Navigation: Loans > Loan Screens > Payoff Screen > FAQ >

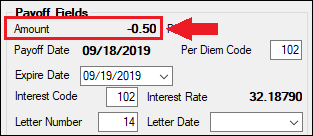

Almost always a Payoff Amount is positive, meaning the borrower has that amount to pay before the loan is paid off and closed. However, every now and again you may find that the Payoff Amount is negative. This can be due to a lot of reasons, such as reversing a late charge that would bring the balance negative; unearned precomputed interest being rebated back to the borrower and bringing the Principal Balance negative; unearned fees rebated back to the borrower; or even unearned insurance premiums bringing the balance negative. Most transactions will block an account from going negative, but on rare occasions, you might find the Payoff Amount is negative, as shown below:

Your institution must decide what to do with that negative amount. Perhaps the amount is just a balancing issue, and you do not need to refund the amount back to the borrower. Other times you may need to create a check, or perform a cash out, to the borrower in the amount of the negative Payoff Amount. The following steps explain one way to balance a negative account, so payoff can occur. Your institution may do things differently from these steps.

This is a three part process. Start by unlocking the loan account if you previously locked it, as described in the Payoff Locking topic. Then see these instructions:

1. |

Go to the Adjustments tab of the Payoff screen. |

2. |

In the next open Description line, enter a description for this negative amount, such as "Insurance G/L Balance" or "Return Amount for Canceled Insurance." Choose a description that can be understood by others. |

3. |

In the Amount field, enter the amount that would balance out the negative payoff amount. In other words, if the negative amount is "-0.50," you would enter "0.50" in the Amount field (see example below). |

4. |

In the G/L Number field, enter a valid General Ledger account number. This will be a General Ledger account your institution uses for balancing or check writing. This may require help from a supervisor to know a valid G/L number. G/L accounts are set up in the General Ledger system (if using GOLDPoint Systems), as described in Chapter 3, Initial Setup, of the General Ledger manual. Valid G/L numbers can be found on the Single Account (function 53) or Multiple Accounts screen (function 57) in the General Ledger system. |

5. |

In the Reference Number field, enter the account number for which you are paying off. This will help with G/L balancing. |

6. |

Click <Save Changes>. |

See the following example illustrating these steps: |

|

Show me how:

|

1. |

|

2. |

|

3. |

|

4. |

|

5. |

|

6. |

|

1. |

|

2. |

|

3. |

|

4. |

|

5. |

|

6. |

|