Navigation: Loans > Loan Screens > Purchase Disclosure Screen >

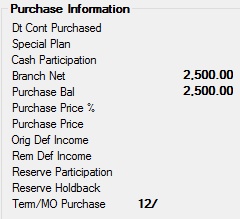

Purchase Information field group

This field group displays information about the transaction performed when your institution purchased the customer loan account from another institution.

For disclosure information about loans originating at your institution, see the Loans > Original Loan Disclosure screen.

The fields in this field group are as follows:

Field |

Description |

|

Mnemonic: LNPUDT |

This field displays the date the customer loan account was purchased from the dealer. |

|

Mnemonic: OTSPPL |

This field displays any special plan financing on the customer loan account.

Special plan financing is institution-defined. |

|

Mnemonic: OTCSPT |

This field displays any amount the dealer pays its customers as an incentive for customers to buy products from them. |

|

Mnemonic: LNOBAL |

This field displays the net gain or loss incurred for the branch after purchasing the customer loan account.

This field is used in the Dealer Consolidation Report (FPSRP214). |

|

Mnemonic: LNOBAL |

This field displays the principal balance of the customer loan account at the time the loan was purchased by your institution. |

|

Mnemonic: N/A |

This field displays the percentage of the customer loan account your institution purchased from the institution that sold the loan. |

|

Mnemonic: LNSELL |

This field displays the amount your institution paid for the customer loan account. |

|

Mnemonic: LNDORG |

This field displays any original deferred income incurred on the customer loan account.

Deferred income is any income received before it is due or earned. For example, a car payment paid in advance is income received during one accounting period but earned in a later accounting period. Interest received that applies to a subsequent period of the loan term is also deferred income. The crediting of the income is deferred until it is earned. Until then, it is listed on balance sheets as a current liability. |

|

Mnemonic: LNDREM |

This field displays any remaining deferred income incurred on the customer loan account.

Deferred income is any income received before it is due or earned. For example, a car payment paid in advance is income received during one accounting period but earned in a later accounting period. Interest received that applies to a subsequent period of the loan term is also deferred income. The crediting of the income is deferred until it is earned. Until then, it is listed on balance sheets as a current liability. |

|

Mnemonic: OTRSPT |

This field indicated whether the customer loan account is participating in reserve disbursement.

A reserve disbursement is the amount of money held back on a yearly or monthly basis that is automatically paid to a third party (such as the government or insurance agency) because of loan regulations. For example, buying a car often requires payment of taxes to the state government. Your institution may reserve some loan money to pay the taxes. Also, most institutions require the customer to have full-coverage insurance on the car while the loan is being paid off. Your institution can require that money be held back in arrears and paid by you to ensure the insurance company is paid and the car is insured. |

|

Mnemonic: OTRSHD |

This field displays the amount held back to pay for any reserve disbursements on the customer loan account.

A reserve disbursement is the amount of money held back on a yearly or monthly basis that is automatically paid to a third party (such as the government or insurance agency) because of loan regulations. For example, buying a car often requires payment of taxes to the state government. Your institution may reserve some loan money to pay the taxes. Also, most institutions require the customer to have full-coverage insurance on the car while the loan is being paid off. Your institution can require that money be held back in arrears and paid by you to ensure the insurance company is paid and the car is insured.

The reserve amount is often added to the loan amount or required at the time of the loan's purchase. |

|

Mnemonic: OTCDRL |

This field displays the conditional reserve or insurance liability established for the customer loan account.

This is the amount the collateral item is worth at auction, if the collateral must be impounded or is damaged to the extent that it loses its monetary value. Insurance liability is the amount of coverage to protect against claims alleging that one's negligence or inappropriate action resulted in bodily injury or property damage. |

|

Mnemonic: LNTERM |

This field displays the term (in months) required to pay off the loan with a monthly minimum payment. For example, "48" would mean 48 months (or 4 years). |