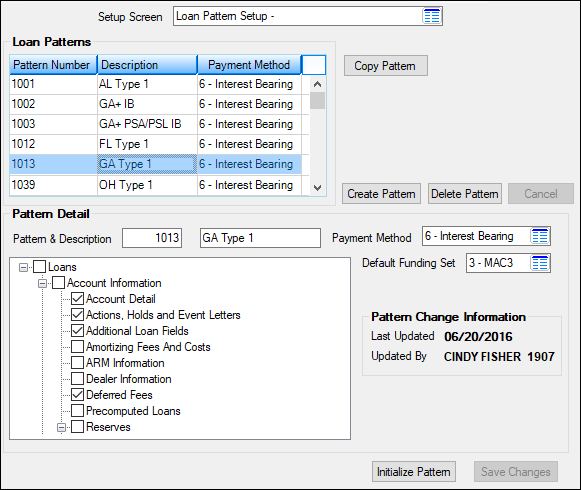

Navigation: Loans > Loan Screens > System Setup Screens >

The Loan Pattern Setup screen is an important screen needed for the system to be able to fund and board loans transferred over from a third-party origination system into CIM GOLD. Your institution may use GOLDTrak PC, Loan Gateway, GOLDAcquire Plus, or a separate API to board and fund the loans.

What is a Loan Pattern?

A loan pattern allows your institution to set up record/field defaults so when that type of loan is boarded through GOLDTrak, Loan Gateway, GOLDAcquire Plus, or another API, applicable fields will already be populated with loan information. You go through the basic loan setup screens and enter the data that will always be constant for each loan of this type, such as interest rate, interest calculation method, general category, amortization code, and payment application. You can create as many loan patterns as you want to cover a variety of loan types.

The setup to ensure loans are boarded and funded correctly requires knowledge of GOLDPoint Systems and the Autopost system. This help will attempt to describe the detailed steps required; however, you will likely need assistance from your GOLDPoint Systems account manager the first few times you set up loan patterns. Once you understand the procedure and you have security clearance to use this screen, you can set up as many loan patterns as your institution needs. Usually, these steps are completed when your institution converts to GOLDPoint Systems. However, additions and modifications can be made using these same steps.

Using Patterns to Board Loans From Loan Gateway, GOLDAcquire Plus, or a separate API

Creating the loan pattern is just the first step in setting up the system to board and fund loans. You will also need to set up the loan funding transactions, so that funds are debited/credited to the correct G/L account when loans are funded. And then everything must be tied to a Loan Gateway Pattern as well. The steps involved in creating loan patterns in order to board loans originating from a third party and boarding into CIM GOLD are as follows:

1. |

First you will use the Loan Pattern Setup screen to create the pattern number, description, and which loan payment method to be boarded with specific funding rules. See the Overview section below. |

||

2. |

Next you will use the Loan Funding Transaction screen to set up the transactions and fields involved with opening a loan, and what G/L accounts are used to debit or credit the funding transactions. See the Loan Funding Transactions screen help for more information. |

||

3. |

Now you will establish loan funding sets using the Loans > System Setup Screens > Loan Funding Sets screen. A loan funding set allows you to group transactions together for loan types. For example, if your institution had a loan type called "Direct Cash Precomputed," you would set up funding sets that would include transactions involved with those types of loans. It would include a transaction that would board an amount to the Precomputed Unearned Interest field (LN78OI), among other transactions. |

||

4. |

After Loan Funding Sets have been established, return to the Loan Pattern Setup screen and select the Default Funding Set set up in step 3 above, as shown below.

|

||

5. |

The final step is to set up Gateway patterns using the Loans > System Setup Screen > Loans > System Setup Screens > Gateway Patterns screen. This screen allows you to tie loan types and classifications to loan patterns, so when those types of loans are boarded (opened) through Gateway, the funding transactions will take place and all funds will be distributed appropriately to the General Ledger accounts and fields on the loan account.

|

Once these screens are set up appropriately, when loans are boarded into CIM GOLD, the applicable fields will be populated with the loan specifications, and lending transaction will debit/credit G/L accounts accordingly.

Boarding Loans From GOLDTrak PC-originated Loans

Loan patterns can also be used with GOLDTrak PC. If using GOLDTrak PC, the process of using patterns is slightly different from that described above. Basically, you would set up the loan pattern as described below, then your GOLDPoint Systems account manager can add the pattern number to your GOLDTrak loan programs, so the system automatically boards and funds the loan including specific field information based on the loan pattern and type of loan. These steps are usually done before you convert onto GOLDPoint Systems, or when new loan programs or loan types are created.

Use the Loans > System Setup Screens > GTPC Funding Rules screen to establish how the system will fund loans boarded from GOLDTrak PC.

Use the Loans > System Setup Screens > Loan Pattern Setup screen to set up loan patterns for your institution, as shown below:

Loans > System Setup Screens > Loan Pattern Setup Screen

Creating Loan Patterns

Follow the steps below to create a new loan pattern:

1. |

Click <Create Pattern>. |

2. |

Enter information in the Pattern Detail field group (see Field Descriptions below), then click <Save Changes>. You should now set up funding transactions, as explained in the Loan Funding Transactions screen help for more information. |

3. |

Select the screens that contain the records or fields used in the loan pattern in Loans tree view. For example, if you were setting up a loan pattern for precomputed loans, you would likely select the Account Detail screen, Additional Loan Fields screen, and the Precomputed Loans screen, to name a few. |

4. |

Click <Initialize Pattern> to open the Initializing Loan Pattern screen, where desired fields in the selected Loans screens are file maintained. Once all necessary file maintenance is performed and <Save Changes> is clicked, the loan pattern will be created and appear in the Loan Patterns list view. Loan patterns created on this screen will be available for selection at loan origination in GOLDTrak PC and GOLDAcquire Plus (as well as the Loans > Loan Initialization screen). For GOLDAcquire Plus and Loan Gateway, you will need to complete the other steps described above in the Using Patterns to Board Loans section. |

Editing Loan Patterns

An existing loan pattern can be edited by selecting the pattern in the Loan Patterns list view, adjusting information in the fields, and clicking <Save Changes>.

Copying Loan Patterns

To save time in the process of creating a new loan pattern (if, for instance, your institution wants to create multiple loan patterns with similar but not identical settings), the settings for an existing loan pattern can be copied.

1. |

Select an existing loan pattern in the Loan Patterns list view and click <Copy Pattern>. A dialog will appear, prompting you to indicate the Pattern number and Payment Method for the new loan pattern, as shown below:

|

2. |

Enter the New Pattern Number (must be unique) and Payment Method, then click <OK>. The dialog will close and the new loan pattern will appear in the Loan Patterns list view. |

3. |

The new loan pattern can then be edited by adjusting information in fields (see below). |

|

Record Identification: The Loan Pattern Setup fields are stored in the FPCJ record (Loan Pattern Header). See Field Descriptions below for mnemonics found in this record (also see FPCJ in the Mnemonic Dictionary)

The legacy records used for loan patterns is FPLP and CFLP (Loan Pattern). These records are still used on older loans and can be maintained in GOLDVision in the Loan system using function 69/70. However, for new loans boarded onto our system, you should only use the Loan Pattern Setup screen in CIM GOLD (the FPCJ record). |

|---|

Field |

Description |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Loan Patterns list view table |

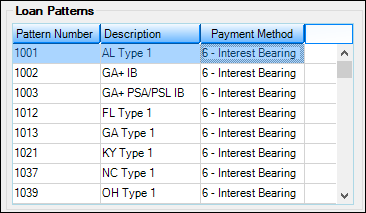

This table displays all loan patterns that were previously set up by your institution on this screen. A loan pattern is an institution-defined setting that establishes what records/fields are used when a loan is boarded (opened) into CIM GOLD. Your institution may use GOLDTrak PC to board, fund and open loans, or you might use a third-party software to originate loans. Patterns ensure that the fields used to originate the loan are properly boarded into CIM GOLD, and the funding transactions properly distribute all open loan balances to G/L accounts and loan fields.

The information displayed in this list view corresponds directly to the fields on this screen. Click any column header to organize the list view by that column's information type. |

||||||||||||||||||

The fields in this field group are described below. |

|||||||||||||||||||

|

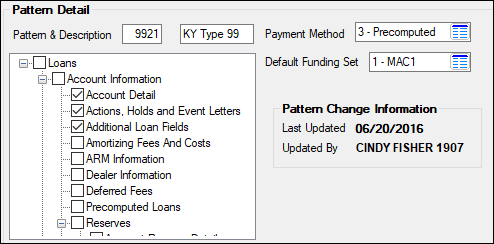

Mnemonics: CJPTN# and CJPTTL |

Use this field to indicate the institution-defined code number for the loan pattern being created. Best practices would have you set up a pattern number that matches the loan type and classification of the loan. For example, in the field group example above, the Pattern code is "9921" because the loan type is 99 and the classification code is 21.

Also enter a description, which can also match the description of the type of loan. |

||||||||||||||||||

|

Mnemonic: CJPMTH |

Use this field to indicate the loan account payment method for the loan pattern being created. Payment Method codes determine how the system processes customer accounts, as well as the calculation of interest. Possible selections in this field are:

|

||||||||||||||||||

|

Mnemonic: CJFSET |

Use this field to indicate the default funding set for the loan pattern being created. Funding sets are combinations of funding transactions used for origination funding. When in use, funding sets determine which monetary fields or General Ledger accounts need to be debited or credited on the loan when certain transactions are processed.

Selections in this field must first set up on the Loans > System Setup Screens > Loan Funding Sets screen. But before you can determine funding sets, you must first set up Loan Funding Transactions screen. See Using Patterns to Board Loans From Loan Gateway, GOLDAcquire Plus, or a separate API above for the appropriate steps in setting up patterns and funding transactions. |

||||||||||||||||||

Screens Tree View |

Check the box next to each screen where fields are found that you want to include in this pattern. The screens indicate the record and fields needed to board information for this loan pattern. For example, if setting up a pattern for precomputed types of loans, you should make sure that the Precomputed Loans screen is checked. And then when you initialize the pattern by clicking <Initialize Pattern>, you can then choose how fields on those screens are populated.

Simple Example: For certain loan patterns, you want to ensure that the Late Charge Code is set to a flat fee of $25, and that Grace Days is set to "10." You would:

1.Check the box next to the Account Detail screen. 2.Click <Initialize Pattern>. 3.When the Initializing Loan Pattern screen opens, select the Account Detail > Payment Late/NSF tab. 4.In the Late Code field, select "15 - Charge a Flat Fee." 5.In the Late Charge Rate Fee, enter "25.00." 6.In the Grace Days field, enter "10." 7.Click <Save Changes>.

You would complete these steps for every field you want populated in the loan pattern. |

||||||||||||||||||

Pattern Change Information field group

Mnemonics: CJDTLA and CJEMPX |

These fields display information about the most recent edits performed on the loan pattern selected in the Loan Patterns list view. This information includes the date of the changes and the name and teller/employee number of the employee who updated the loan pattern.

|

In order to use this screen, your institution must:

•Subscribe to System Setup Screens on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for System Setup Screens on the CIM GOLD tab of the Security > Setup screen. |