Field

|

Description

|

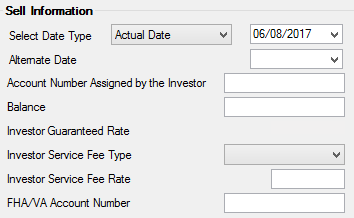

Select Date Type

Mnemonic: N/A

|

From the drop-down list, select the appropriate option (As of Date, Paid to Date, or Due Date) to designate which date to use in the loan record as the effective date of the loan sale. Then, in the second field, enter the corresponding effective date from the drop-down menu. See below for more information.

This date indicates the method in which history will be backed out. If the "As of Date" is used, history is backed out from today's date to the actual date entered. If “Paid to Date" is used, history is backed out from today's date to the transaction showing the interest paid-to date entered. If “Due Date” is used, history is backed out from today's date to the transaction showing the due date.

Any of these dates must be on or after the investor group Cycle Start Date, or Override Cycle Start Date, if entered. You can also sell a loan as of a future date. “Paid to Date” or “Due Date” must be selected to specify the date. “As of Date” will not function when selling a loan as of a future date. When “Paid to Date” is selected, the system will place an action code 151 on the loan. When “Due Date” is selected, the system places action code 152 on the loan. Action codes 151 and 152 are always placed in the ninth Action Code field on the Loans > Account Information > Actions, Holds and Event Letters screen. The system also places the date entered from this field in the Date field for the action code.

These action codes are defined as follows:

| Date Code/Action Code | Description |

| P/151 | Loan Sale Effective Paid-To Date |

| D/152 | Loan Sale Effective Due Date |

With these action codes in place, any payment received prior to or on the date entered for action codes 151 or 152 will not show as a sold transaction. However, payments received after the action code date will show as investor transactions.

|

|

Alternate Date

Mnemonic: N/A

|

This field is only used for FHLMC loan level reporting. GOLDPoint Systems uses the date entered in the in the Date of Sale field to determine which loans are new by looking for dates from the first to the fifteenth of the current month. See below for more information.

If a date is entered in this field, when the loan is sold, an action code of 170 and the alternate date are placed on the loan record. Action codes are found on the Loans > Account Information > Actions, Holds and Event Letters tab on various loan screens.

The settlement date on the FHLMC Purchase Advice should be entered in the Alternate Date field. If a date is entered in this field, an action code of 170 and the alternate date are placed on the loan record when the loan is sold. This date will be used the first time this loan is reported to Freddie Mac on the 15th of the month.

Examples:

| 1. | A loan is sold on 4-29 and the date entered in the Alternate Date field is 4-28 (settlement date on the Freddie Mac purchase advice). Once the loan is sold, an action code 170 with an action date of 4-28 is placed on the Loans > Account Information > Actions, Holds and Event Letters screen. When the loan reports for the first time on 5-15, net interest will be calculated for this loan and put on the Freddie Mac Loan Activity Report (FPSRP037). The same thing would apply for all loans with action codes of 170 and dates between 4-16 and 4-30. |

| 2. | A loan is sold on 5-05 and the date entered in the Alternate Date field is 5-02 (settlement date on the Freddie Mac purchase advice). Once the loan is sold, an action code 170 with an action date of 5-02 is placed on the Actions, Holds and Event Letters screen. When the loan reports for the first time on 5-15, net interest will not be calculated for this loan and put on the Freddie Mac Activity Report (FPSRP037). The same thing would apply for all loans with action codes of 170 and dates between 5-01 and 5-15. |

|

|

Account Number Assigned by the Investor

Mnemonic: LNIACT

|

Enter the account number assigned by the investor to this loan, if there is one. It will transfer to the Loans > Investor Reporting > Loan Investor Fields screen.

If “02” (FNMA) or “03” (FHLMC) is entered in the Investor Identifier field on the Loans > Investor Reporting > Investor Master screen, the system will display an online error message if a valid investor loan number does not exist for this loan or if the investor loan number is an incorrect size (FNMA account numbers are 10 digits; FHLMC account numbers are 9 digits).

|

Balance

Mnemonic: N/A

|

This is a required field. If the Verify Balance at Time of Sale field is selected, you must enter a balance in this field. If that field is checked and you don’t enter a balance, the error message “YOU MUST ENTER A BALANCE IF YOU WANT TO VERIFY” will appear.

|

Investor Guaranteed Rate

Mnemonic: LNIGRT

|

The rate entered in this field is the investor's guaranteed rate, taken from the Guaranteed Rate field on the Loans > Investor Reporting > Investor Group screen. The system enters this information, but the field is file maintainable, if necessary.

|

Investor Service Fee Type

Mnemonic: LNISFC/LNISFM

|

This field is used to select a service fee type guaranteed rate roll option. It can be left blank or one of the following codes can be selected.

| Constant | The service fee is constant. When the loan rate is calculated the next guaranteed rate is also calculated by subtracting the service fee from the next loan accrued rate. |

| Minimum | Minimum service fee. After the next loan accrued rate and next guaranteed rate are calculated, the difference between the two rates is determined. If the difference is less than the minimum service fee, the next guaranteed rate is recalculated by subtracting the minimum service fee from the next accrued rate. If "Minimum" is selected, a service fee code of “9” or “10” must be placed in the Investor Service Fee Rate field below. |

|

Investor Service Fee Rate

Mnemonic: LNISVC

|

This field displays the current investor service fee rate as it was entered on the Investor Group screen. This rate is the rate charged the investor for servicing the loans. Although this field is pulled from information entered on another screen, it is file maintainable.

|

FHA/VA Account Number

Mnemonic: LNFVNO

|

Enter the FHA or VA number for this loan. The number entered here will be transferred to the FHA/VA Account Number field on the Loans > Investor Reporting > Loan Investor Fields screen.

|