Navigation: GOLD Services Screens > General Ledger Screen Group >

The Autopost is basically a filter through which transactions from the Loan and Deposit systems are fed. The transactions come out on the other side of the filter in a format suitable for posting to the General Ledger system. The filter converts loan and deposit information into amounts and General Ledger account information. This information is then automatically posted to the General Ledger through control group "MMDDYY00," where MMDDYY is the current date. For a list of General Ledger control group numbers, see General Ledger Control Group Numbers.

Once set up, the Autopost runs on its own, keeping your Loan and Deposit systems in balance with your General Ledger system. However, the setup of the Autopost is crucial to make this filter work and correctly place the appropriate amounts in the appropriate G/L accounts.

Transactions and Tran Logs

Transactions are grouped in two categories:

•Day transactions are those transactions performed online by tellers in institutions. Examples of day transactions are deposits, withdrawals, loan payments, etc.

•Night transactions are those transactions performed during the afterhours by the system. Examples of night transactions are interest postings, service charges, late charges, ACH, inclearings, etc.

Every time a transaction (day or night) is run, the system records it in a tran log. This tran log may be considered as a snap shot of what the account looked like at the time of the transaction. Selected fields in the account and specific information about the account, as well as the affected monetary fields, are recorded in the tran log.

For example, if the transaction is an interest-only payment on an ARM loan, the tran log records the interest rate at the time of the payment. Although the loan is adjustable, and the interest rate may fluctuate, the system will always know the interest rate at the time of this specific payment transaction because it is recorded in the tran log, which was created when that payment transaction was completed.

Two Types of Information

Two types of information are recorded in the tran logs that the Autopost must handle in order to sort transactions into the correct General Ledger accounts—characteristics and amounts.

Characteristics

The characteristics of a transaction are those pieces of information about the account on which the transaction was run, and about the transaction itself. Information about the account includes the account number, the loan type code, the product code, the investor master number, the investor group number, general category, reserve disbursement type, etc.

Other characteristics of a transaction concern the transaction itself, such as the number of the teller who performed the transaction, the originating branch of the transaction, the transaction origination code (TORC), etc.

Up to 45 transaction characteristics (15 for loans, 15 for deposits, 15 for other), which the system keeps in the tran log, may be selected by the institution. These are known as posting fields.

Amounts

Amounts are the monetary parts of the transactions. Some transactions, such as a cash withdrawal, will contain only two amounts. In a cash withdrawal, the two amounts considered are the "cash" amount and the withdrawal from the account balance. Other transactions may contain several amounts. For example, a loan payment may contain an amount that goes to principal, an amount that goes to interest, an amount that goes to reserve 1, an amount that goes to reserve 2, an amount that goes to a late charge, and the amount that goes to "check." That one transaction contains six different amount fields, even though it was processed with a single check.

All the various monetary parts of a transaction are known as amount fields in the Autopost.

Steps to Setting Up the Autopost

Only two steps are required to set up the basic General Ledger Autopost.

1.Identify the posting fields for the amount fields.

2.Set up the Autopost Parameters by supplying the General Ledger account numbers for the amount fields as defined by the posting fields.

Other Autopost functions, such as Cross References and External Postings, simply give the Autopost greater scope in handling General Ledger posting and in providing reports regarding the Autopost system.

Before going on, let's more clearly define amount fields and posting fields.

Posting Fields

Posting fields identify special characteristics of either the transaction or the account on which the transaction was run. These fields allow you to have an amount field posted to different General Ledger accounts based on the characteristics of the particular transaction. For example, the transaction is a mortgage payment. Posting fields can allow you to have the principal portion of mortgage payments posted to different General Ledger accounts depending on the account's loan type code when the transaction was run.

Each institution selects up to 15 posting fields they will use with the Loan system, 15 they will use with the Deposit system, and 15 they will use as "Other." Other is considered any transaction coming in that does not affect either the Loan or Deposit system, such as a transaction posted by a teller directly to a G/L account, or to a contract collection account. When a customer purchases a money order or travelers check, this would be considered an "other" transaction because it does not affect either a loan or deposit account.

The selected posting fields are then entered in the institution options (option GLLN for Loans, GLDP for Deposits, and GLOT for Other). When posting fields are assigned to amount fields, the system validates the posting fields against the list in the institution options.

Available posting fields are listed in the General Ledger Posting Fields help. There are 42 possible posting fields that may be selected for use by an institution. These are divided into loan, deposit, and other categories. Up to 15 posting fields may be selected from each category.

Amount Fields

Amount fields are the amount portions of a transaction that can be posted to different General Ledger accounts. For example, a mortgage payment is the transaction. The principal and interest are the amount fields. The amount of the payment that is applied to principal can be posted to a different General Ledger account than the amount that is applied to interest because each is considered a different amount field. Each institution may specify to which General Ledger account each amount should go.

GOLDPoint Systems Only

The amount portions of transactions are programmed and assigned to the various amount fields used by the Autopost in FPSAH70. |

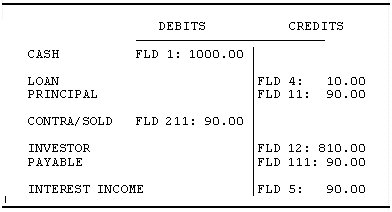

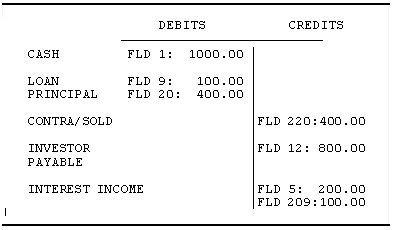

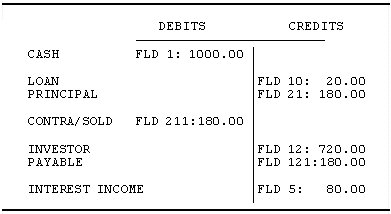

The following examples show how amount fields would be used when posting loan transactions and how they may be broken down in your General Ledger as payments are taken on sold loans. Each field number in these examples represents a different amount field.

This example shows the normal entries on a loan that is 90% sold when a $1,000.00 payment is received.

This example shows the entries for a $1000.00 cash payment on an ARM loan which also has deferred interest of $500.00 and is 90% sold.

This example shows the entries for a $1000.00 cash payment on an ARM in which deferred interest has been deferred and is now being paid which is also 90% sold.

Available amount fields are defined in Autopost Parameters > General Ledger Amount Fields. You may want to go through these amount fields and locate the field numbers from the examples given above for a clearer understanding of how those amounts are being used.

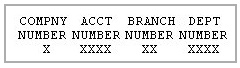

On your actual screens, the system will use and display the General Ledger account number structure and terminology as set up in your General Ledger system.