Navigation: Loans > Loan Screens > Purchase Disclosure Screen >

Click <Show Disclosure History> on the Loans > Purchase Disclosure screen to open this screen. Click <Return> on this screen to return to the Purchase Disclosure screen or <Return Next> to return to the Purchase Disclosure screen for the next loan account on file.

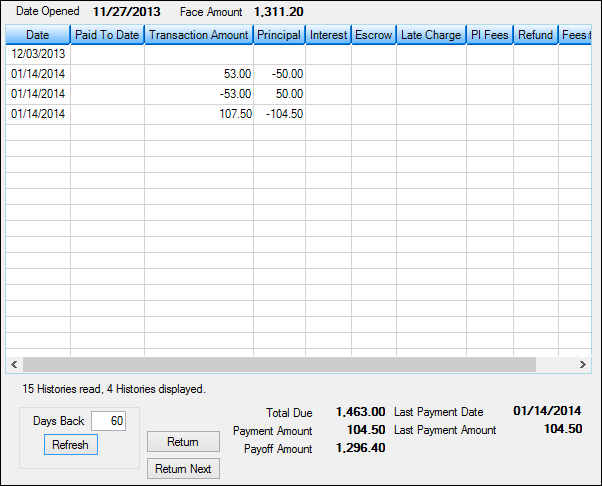

This screen displays transaction and general history information for the customer loan account.

For disclosure information about loans originating at your institution, see the Loans > Original Loan Disclosure screen.

Options

Certain options set up under Options > User Preferences screen > Options tab on the CIM GOLD menu bar affect this screen:

1.Combine Balance in Disclosure History: If this option is selected, the Balance and Fee Balance columns are combined under the Balance column on the Disclosure History screen.

2.Combine Entries in Disclosure History: Use this field to indicate whether actions occurring within two seconds of each other should be combined when viewing the Disclosure History screen.

3.Some institutions want only simplified loan history on this screen. Others want detailed descriptions of transactions. Therefore, an option is available under Options > User Preferences in the CIM GOLD menu bar. This option, Show all Open/Payoff in Disclosure History, causes the system to display all transactions involved with opening or paying off a loan. Transactions included in this option are as follows:

Open loan transaction (tran code 680) Field Credit (tran code 510) LIP Disbursement (tran code 430) Amortizing Fee Credit (tran code 910) G/L Credit (tran code 1810) Payoff (tran code 580) Dealer Interest Increase (tran code 210-01)

It also displays all payoff information, such as: a.Overpayment/Underpayment information b.All insurance rebates c.All G/L transactions for items such as refunds for maintenance fees, late charges, loan fees, interest refunds, etc. |

Loans > Purchase Disclosure Screen, then click <Show Disclosure History>

The fields on this screen are as follows:

Field |

Description |

|

Mnemonic: LNOPND |

This field displays the date the customer loan account was opened, as pulled from the Date of Loan field on the Loans > Purchase Disclosure screen. |

|

Mnemonic: LHPAMT |

This field displays the face amount of the total cost of the customer loan account as it appears on the Deed of Trust/Mortgage Loan.

This field displays the total payment amount, including amounts to interest and principal. The information in this field is pulled from the Face Amount field on the Loans > Purchase Disclosure screen. |

Disclosure History Information list view |

See Disclosure History Information list view for more information. |

|

Mnemonic: N/A |

Use this field to indicate how far back the system should search for history to display on this screen (when <Refresh> is clicked). This information can also be set in User Preferences accessed from the CIM GOLD Options menu.

If zero (0) is entered in this field, all history will be displayed. |

|

Mnemonic: LNFEES + LNLATE + LNPBAL |

This field displays the total amount needed to pay off the customer loan account. This amount includes all loan fees, late charges, and the remaining principal balance on the loan. |

|

Mnemonic: LNPICN |

This field displays the portion of regular payments on the customer loan account that is divided between the amount to interest and amount to principal. |

|

Mnemonic: LHPOFF |

This field displays the total amount needed to completely pay off the customer loan account. This amount includes fees, precomputed charges, etc. |

|

Mnemonic: LNDTLP |

This field displays most recent date a payment was posted on the customer loan account.

If a payment reversal occurs, the system will look in the collection history for the previous value in this field and enter that value in this field. This information is reported to credit bureaus. This field is updated as payment activity occurs on the loan.

If institution option NDLP is not set and a deferment was recently run, this field will display the deferment date. |

|

Mnemonic: LNLPMA |

This field displays the payment amount made on the Last Payment Date (see above).

If institution option NDLP is not set and a deferment was recently run, this field will display the deferment amount. |