Navigation: Loans > Loan Screens > Account Information Screen Group > Signature Loan Details Screen > Loan tab >

Payment fields

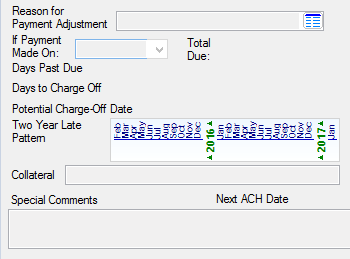

Use these fields to view and indicate basic payment information for the selected signature loan. These fields are located beneath the Payments Due field group.

The fields in this unlabeled field group are as follows:

Field |

Description |

|

|

Mnemonic: M1RPRC |

Unlike most other loan types, signature loan payments can be adjusted on this screen. Use this field to indicate a reason why a loan payment was adjusted on the customer signature loan account. See below for more information.

|

|

|

Mnemonic: N/A |

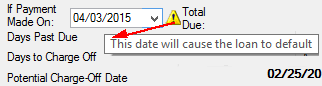

You can use this field for collection purposes. Select a date from this field (must be in the future) of when the customer can make their next payment, then the Total Due field to the right is populated with how much the customer would still owe after the payment to pay off the loan. These fields give collectors a quick tool to encourage the customer to make a payment, or to communicate with the customer how much would be owed after a payment is made.

If the date selected would take the account delinquent, the Total Due will not display and an error message will be displayed, as shown below:

|

|

|

Mnemonic: N/A |

This field indicates the number of days a payment on the customer account is past due. |

|

|

Mnemonic: N/A |

This field indicates how many days are left before the customer account's Potential Charge-Off Date (see below). Charge-off information is adjusted on the Loans > Transactions > Charge Off Transactions screen. |

|

|

Mnemonic: N/A |

This field indicates the customer account's potential charge-off date. Charge-off information is adjusted on the Loans > Transactions > Charge Off Transactions screen. |

|

|

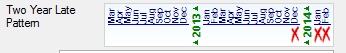

Mnemonic: LNDELQ |

This graphic indicates which months the customer loan account has been delinquent (failed to make payments on time) during a rolling 24-month basis.

Each month a loan is delinquent, an X will be placed below the letter for the delinquent month, as shown above. The X is created the night following the end of the grace period. If the Due Date is 4/1 and the grace period is 15 days, the X will appear the night of 4/16. An X is not removed if a Late Charge is waived.

This information is used by the Credit Reporting system in evaluating the account's delinquency status. |

|

|

Mnemonic: LNCLDS |

This field displays the user-defined Collateral information entered on the Loans > Account Information > Account Detail screen. |

|

|

Mnemonic: QACLDS |

Use this field to indicate any additional information about the signature loan account. This information is also saved to the Special Comments field on the Collection Comments dialog box, which is accessed from the Options > Show Collections Comments in the CIM GOLD menu bar. |

|

|

Mnemonic: RAEFDT |

This field indicates the date of the next upcoming ACH payment attempt on the customer account. ACH payments are set up on the Late Fees/ACH tab. |