Navigation: Loans > Loan Screens > Account Information Screen Group > Account Detail Screen > Account tab > Payment and Classification field group > Payment Method 0: Conventional Loans >

The Next Payment Due is the amount of payment due each month. For conventional loans (payment method 0), it is common for your customers to make a larger payment than required by the Next Payment Due, which is a calculated field that adds together the P/I Constant and Reserve 1/2 Constant (if the loan includes reserves).

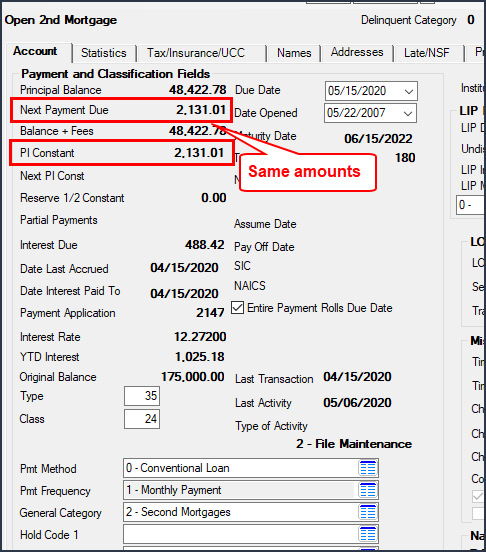

If the loan does not include reserve payments, the P/I Constant is usually the same as the Next Payment Due, as shown below:

When a payment is made that is equal to or greater than the Next Payment Due, the Due Date rolls ahead one month.

The following paragraphs explain how the system applies extra funds when making a payment larger than the Next Payment Due, as well as whether the system rolls the Due Date for each P/I Constant amount met.

First, the system applies the payment according to the Payment Application, which is usually set up as follows:

1.Pay interest from P/I Constant (2)

2.Pay principal from P/I Constant (1)

3.Pay any outstanding late charges (4)

4.Pay any remaining miscellaneous fees (7)

5.Should loans include reserve payments (3 and 6), they can also be added to the Payment Application in the order required by your institution.

6.Maintenance fees (P/I Fees – 8). Note: Maintenance fees are not allowed on conventional loans.

Local, state, or federal regulations stipulate the Payment Application order. Verify the order required for payments with your institution's protocols. For most mortgage loans, interest and principal must be applied first. The Payment Application can be changed on the Loans > Account Information > Account Detail screen, but instances where this is advisable are rare. As a general rule, the Payment Application should never be changed once an account is opened unless the user understands the consequences and has security to do so.

If the payment exceeds the amount of Next Payment Due + late charges + fees + reserves, all extra funds are put towards paying down the Principal Balance on the loan.

|

Note:

The Entire Payment Rolls Due Date option on the Account Detail screen isn’t needed if the Payment Application order consists of 2 (interest) first then 1 (principal) second, because principal and interest are always required first anyway and conventional loans require a full payment (see Payment Amount Less Than Next Payment Due for more information). |

|---|

Due Date Only Rolls Once per Transaction

Once the Next Payment Due has been met for a payment transaction, the Due Date rolls, but only once per transaction. This means, for example, that if a single payment included enough funds to cover two or three Next Payment Due amounts, the Due Date would still only roll once and any additional funds (after P/I Constant, fees, late charges, and reserves) would go toward principal.

However, if a customer were to make a payment that was greater than or equal to the Next Payment Due, then make another full payment later that day, the Due Date would roll once for each transaction. In other words, the Payment Application is re-assessed with each individual payment. (Does the payment meet Next Payment Due? Are there any late charges or fees?, etc.) The system will apply amounts to each Payment Application and then apply any extra funds to the Principal Balance.

Your institution may want to train its tellers on this important distinction. If a customer wants to make three payments’ worth at a time, for example, and they expect the Due Date to roll ahead three months, tellers should run three separate payment transactions rather than a single lump-sum transaction.

|

Note

The Roll Due Date Within option is ignored with conventional loans.

If Partial Payments add up to a full payment, the system will roll the Due Date forward one frequency. There are some important setup requirements for this to happen.

Both of these options are discussed further on the Payment Amount Less Than Next Payment Due help topic. |

|---|

Example 1:

Next Payment Due = $200.00

Payment Application = 2 (interest), 1 (principal), 4 (late charges), 7 (fees)

Outstanding Late Charges = $35.00 (one month’s worth)

Outstanding Miscellaneous Fees = $45

Borrower makes a $300 payment.

•$200 goes to principal and interest requirement; Due Date rolls once.

•$35.00 goes to reducing Late Charges Due (LNLATE) to zero.

•$45 goes to reducing Miscellaneous Fees to zero.

•$20 extra goes to reducing the Principal Balance.

Example 2:

P/I Constant = $200.00

Payment Application = 2 (interest), 1 (principal), 4 (late charges), 7 (fees)

Outstanding Late Charges = $70.00 (two months’ worth of late charges)

Outstanding Miscellaneous Fees = $45

Borrower makes a $300 payment.

•$200 goes to principal and interest requirement; Due Date rolls once.

•$70.00 goes to reducing Late Charges Due (LNLATE) to zero.

•$30 goes to reducing Miscellaneous Fees to $15.

Example 3:

P/I Constant = $200.00

Payment Application = 2 (interest), 1 (principal), 4 (late charges), 7 (fees)

Outstanding Late Charges = $70.00 (two months’ worth of late charges)

Borrower makes a $1,000 payment.

•$200 goes to principal and interest requirement; Due Date rolls once.

•$70.00 goes to reducing Late Charges Due (LNLATE) to zero.

•$730 extra goes to reducing the Principal Balance.

Example 4:

P/I Constant = $200.00

Payment Application = 2 (interest), 1 (principal), 4 (late charges), 7 (fees)

Outstanding Late Charges = $70.00 (two months’ worth of late charges)

Borrower makes a $600 payment, but they want the Due Date to roll two times, and any remaining amount should go to Partial Payments instead of paying down the Principal Balance (curtailment).

•Teller would need to make the first payment for $270.00 (tran code 600). The teller can make that payment from the EZPay, Make Loan Payment screen, or one of the payment transactions in GOLDTeller.

o$200 goes to P/I Constant.

o$70 goes to late charges.

oDue Date rolls once.

•Teller makes another payment for $200.

o$200 goes to P/I Constant.

oDue Date rolls once again.

•Teller makes a Partial Payment Increase (tran code 510-33) for the remaining amount.

o$130 goes to Partial Payments.

oDue Date does not roll.

oThe amount in Partial Payments stays there until a full payment can be made, as described on the Payment Amount Less Than Next Payment Due help topic.