from the average balance. This amount is used in calculating the reserve and FDIC insurance amounts. |

Interest Earned

Mnemonic: WKINTE |

This field displays an estimate of the Amount of interest this account will earn based on the balance, the rate entered, and the number of days in the statement cycle. |

From/To

Mnemonic: WKFRDT, WKTODT |

These fields display the cycle start and end dates calculated from the Statement Date field above. These dates are calculated using a monthly statement frequency. |

Total Days in Current Cycle

Mnemonic: WKDAYS |

This field displays the number of days between the cycle start date and the next cycle date. This is the number of days the account earns interest or is charged negative interest. |

In order to use this screen, your institution must subscribe to it on the Security > Subscribe To Mini-Applications screen. |