Navigation: Loans > Loan Screens > System Setup Screens >

The Loans > System Setup Screens > Loan Funding Transactions screen is an important screen needed when your institution uses a third-party to originate loans, then boards those loans into CIM GOLD (using Loan Gateway or GOLDAcquire Plus). The Loan Funding Transactions screen is set up so loans are funded using the appropriate General Ledger account.

For example, if a specific loan type is boarded from Gateway, the system runs all transactions tied to that loan type accordingly, and withdraws or credits funds to the applicable G/L account or field set up on this screen. However, other screens must also be set up in order for the system to board loans over from a third party correctly. See the Important box below for more information.

|

Important: Creating Funding Transactions is only one part of a multi-step process. Before using this screen, you should first complete the following screens in this order:

|

|---|

GOLDPoint Systems usually sets up this screen before your institution converts onto GOLDPoint Systems. However, additions and adjustments can be made to this screen if you have proper security. See the Setup of Loan Funding Transaction for basic steps in setting up funding transactions. When in use, loan funding transactions determine which monetary fields or General Ledger accounts need to be debited or credited on the loan.

Loan funding transactions can be used individually or grouped together in sets. Sets are created on the Loans > System Setup > Loan Funding Sets screen.

Access to this screen should be restricted to individuals with a thorough knowledge of your institution's General Ledger, Autopost, and general accounting practices.

|

Note: If boarding loans through GOLDTrak PC, you will not use this screen to set up loan funding sets. Instead, use the GTPC Loan Funding Rules screen. |

|---|

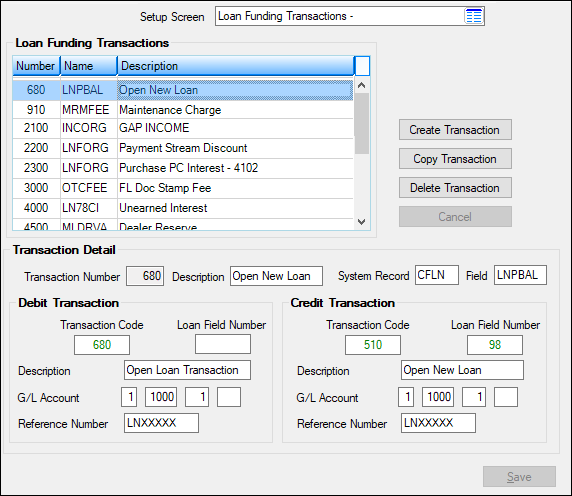

Loans > System Setup Screens > Loan Funding Transactions Screen

|

Record Identification: The Loan Funding Transactions fields are stored in the CSFN record (Loan Funding Transactions). If your institution uses Gateway or GOLDAcquire Plus, you will need this record set up accordingly. See CSFN in the Mnemonic Dictionary.

For Gateway Loan Funding, the system also uses the CSGW (Gateway Funding Record). See the Gateway Loan Funding topic for more information.

GPS Only: We no longer use the CDFN record; only the CSFN record. |

|---|

Field Descriptions

Field |

Description |

|||||||||||||||||||||||

Loan Funding Transactions list view table |

This list view table at the top of this screen displays all funding transactions currently set up for your institution. This list view displays the Transaction Number, field mnemonic Name, and Description of each transaction.

Selecting a previously created loan transaction in this list view will populate the fields on this screen with that transaction's information. This information can then be edited for the selected transaction (with the exception of the Transaction Number field).

Click any column header to organize the list view by that column's information type. |

|||||||||||||||||||||||

Transaction Detail field group |

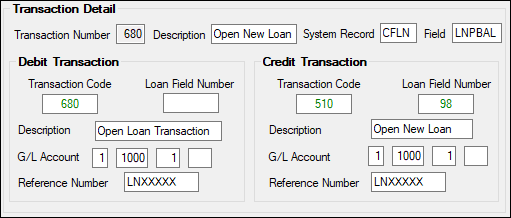

Use this field group to view and edit information about loan funding transactions set up for your institution, as shown below:

Each transaction requires a debit from a field, G/L account, or Debits and credits can be made from either the loan account or a General Ledger account (G/L). Your institutions’ Autopost parameters are used in these transactions. Both Debit and Credit information must be entered for each loan funding transaction (for balancing purposes).

Loan funding transactions can be used individually or grouped together in sets. Sets are created on the Loans > System Setup > Loan Funding Sets screen.

Access to this screen should be restricted to individuals with a thorough knowledge of your institution's General Ledger, Autopost, and general accounting practices. See the field descriptions in the rest of the table below. |

|||||||||||||||||||||||

|

Mnemonic: FNPOST |

Use this field to indicate the institution-defined ID number of the loan funding transaction being created. This can be any number between 500 and 9999. Best practices match the Transaction Number and Loan Field Number (see below). |

|||||||||||||||||||||||

|

Mnemonic: FNDSC |

Use this field to indicate the institution-defined description of the loan funding transaction being created/edited. This should match the Description in the Debit and Credit Transaction field groups. |

|||||||||||||||||||||||

|

Mnemonic: FNRTYP/FNFLD |

Use these fields to indicate the system record and field mnemonic of the field affected by the loan funding transaction being created/edited. GOLDMiner lists all available system records in the Field Selection tab, then Main Record field, if you need help on what the four-letter code for a system record is. Also, you can search the Field Level Security help for the record.

|

|||||||||||||||||||||||

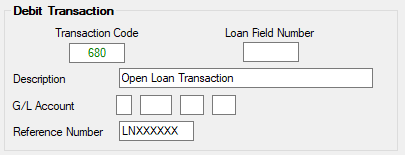

Use this field group to enter debit information for the loan funding transaction being created/edited, as shown below:

See field descriptions in the rest of the table below. |

||||||||||||||||||||||||

|

Mnemonic: FNTRAN |

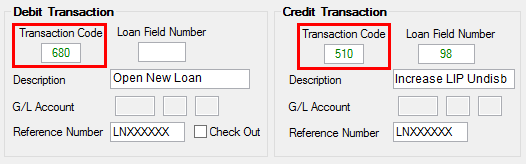

Use this field to indicate the debit transaction code being created/edited. The Debit and Credit Transaction Code fields allow you to enter a transaction code for the type of transactions the funding rule should process. You will generally need to enter transaction codes in both the Debit and Credit fields. The debit transaction will be offset automatically by a journal out and the credit transaction will be offset by a journal in.

|

|||||||||||||||||||||||

|

Mnemonic: FNFLD# |

This field is used to identify which field in the Loan system should be posted to for the transaction code specified. Specific field numbers, when used with certain transaction codes, have been programmed to translate into designated loan fields.

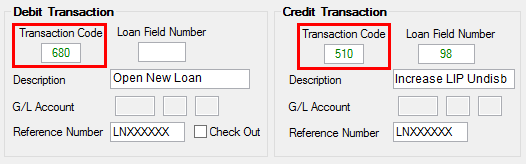

Not all transaction codes require field numbers in order to post to loan amount fields (for example, tran codes 580 and 680 will automatically affect the principal balance and do not need to be designated with a field number to direct amounts to the principal balance field in the Loan system). However, some transaction codes must have a field number in order to identify which amount field in the Loan system should be affected (such as tran codes 500 and 510 which are simply field debits and credits).

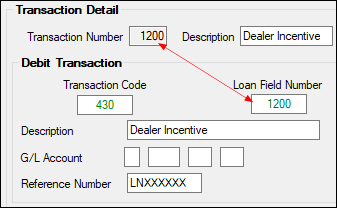

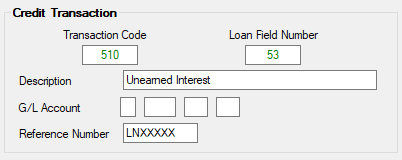

For example, in the screen example below, "98" is entered in the Field Number field for transaction code 510. This translates into an increase (credit) to the LIP balance, found in the Undisbursed Balance field (LNLBAL). For a list of the field numbers, which loan amount fields they translate to, and their associated transaction codes, see Loan Field Numbers.

The second use for this field is to establish the purpose of the disbursements (tran code 430). Disbursement codes are set up on the Loans > System Setup Screens > Construction Budget Descriptions screen. When setting up tran code 430, you should set up the Transaction Number to be the same as the Loan Field Number (which should also match the disbursement code set up on the Construction Budge Description screen), as shown below:

|

|||||||||||||||||||||||

|

Mnemonic: FNTDSC |

Use this field to indicate an institution-defined description of the loan funding transaction being created/edited. This should match the Credit and Transaction Descriptions.

|

|||||||||||||||||||||||

|

Mnemonic: FNGLAC |

If the transaction debits a General Ledger account, use this field to indicate the G/L number used by the loan funding transaction being created/edited. Not all transactions debit a G/L account number. Transaction codes 680 (Open Loan) and 1800 (G/L Debit) do require a G/L account number.

This field matches the format of the G/L account structure set up by your institution within the General Ledger system in GOLDVision. As you fill in each of the sub-fields of the G/L account number with the maximum number of characters, the cursor is automatically tabbed to the next field. The system will return an error provider

Parameter substitutions can be used in these fields. For more about parameter substitutions, see the Parameter Substitutions topic in the Autopost. |

|||||||||||||||||||||||

|

Mnemonic: FNREF# |

Use this field to indicate the reference number that will appear in history and reports to identify the loan funding transaction being created/edited.

Whatever data is entered in this 8-character field will be assigned to the teller transaction in the Reference Number field. Additionally, this data will be sent to the General Ledger history in the Reference Number field if no summarization is requested through the G/L Autopost Recap Report (FPSDR016). The default entry in this field is "LNXXXXXX." This entry will automatically place the loan account number into the G/L Reference Nbr field. In addition, "LNXXXXXX" on G/L debit and credit transactions (tran code 1800/1810) will carry the loan account number to the General Ledger Autopost Resolution Detail Report (FPSDR205). |

|||||||||||||||||||||||

Credit Transaction Field Group |

Use this field group to enter credit information for the loan funding transaction being created/edited, as shown below:

See field descriptions in the rest of the table below. |

|||||||||||||||||||||||

|

Mnemonic: FNTRAN |

Use this field to indicate the credit transaction code being created/edited. The Debit and Credit Transaction Code fields allow you to enter a transaction code for the type of transactions the funding rule should process. You will generally need to enter transaction codes in both the Debit and Credit fields. The debit transaction will be offset automatically by a journal out, and the credit transaction will be offset by a journal in.

|

|||||||||||||||||||||||

|

Mnemonic: FNFLD# |

This field is used to identify which field in the Loan system should be posted to for the transaction code specified. Specific field numbers, when used with certain transaction codes, have been programmed to translate into designated loan fields.

Not all transaction codes require field numbers in order to post to loan amount fields (for example, tran codes 580 and 680 will automatically affect the principal balance and do not need to be designated with a field number to direct amounts to the principal balance field in the Loan system). However, some transaction codes must have a field number in order to identify which amount field in the Loan system should be affected (such as tran codes 500 and 510 which are simply field debits and credits).

For example, in the screen example below, "98" is entered in the Field Number field for transaction code 510. This translates into an increase (credit) to the LIP balance, found in the Undisbursed Balance field (LNLBAL). For a list of the field numbers, which loan amount fields they translate to, and their associated transaction codes, see Loan Field Numbers.

For transaction code 910 (Amortizing Fee Credit), the Loan Field Number will be the amortizing Fee Code field (F1FEEC; loan posting field #25) found on the Loans > Amortizing Fees and Costs in CIM GOLD. The amortizing fee code can be up to four digits long. |

|||||||||||||||||||||||

|

Mnemonic: FNTDSC |

Use this field to indicate an institution-defined description of the loan funding transaction being created/edited. This should match the Debit and Transaction Descriptions.

|

|||||||||||||||||||||||

|

Mnemonic: FNGLAC |

If the transaction credits a General Ledger account, use this field to indicate the G/L number used by the loan funding transaction being created/edited. Not all transactions credit a G/L account number. Transaction code 1810 (G/L Credit) does require a G/L account number.

This field matches the format of the G/L account structure set up by your institution within the General Ledger system in GOLDVision. As you fill in each of the sub-fields of the G/L account number with the maximum number of characters, the cursor is automatically tabbed to the next field. The system will return an error provider

Parameter substitutions can be used in these fields. For more about parameter substitutions, see the Parameter Substitutions topic in the Autopost. |

|||||||||||||||||||||||

|

Mnemonic: FNREF# |

Use this field to indicate the reference number that will appear in history and reports to identify the loan funding transaction being created/edited.

Whatever data is entered in this 8-character field will be assigned to the teller transaction in the Reference Number field. Additionally, this data will be sent to the General Ledger history in the Reference Number field if no summarization is requested through the G/L Autopost Recap Report (FPSDR016). The default entry in this field is "LNXXXXXX." This entry will automatically place the loan account number into the G/L Reference Nbr field. In addition, "LNXXXXXX" on G/L debit and credit transactions (tran code 1800/1810) will carry the loan account number to the General Ledger Autopost Resolution Detail Report (FPSDR205). |

After completing this screen, you should use the Loans > System Setup Screens > Loan Funding Sets screen to group transactions together for loan types.

In order to use this screen, your institution must:

•Subscribe to System Setup Screens on the Security > Subscribe To Mini-Applications screen.

•Set up employees and/or profiles with either Inquire (read-only) or Maintain (edit) security for System Setup Screens on the CIM GOLD tab of the Security > Setup screen. |