Navigation: Loans > Loan Screens > Account Information Screen Group > Payment Information Screen >

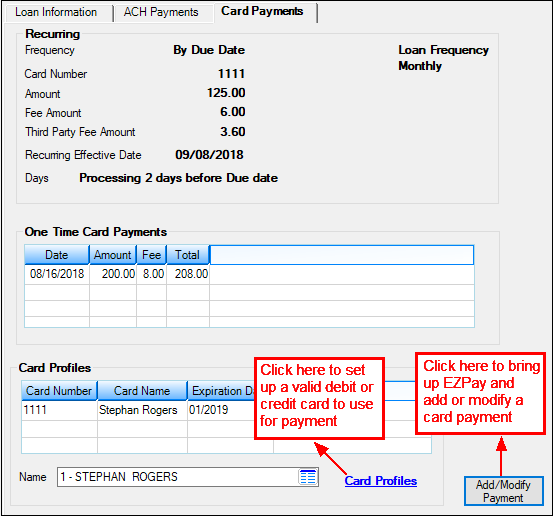

The Card Payments tab on the Payment Information screen shows information concerning any recurring or one-time debit or credit card payments, as well as any credit/debit card profiles already connected to this account. This tab is for informational purposes only.

|

Note: This tab only shows if your institution allows recurring card payments. The EZPay option, Allow Recurring Card (EZPRCD), must be set up for your institution on the EZPay IMAC Table. |

|---|

If you want to set up recurring or one-time payments via debit or credit card, click the <Add/Modify Payments> button at the bottom of the tab, as shown in the following example. Before setting up payments, make sure a valid credit or debit card has been added to this account by clicking the Card Profiles link. This link allows you to enter any credit or debit cards this account owner wants to use to make ACH payments.

Loans > Account Information > Payment Information Screen > Card Payments Tab

Once you click <Add/Modify Payment>, the EZPay screen is displayed in a pop-up. Here is where you can enter the payment details such as when the recurring or one-time payment should be made, the amount of the payment, and from which account to pull the payment.

For more information concerning making payments on the EZPay screen, see the EZPay help.

Be aware of a few options that affect recurring payments. |

|

Fee Amount |

If your institution collects a fee for each recurring payment, you need to set up the General Ledger account for the fee to be credited to on the GOLD Services > General Ledger > G/L Account By Loan Type screen using the EZPay Fee field and EZPay Offset field. However, if institution option EGPO (EZPay G/L Posting By Office) is set, the system uses the G/L account in the ACH Fee and ACH Offset fields for the account's office on the G/L Accounts tab of the GOLD Services > Office Information screen. See the Fees topic in the EZPay help for more information. |

Modified Payments |

If this loan has a modified payment schedule set up (using the Loans > Transactions > CP2 screen, Payment Schedule tab), the amount defaulted into the Payment Amount field on that screen for recurring payments will reflect the amount from the payment schedule. This is ignored when the Override Payment Amount is used with a recurring payment. |

Maturity Date |

An option is available that stops recurring payments once the loan is past the Maturity Date (see Stop Recurring Payment if Past Maturity on the Loan Information tab of this screen). If that option is set and a loan is past the Maturity Date when a recurring payment is attempted on the account, the payment will be rejected and the account will appear on the Afterhours Processing Exceptions Listing report (FPSRP013). Make a habit of checking that report every morning. You'll need to manually handle those accounts, such as contacting the borrower and asking for a final payment; running a payoff transaction through the Loans > Payoff screen; sending an event letter to the customer about a final payoff amount; or whatever other methods your institution requires.payment. |

Hold Codes |

Recurring payment transactions are not allowed on loans that are severely delinquent, such as loans that have been charged off or are in bankruptcy. The following Hold Codes will cause the ACH payment to reject if they are on the account:

•2, 4, 5, 6, 7, 8, 9, 27, 48, 86, or 94-99 are applied to the account. |

Locked for Payoff |

If the loan is locked for payoff on the Loans > Payoff screen, and the loan is not unlocked before afterhours is run the night the recurring payment is pulled, the recurring payment will be rejected and show on the Afterhours Processing Exceptions Listing report (FPSRP013) with the message: "LOAN LOCKED IN FOR PAYOFF." You will need to manually handle the account at that point, such as unlocking the payoff; calling the customer for a final payment; running a manual payment through CIM GOLDTeller; or however else your institution wants to handle the account. |

Balloon Payment Due |

Some loans require a final balloon payment, which is more than the regular recurring amount. Action Code 1 with an Action Date on or after the recurring payment effective date will cause the recurring payment to reject and show on the Afterhours Processing Exceptions Listing report (FPSRP013). |

|

Note: An EZPay option must be set if your institution wants to allow one-time payments to be set up in addition to recurring payments. For example, if a customer already has recurring payments set up, but they'd like to make an additional payment because they have extra funds available, the Allow One Time with Recurring EZPay option must be set.

The EZPay options are set up by your GOLDPoint Systems account manager in the EZPay IMAC Table. Contact your account manager if you would like this option set up for your institution.

If you get the following error message after trying to set up a one-time payment at the same time as a recurring payment, you know that this option has not been set up for your institution and recurring and one-time payments are not allowed together.

"Error processing one-time payment. Error: BLPP: Loan has a recurring."

GOLDPoint Systems Only: The EZPay IMAC Table is found under GOLDPoint Systems > EZPay IMAC Table on the left tree-view in CIM GOLD. This option, Allow One Time with Recurring, is on the Recurring tab. |

|---|

To add an ACH recurring or one-time payment, see the ACH Payments tab.